Sensex & Nifty Trade Near All-Time Highs; IT Stocks Lead

Jul 11, 2017

Jeremy Parkinson

Finance

After opening the trading day on a positive note, Indian share markets continue to trade firm in the morning session. Gains are largely seen in information technology stocks and automobile stocks. Meanwhile, consumer durables sector and FMCG sector trading in the red. The BSE Sensex is trading higher by 132 points and the NSE Nifty is trading higher by 47 points. The BSE Mid Capindex is trading flat while […]

Packaged-Goods Companies Slash Marketing Spending As Amazon Makes Sales “All About Price”

Jul 11, 2017

Jeremy Parkinson

Finance

Amazon’s dominance of all things retail-related in the US is starting to effect on how packaged goods are marketed: Big Brands are starting to give up on expensive advertising campaigns because customers no longer see the value in expert branding. Now, thanks to Jeff Bezos and his algorithms, they’re fixated at finding the lowest price […]

Brexit Briefing: Trade, The Repeal Bill And May’s Woes

Jul 11, 2017

Jeremy Parkinson

Finance

In recent days, the Brexit debate has focused on the rights of EU citizens in the UK after the country’s divorce becomes absolute; an important issue but unlikely to be a market mover. There are plenty of other issues bubbling under the surface, however, that could yet affect the British Pound. Take trade. It looks […]

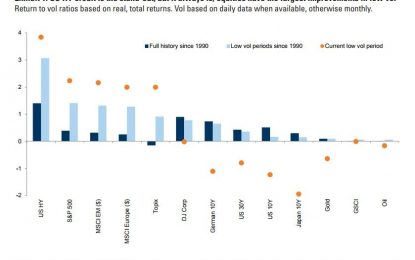

Goldman: Assume Low Volatility Lasts For At Least One Year

Jul 11, 2017

Jeremy Parkinson

Finance

With volatility oddly low, Goldman Sachs strikes a pose that is not too dissimilar to that of Bridgewater’s Ray Dalio, who said the dance with central banks and their negative interest rates and free market antics won’t end until cracks become apparent. In a July 5 portfolio strategy report, Goldman’s European-based analysts Ian Wright, Christian Mueller-Glissmann and Alessio Rizzi say ignore […]

Are You Running Out Of Patience?

Jul 11, 2017

Jeremy Parkinson

Finance

“Give me a stock to buy,” my friend demanded. “I can’t give personal advice,” I responded. “Besides, it’s not that simple, I don’t know your tolerance for risk, your long-term goals…” He cut me off. “I just need something that’s going to make me a lot of money, quickly.” Then this email came in the […]

Equity Income Profile: Gap Inc.

Jul 11, 2017

Jeremy Parkinson

Finance

A stock with a 4% dividend yield: I’m not saying it’s an automatic buy for income investors (nothing ever is), especially when it involves brick-and-mortar retail. But in this continuing era of nano-yields, one has to at least look. As it turns out, I can’t warm up so easily to growth prospects, but then again, […]

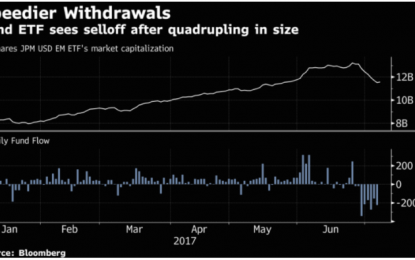

An Anomaly Emerges In Emerging Markets

Jul 11, 2017

Jeremy Parkinson

Finance

Earlier on Monday in “‘People Are Going To See There’s No Liquidity’: EM ETFs Face ‘Minsky Moment’,” we highlighted a new FT piece that flags many of the same risks we’ve been pounding the table on for months with regard to HY and EM bond ETFs. Simply put: the ETFs promise all-day liquidity while the underlying bonds […]

Retail Investors Are Piling Into “The Most Dangerous Trade In The World”

Jul 11, 2017

Jeremy Parkinson

Finance

It shouldn’t be too surprising that the XIV exchange-traded note – which is designed to deliver the inverse performance of the well-known CBOE Volatility Index (or the VIX) on a daily basis – is attracting fresh attention after surging as much as 87 percent this year. But, as CNBC notes, some caution that investing in the exchange-traded […]

EUR/USD Forex Signal – Tuesday, July 11

Jul 11, 2017

Jeremy Parkinson

Finance

Yesterday’s signals were probably not triggered as the bullish price action took place a little way below the support level identified at 1.1388. Today’s EUR/USD Signals Risk 0.75%. Trades may only be entered before 5pm London time today. Long Trades Go long following a bullish price action reversal on the H1 time frame immediately upon the […]

Euro Bund Market Observations (Ending One-Time-Framing)

Jul 11, 2017

Jeremy Parkinson

Finance

Looking at the plain daily chart, we can observe the end of the one-time-framing lower behavior which occurred for several weeks as Friday’s high got taken out. A previous balance area seems to be supportive for now. Looking at the weekly volume profiles, we can identify a double distribution profile. The market opened inside of […]