E

Was That A Spike Bottom In Corn?

Mar 26, 2018

Jeremy Parkinson

Finance

Corn Futures Corn futures in the May contract are currently trading higher by 2 cents to start off the week in Chicago as prices have experienced higher volatility in recent weeks as the Trump tariffs sent prices down about $0.25 from the March 13th high of 3.95 as a spike bottom was created last Friday […]

The Scariest Chart For Business In The Coming Decade: Workers Not Available

Mar 26, 2018

Jeremy Parkinson

Finance

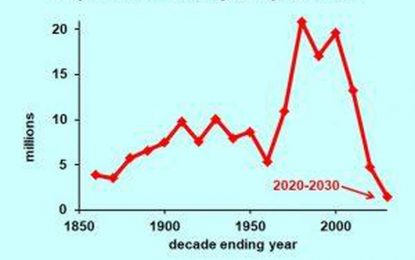

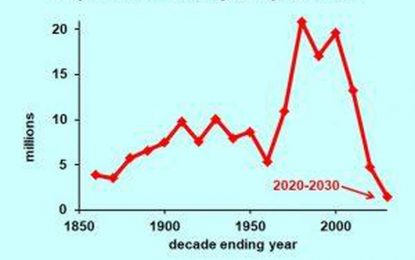

The scariest chart I’ve ever developed shows that the pool of available workers will grow at the slowest pace since the Civil War. If your business plans include expansion, either figure out a way to do it without more workers, or get better than other companies at employee retention and recruiting. Dr. Bill Conerly based […]

3 Large-Cap Mutual Funds With Stupendous Return Potential

Mar 26, 2018

Jeremy Parkinson

Finance

Large-cap funds are ideal investment options for those seeking a high return potential accompanied by lower risk than small-cap and mid-cap funds. These funds have exposure to large-cap stocks with a long-term performance history, assuring more stability than what mid or small caps offer. Additionally, growth funds focus on realizing an appreciable amount of capital […]

PetroYuan Vs. PetroDollar… Dollar Crisis?

Mar 26, 2018

Jeremy Parkinson

Finance

In Stock Charts today we discuss the PetroYuan which is the new competitor to the US PetroDollar. This is the first competition to the PertroDollar since the early 1970’s when President Nixon took the United States off of the Gold Standard. We also discuss Gold which is on the verge of a major breakout in […]

Dollar Dumps To 6-Week Lows As Stock Rebound Stalls

Mar 26, 2018

Jeremy Parkinson

Finance

The late-day 300-plus-point plunge in The Dow (and the rest of the market) has been slowly but surely erased overnight as the machines gently run stops ahead of the open. Interestingly, stocks stalled after President Trump tweeted about how strong the economy is… Bond yields are following stocks higher but the dollar is […]

What Trade War?

Mar 26, 2018

Jeremy Parkinson

Finance

Trade War? What Trade War? The fears that President Donald Trump’s threats of tariffs would plunge the globe into a devastating trade war is easing quite a bit. The Wall Street Journal reported that “China and the U.S. have quietly started negotiating to improve U.S. access to Chinese markets, after a week filled with harsh […]

Japan Discounts Trade Wars—Now A Value Trap?

Mar 26, 2018

Jeremy Parkinson

Finance

In Friday trading, Japan became the first casualty in the U.S.–China trade war. Market dynamics followed the standard pattern of “risk-off”—yen strength compounded by a sharp equity market drawdown. The timing could not have been worse: Japanese institutions are preparing for the March-end fiscal yearbook closing and are now forced into even greater repatriation of […]

Morning Call: U.S. Stocks Soar As Concerns About A U.S.-China Trade War Ease

Mar 26, 2018

Jeremy Parkinson

Finance

Overnight Markets And News Jun E-mini S&Ps (ESM18 +1.19%) this morning are up sharply by +1.23% and European stocks are up +0.49% as concerns eased over a China/U.S. trade war. The WSJ reported that unidentified people with knowledge of the matter said China and the U.S. have quietly started negotiations to improve U.S. access to Chinese […]

Foreign Bond Markets Rallied Last Week On Trade-War Fears

Mar 26, 2018

Jeremy Parkinson

Finance

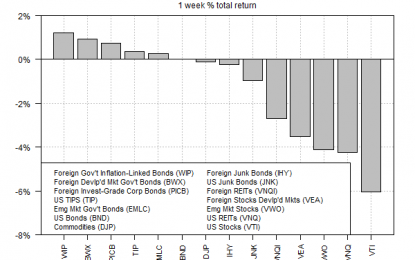

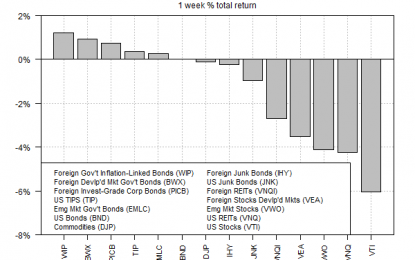

Stock markets around the world tumbled last week over concerns about a possible trade war between the US and China. The risk-off posture generated renewed demand for bonds, particularly foreign bonds, which delivered the only gains last week for the major asset classes, based on a set of exchange-traded products. Supported by a weak greenback, foreign inflation-indexed […]

Global Equity Breadth Check: New Lows

Mar 26, 2018

Jeremy Parkinson

Finance

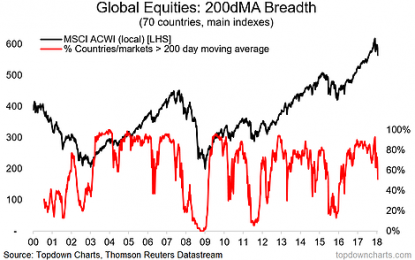

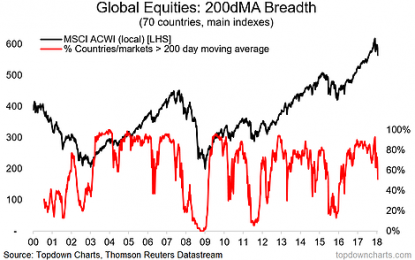

Just a quick global equity breadth check here. As a reminder, these breadth models are looking at breadth across countries i.e. the main benchmark stock index for each of the countries we monitor (70 countries in total). Looking at breadth in this fashion for global equities can help flag early warning signs if certain pockets of […]