Paying The (Volatility) Tax Man

Mar 15, 2018

Jeremy Parkinson

Finance

Zerohedge reposted a short commentary by Mark Spitznagel from Universa Investments, the firm that Nassim Taleb is affiliated with. The short version is that buy and hold doesn’t work due to what he calls a volatility tax. Investors can’t capture the average return of the market due to the lumpiness of returns citing this example; “lose 50% […]

Bull Of The Day: Applied Material

Mar 15, 2018

Jeremy Parkinson

Finance

Semiconductor sector is one of the best performing sectors this year. It is up about 11%, handily beating the broader technology sector’s return of 9.3% and S&P 500’s return of 3.4%. About the Company Headquartered in Santa Clara, CA, Applied Material (AMAT – Free Report) is a leading equipment supplier to the global semiconductor industry. They have been the […]

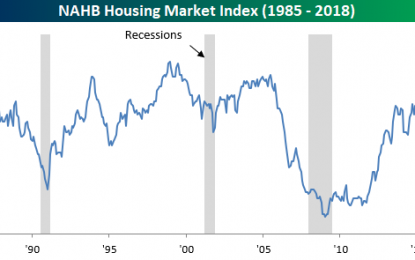

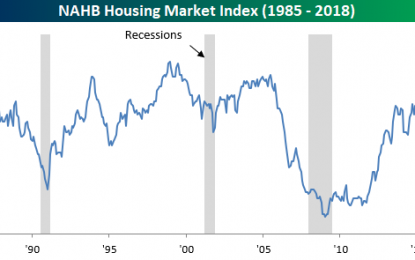

Homebuilder Sentiment Continues Retreat From Extreme Highs

Mar 15, 2018

Jeremy Parkinson

Finance

After a hitting the highest level since 1999 back in December, Homebuilder sentiment dropped for the third straight month in March, falling from a downwardly revised level of 71 down to 70. A decline is a decline, but any reading in homebuilder sentiment that still has a 7-handle is quite impressive. The table below shows […]

Swing Trading

Mar 15, 2018

Jeremy Parkinson

Finance

We perform technical analysis of the charts using candlestick charting. Indicators used are the relative strength indicator as well as the stochastic. We are very bullish on the gold stocks and very bearish on the US Dollar.

The Many Uses Of Gold

Mar 15, 2018

Jeremy Parkinson

Finance

As our loyal readers know, at U.S. Global Investors we carefully monitor the price of gold. We pay close attention to the macro drivers moving the yellow metal, like government policy and cultural affinity spurring demand globally. We also monitor the micro drivers, like company management and quant factors that make one gold stock superior […]

Investor Sentiment Turning; Bigger Stock Market Crash Possible In 2018

Mar 15, 2018

Jeremy Parkinson

Finance

iStock.com/vlastas Earnings Surprises Are Foretelling a Stock Market Crash If you own stocks, you might what to read this: the stock market could disappoint in 2018. Don’t get too complacent just yet. There are developments suggesting that a stock market crash is still a possibility this year. Go back to late 2016 and 2017… No […]

Derivatives – A Recipe For Disaster & Systemic Collapse

Mar 15, 2018

Jeremy Parkinson

Finance

Gambling is according to Wikipedia the wagering of money (or something of value) on an event with an uncertain outcome. Three elements are required for gambling. Consideration, chance, and prize. Thus, you make a bet and if you are lucky you win a prize but you can also lose it all. Gambling has been around […]

Two Strong-Buy Renewable Energy Stocks To Consider Now

Mar 15, 2018

Jeremy Parkinson

Finance

With the harmful effects of pollution and the advent of global climate change finally reaching everyday conversations throughout society, investors are finally starting to see the traditional energy sector respond. Serious money is being poured into clean-energy research, and even oil behemoths like BP (BP – Free Report) and Exxon Mobil (XOM – Free Report) have taken up the […]

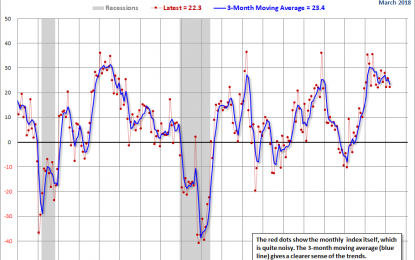

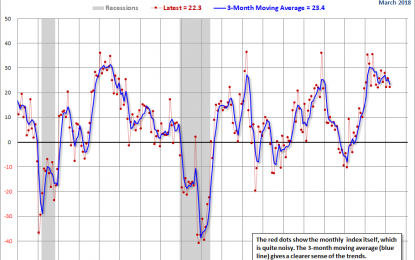

Philly Fed Manufacturing Index: Continued Expansion In March

Mar 15, 2018

Jeremy Parkinson

Finance

The Philly Fed’s Manufacturing Business Outlook Survey is a monthly report for the Third Federal Reserve District, covers eastern Pennsylvania, southern New Jersey, and Delaware. While it focuses exclusively on business in this district, this regional survey gives a generally reliable clue as to the direction of the broader Chicago Fed’s National Activity Index. The latest Manufacturing Index […]

Loonie Tests 2018 Lows As Canada Existing Home Sales Crash To 5 Year Lows

Mar 15, 2018

Jeremy Parkinson

Finance

The Canadian Dollar dropped, testing the lows of 2018, following CREA data showing existing home sales crashed to the lowest since 2013 and price appreciation slowed dramatically. Home sales via Canadian MLS® Systems were down 6.5% in February. This marks the second consecutive monthly decline following the record set in December 2017 and the lowest reading in nearly five years. […]