Dumped Dollar Due To Be Done Dropping? It Depends…

Jul 25, 2017

Jeremy Parkinson

Finance

There are no two ways about it: it’s been a rough month, quarter, and year for the world’s reserve currency. The widely-followed US Dollar Index started the year in peak “Trump Trade” euphoria, with traders expecting a burst of fiscal stimulus to boost the economy and accelerate the Fed’s pace of tightening. Since then, the […]

Rate Sensitive ETFs In Focus As Fed Meets

Jul 25, 2017

Jeremy Parkinson

Finance

All eyes are currently on the crucial two-day FOMC meeting slated to start today. The central bank is expected to hold rates steady and lay out plans to unwind its $4.5 trillion balance sheet. It will likely reduce bond holdings by a maximum of $50 billion per month, or $600 billion per year. Both the […]

The Next Big Worry? Well, Never Mind…

Jul 25, 2017

Jeremy Parkinson

Finance

A couple weeks back, I opined that the next big problem for the stock market might revolve around global central bankers changing their monetary policy tune on a coordinated basis. The idea was simple. Stocks have enjoyed the benefits of capital creation via global QE programs since the crisis ended in early 2009. The key […]

Healthcare Vote Tuesday

Jul 25, 2017

Jeremy Parkinson

Finance

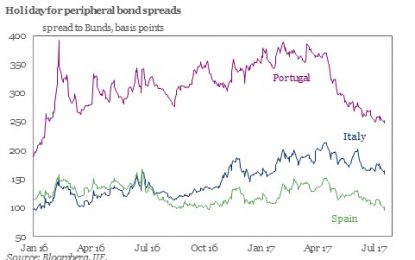

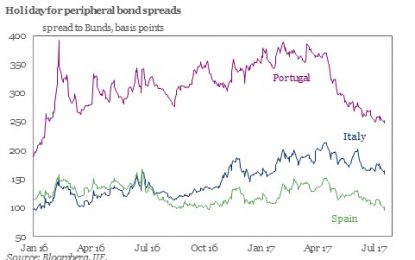

Draghi Won’t Taper? The bond market gives us a picture of what investors are expecting from policy makers. The chart below shows the bond spreads the riskier European countries are trading at compared to the German Bund. The spreads of these countries, formerly known as the PIGS, have been tightening in the past few months. […]

Brokerage Or Tech Firm? Redfin’s Valuation Requires The Latter

Jul 25, 2017

Jeremy Parkinson

Finance

As the Redfin (RDFN: $13/share) IPO approaches, investors must decide whether the firm is a traditional real estate brokerage or a technological innovator likely to disrupt the traditional real estate brokerage market. RDFN currently looks like a traditional brokerage and generates roughly 90% of its revenue from traditional commissions. The company’s ultimate mission is to […]

Case-Shiller 20 City Home Price Index May 2017 Shows 5.7 % Year-Over-Year Growth

Jul 25, 2017

Jeremy Parkinson

Finance

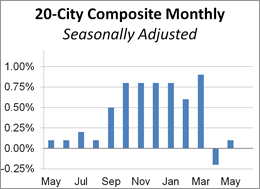

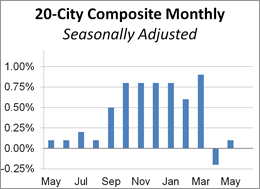

The non-seasonally adjusted Case-Shiller home price index (20 cities) year-over-year rate of home price growth was declined from 5.8 % (was reported as 5.7 % last month) to 5.7 %. The index authors stated “The small supply of homes for sale, at only about four months’ worth, is one cause of rising prices. New home […]

Can U.S. Interest Rates Ever Rise?

Jul 25, 2017

Jeremy Parkinson

Finance

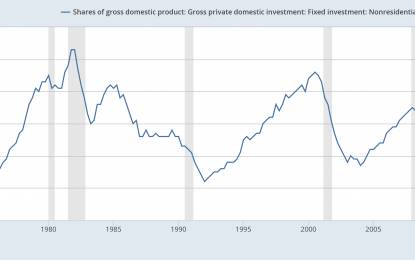

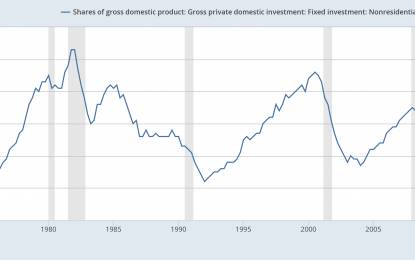

While interest rates have risen from depths that saw the 10-year treasury yielding 1.36% on 7/3/16, to 2.25% today, given Fed plans to tighten and pledge to shrink its balance sheet should rates be even higher? The Fed will typically engage in the monetary policy of tightening and lift the Fed Funds rate when the two […]

Last Week’s Rally In Gold Stocks Erased

Jul 25, 2017

Jeremy Parkinson

Finance

Gold, silver and the USD Index didn’t do much in yesterday’s trading, but that was not the case with mining stocks. The divergence between gold stocks and gold was particularly visible and the implications are once again particularly important. Let’s take a look at the charts, starting with the HUI Index (gold stock chart courtesy of StockCharts). […]

Low Inflation: Should We Worry?

Jul 25, 2017

Jeremy Parkinson

Finance

Binyamin Appelbaum had an interesting discussion of inflation in the NYT yesterday. As he notes, it has been below the Fed’s target throughout the recovery and, contrary to expectations, it has been falling in recent months. This suggests that the economy could be operating at a higher level of output with more employment. That would put more […]

Home Prices Rose 5.6% Year-Over-Year NSA In May, Sixth Record High

Jul 25, 2017

Jeremy Parkinson

Finance

With today’s release of the May S&P/Case-Shiller Home Price Index, we learned that seasonally adjusted home prices for the benchmark 20-city index were up 0.1% month over month. The seasonally adjusted national index year-over-year change has hovered between 4.2% and 5.8% for the last twenty-seven months. Today’s S&P/Case-Shiller National Home Price Index (nominal) reached another […]