Nifty Hits Record High; 15 Points Shy Of 10,000

Jul 25, 2017

Jeremy Parkinson

Finance

Asian stock markets are lower today as Japanese and Hong Kong shares fall. The Nikkei 225 is off 0.13%, while the Hang Seng is down 0.06%. The Shanghai Composite is trading down by 0.17%. US equities finished mostly lower as Wall Street geared up for a major week of earnings and US Federal Reserve meeting. Meanwhile, Indian […]

The Fed Versus The Market

Jul 25, 2017

Jeremy Parkinson

Finance

The following monthly chart shows that the year-over-year (YOY) growth rate of US True Money Supply (TMS) made a multi-year peak in late-2016 and has since fallen sharply to an 8-year low. The downward trend in US monetary inflation since late last year has been driven by the commercial banks, meaning that the pace of […]

Technically Speaking: I Bought It For The Dividend

Jul 25, 2017

Jeremy Parkinson

Finance

Okay, I have to discuss something this week that has been bugging me. I have had several emails as of late suggesting one of the biggest investing fallacies stated during late stage bull market advances. “I don’t care about the price, I bought it for the yield.” First of all, let’s clear up something. Company […]

FOMC July 2017 Meeting Preview: Inflation Expectations And Balance Sheet Reduction

Jul 25, 2017

Jeremy Parkinson

Finance

The Federal Reserve Bank will be holding its monetary policy meeting today. The central bank meeting is expected to see the fed funds rate remain unchanged at 1% – 1.25%. The probability of a rate hike is also extremely low, according to the CME Group’s rate hike probability tool. Today’s FOMC meeting will not be […]

Peak Shale: Anadarko Just Became The First US Oil Producer To Slash CapEx

Jul 25, 2017

Jeremy Parkinson

Finance

It appears that Horseman Global’s Russell Clark may have been spot on with his bearish take on the US shale sector. As a reminder, in his latest letter to investors, Clark said that “the rising decline rates of major US shale basins, and the increasing incidents of frac hits (also a cause of rising decline rates) […]

Stocks Watchlist: WDAY, DHI, MOBL

Jul 25, 2017

Jeremy Parkinson

Finance

Today’s stock picks Long Workday (WDAY) Long DR Horton (DHI) Short MobileIron (MOBL)

USD/CAD’s Bearish Movement Extended To 1.2483

Jul 25, 2017

Jeremy Parkinson

Finance

USD/CAD’s bearish movement from 1.3347 extended to as low as 1.2483, facing the import support at 1.2460 (May 2016 low). Near-term resistance is at the falling trend line on the 4-hour chart. As long as the trend line resistance holds, the downtrend could be expected to continue. Key resistance is at 1.2608, only a break […]

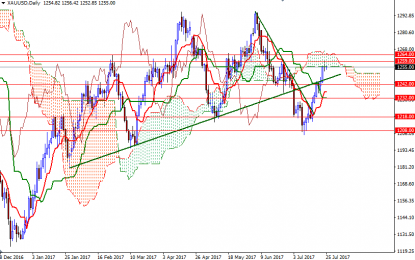

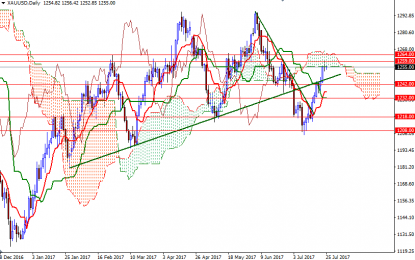

Gold Steady As Market Pauses After Recent Gains

Jul 25, 2017

Jeremy Parkinson

Finance

Gold prices ended Monday’s session nearly unchanged after shuffling between gains and losses as investors took a cautious stance ahead of the Federal Open Market Committee’s two-day policy meeting which kicks off today. The central bank is widely expected to leave rates unchanged. However, the tone of the official statement will be important for the […]

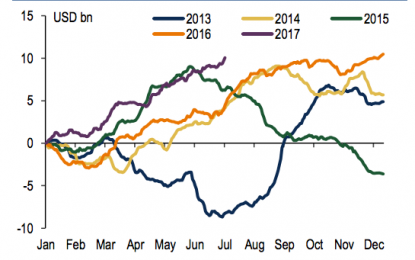

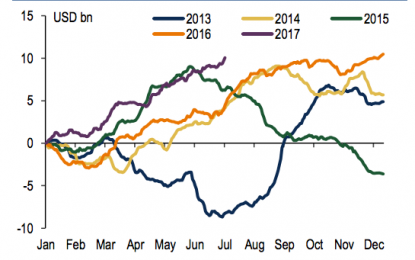

This Top Performing Asset Should Keep Performing: Goldman

Jul 25, 2017

Jeremy Parkinson

Finance

Who out there is concerned about the sustainability of the rally in all things Emerging Markets? Our hands are raised and you can review some of our concerns in detail in our handy emerging markets section here. The list of worries is long, but you wouldn’t know it to look at flows data. Essentially, EM is […]

Oil Prices Head Higher On OPEC Moves

Jul 25, 2017

Jeremy Parkinson

Finance

OPEC’s move to limit Nigerian oil production combined with Saudi Arabia’s promise to limit exports in August sent oil prices higher on Tuesday morning. Nigeria had previously been exempt from OPEC’s production cuts that are currently in place until March 2018 due because it had been assumed that conflict in the region would limit output […]