Will Volatility Continue To Flatline?

Jul 11, 2017

Jeremy Parkinson

Finance

So the VIX has flatlined. It’s been meandering along in a sideways direction for nearly four years. In fact, the four-year chart of the VIX looks like an electrocardiograph (EKG) of a recently diseased person. Sure, you’ll see an occasional blip. But not even a dead person has a ruler-straight EKG line. Sorry, folks — […]

Consumer Credit Surges Most Since November 2016

Jul 11, 2017

Jeremy Parkinson

Finance

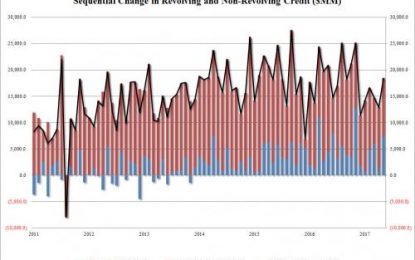

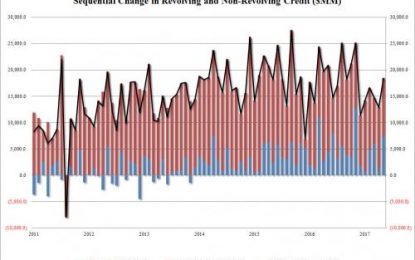

After a big miss in April, when US consumer credit posted its smallest monthly increase in 6 years, resulting form a slump in demand for revolving credit, one month later things promptly reverted back to normal, and according to the Fed, in the month of May, total consumer credit rose by $18.4 billion, well above […]

Dividends By The Numbers For June 2017

Jul 11, 2017

Jeremy Parkinson

Finance

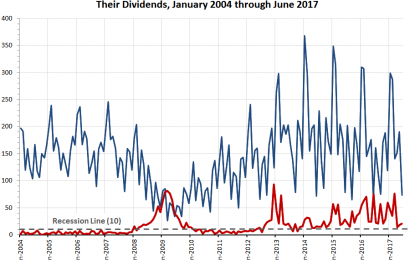

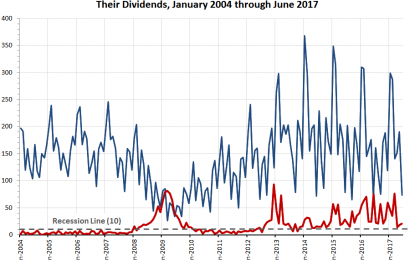

June 2017 ended the best quarter for dividends in the last three years. Before getting into the tally of dividend data for the month, let’s take a quick look at the number of publicly-traded U.S. companies that either increased or decreased their dividends in each month from January 2004 through June 2017 in the following […]

S&P 500 And Nasdaq 100 Forecast – Tuesday, July 11

Jul 11, 2017

Jeremy Parkinson

Finance

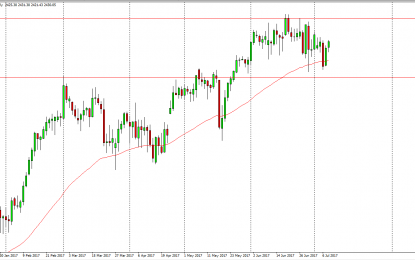

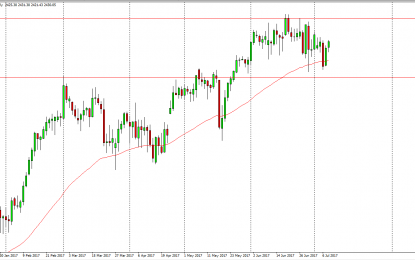

S&P 500 The S&P 500 initially fell on Monday but found enough support underneath to bounce and reach towards the 2430 level. The market looks likely to continue to grind to the upside, perhaps trying to reach towards the 2450 handle above. A break above that level would send this market to the 2500 level, […]

Stage Analysis Gold And USD

Jul 11, 2017

Jeremy Parkinson

Finance

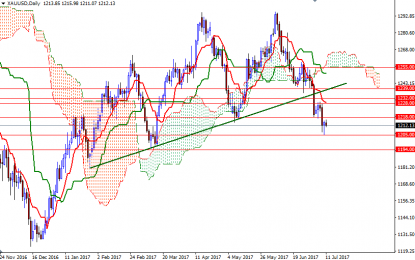

This post will use Weinsteins Stage Analysis to examine where we are in both Gold and the USD. For this analysis, I will use Weekly charts and highlight the Weekly 30ema as a guidepost for our analysis. First let’s start with a bit of History and go back to 1998 to 2002 to examine the […]

Gold Mildly Up On Short Covering

Jul 11, 2017

Jeremy Parkinson

Finance

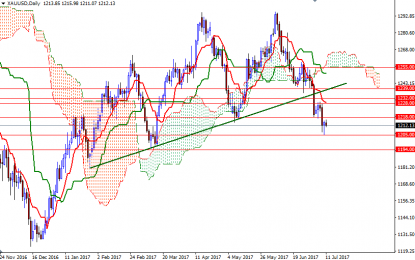

Gold started the week on the back foot, testing the $1208-$1205 area, but managed to recover its earlier losses and ended the day up $1.55 at $1214.09 an ounce. Gold has come under renewed pressure in recent days, as investors recalibrated their outlook on U.S. monetary policy in the light of recent economic data. The […]

EUR/USD, GBP/USD Approaching Confirmation Or Invalidation Zone Of Wave-4

Jul 11, 2017

Jeremy Parkinson

Finance

EUR/USD 4 hour The EUR/USD is moving sideways after failing to break above the previous top (red). A bullish breakout could however restart the uptrend towards the Fibonacci targets of wave 5 vs 1+3 and the round level of 1.15. 1 hour The EUR/USD expanded the wave 4 (orange) correction back to the 50% Fibonacci […]

EUR/USD: Trend Line Broken Through On The Hourly Timeframe

Jul 11, 2017

Jeremy Parkinson

Finance

Previous: On Monday, trading on the euro closed slightly down and within Friday’s range (intraday bar). My expectations for Monday came off in full. In the first half of the day, the NFP report continued to provide support for the dollar. Given that the economic calendar was empty, euro bulls were easily able to induce […]

BoC: To Hike Or Not To Hike?

Jul 11, 2017

Jeremy Parkinson

Finance

On one hand, a rate hike in Canada is priced in. On the other hand, there is no 100% consensus among analysts that the BOC will indeed pull the trigger. Here are two opinions: Here is their view, courtesy of eFXnews: CAD: BoC Hike In The Price; Investors May Sell On Fact – Citi Citi […]

“… A Recession Has Always Followed”: Is This The Real Reason The Fed Is Suddenly Panicking?

Jul 11, 2017

Jeremy Parkinson

Finance

“Why is the Fed so desperate to raise rates and tighten financial conditions? Why has the Fed shifted from a dovish to a hawkish bias?” That is the question on every trader’s, analyst’s and economist’s mind in the past month. Is it because the Fed is suddenly worried it has inflated another massive equity bubble […]