British Pound Falls As Inflation Disappoints, But Will GDP Revive The Trend?

Jul 22, 2017

Jeremy Parkinson

Finance

Fundamental Forecast for GBP: Bearish GBP/USD Below 1.3000 As Talks End with Little Progress. GBP/USD Technical Analysis: Back to 1.3000, Now What? As we came into this week, there were very legitimate bullish prospects for the British Pound, and this wasn’t necessarily a new story. Ahead of Brexit, Bank of England Governor, Mark Carney, warned that the […]

NRZ’s 12.5% Yield: A Deeper Dive

Jul 22, 2017

Jeremy Parkinson

Finance

As a follow-up to our article on New Residential at the beginning of this week, this article takes a deep dive into a variety of big risks as well as reasons to be optimistic (and we’re not only talking about the big dividend yield). New Residential (NRZ) is a real estate investment trust (REIT), and its big […]

Strong Earnings Growth And Favorable Valuations Lead To Weak Stock Returns

Jul 22, 2017

Jeremy Parkinson

Finance

One factor utilized in uncovering potential investment opportunities is to evaluate companies and sectors that are projected to generate strong earnings and cash flow growth over the course of the next year or more. The risk associated with simply reviewing earnings growth rates is the fact other variables often influence the future price performance of […]

E

Market Briefing For Monday, July 24

Jul 22, 2017

Jeremy Parkinson

Finance

Keeping a ‘bid’ under the market is what traders are now focusing on; as expiration is out of the way and nobody knows how to weigh prospects for a healthcare bill being passed by the Senate in the week ahead. Given a slew of pressures now, we do think they will actually try getting it […]

Your Tails Aren’t As Fat This Week…

Jul 22, 2017

Jeremy Parkinson

Finance

The clear and present danger headed into this week was Mario Draghi and the extent to which he would get it “wrong” with the messaging and “inadvertently” catalyze a continuation of the rates mini-tantrum we saw in the wake of Sintra. Simple put, a rates tantrum has become one of the key risks facing markets […]

Democrats Urge Antitrust Action Against Amazon Over Whole Foods Deal

Jul 22, 2017

Jeremy Parkinson

Finance

In the wake of their embarrassing electoral defeat in November, Congressional Democrats are turning against the wealthy tech benefactors who bankroll their campaigns. To wit, a group of 12 Democratic Congressman have signed a letter urging the Department of Justice and the Federal Trade Commission to conduct a more in-depth review of e-commerce giant Amazon.com Inc.’s […]

EC

Four Takeaways From The Q2 Earnings Season

Jul 22, 2017

Jeremy Parkinson

Finance

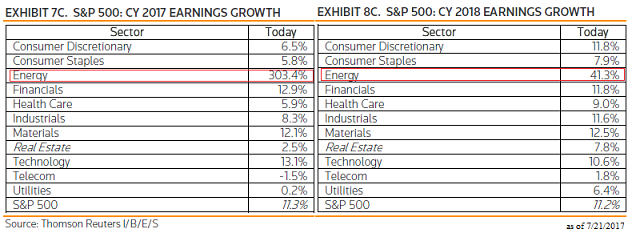

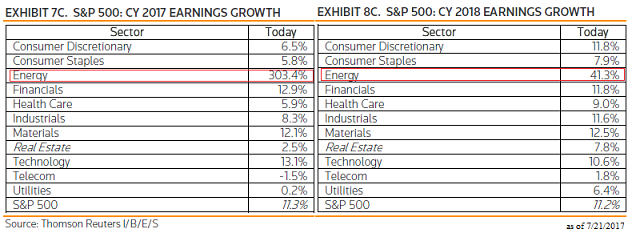

Earnings reports are front and center this week, with more than 800 companies coming out with quarterly results, including 183 S&P 500 members. With results from 97 S&P 500 members already out, as of Friday, July 21st, we will have crossed the halfway mark by the end of this week. The results thus far provide […]

Volatility, Skew, And The Trade For Next Week

Jul 22, 2017

Jeremy Parkinson

Finance

Stocks end the week on a quiet note as they rallied up to the upper weekly expected move in the Nasdaq and S&P 500. In this weekend’s crucial market update video we look in-depth at the historical record low volatility. Volatility is how traders generate returns in the market. Many of the big banks are […]

Canadian Dollar: Don’t Fight The Trend

Jul 22, 2017

Jeremy Parkinson

Finance

Talking Points: The downward trend in USDCAD remains intact. Data on Friday showed core inflation rising and buoyant retail sales. A further Canadian interest rate rise in October now seems more likely than not. Fundamental Forecast for CAD: Bullish Ever since the Bank of Canada raised its overnight lending rate by a quarter of a percentage point to 0.75% […]

E

Financial Forecasts – Myth Or Reality?

Jul 22, 2017

Jeremy Parkinson

Finance

During a recent trip from San Francisco to Ohio, I spent several hours indulging in the Wall Street Journal, cover-to-cover. Fascinated by their second quarter Markets Review & Outlook Section on July 3, 2017, I fervently read the predictions made by pros compared with reality. I assumed that at least one prediction for the markets […]