Further Selling—But Markets Rangebound

Dec 08, 2015

Jeremy Parkinson

Finance

It will rank as another distribution day for markets, but despite a second day of selling bears were unable to erase Friday’s big bullish bonanza for Large Cap and Tech indices. The only index to suggest bears are gaining some form of control is the Russell 2000. Today saw the trendline connecting September and November […]

Netflix: “We Don’t Believe You… You Need More People”

Dec 08, 2015

Jeremy Parkinson

Finance

The culprit for Netflix’s (NASDAQ:NFLX) recent fall was the company’s underwhelming domestic subscriber growth. Domestic and international subscribers were up Q/Q by 2.1% and 11.8%, respectively. The performance was consistent with that of Q2 2015 where domestic and international subscribers grew Q/Q by 2.1% and 11.4%, respectively. Netflix Needs More People Management’s rationale for the […]

It Is Getting Harder To Continually Look Lower

Dec 08, 2015

Jeremy Parkinson

Finance

As I noted over the weekend on ElliottWaveTrader.net, the bears are bearish, the bulls are bearish and the gold bugs have resigned themselves to “hoping.” Even most of the bulls I read strongly believe that we have to see a capitulation drop below $1,000 in gold before a bottom can be seen. But, as […]

E

Making Sense Of The Commodities Rout

Dec 08, 2015

Jeremy Parkinson

Finance

Making Sense: There is a rout going on in the commodities space. Some of this is based on fundamentals. Some of the rout is due to technical factors. Investors and advisors need to understand this before trying to become an asset class hero or consider stepping out. Asset Class Hero Commodity prices have been beaten […]

Factors In Long-Term Unemployment

Dec 08, 2015

Jeremy Parkinson

Finance

The BLS reported on Friday that the U.S. unemployment rate was down to 5% in October and November, its lowest level since 2008. The dramatic surge in unemployment during the Great Recession and its stubborn persistence in coming back down were both dominated by a tremendous increase in the number of people who spent longer […]

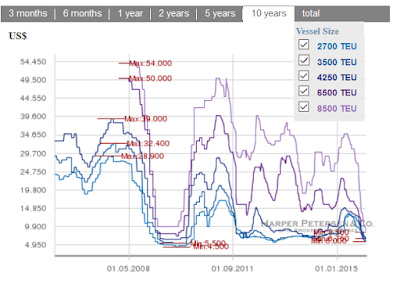

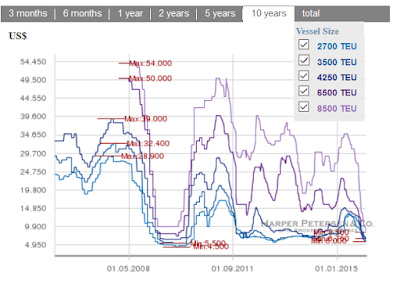

When Shipping Overcapacity Meets Falling Demand

Dec 08, 2015

Jeremy Parkinson

Finance

The following charts show what happens when an increasing number of ships meets falling demand. Harper Petersen Shipping Rates by Vessel Size – Ten Years image: http://4.bp.blogspot.com/-NeQn5KKa5pw/VmdF03IIrFI/AAAAAAAAgfY/gdbzBSVawug/s400/Harper%2BPetersen%2B2015-12-08A.png Source: More charts below, but first let’s explain TEU. TEU stands for twenty-foot-equivalent unit. It’s an imprecise term because lengths have a 20-foot long (6.1 meters) standard but […]

Market Talk – December 8th, 2015

Dec 08, 2015

Jeremy Parkinson

Finance

China’s Trade surplus did not live up to expectation and a result we saw weaker prices across all major Asian Indices. Shanghai and HSI were both down around 1.5% while the Nikkei lost only 1%. The Nikkei did attempt to lead the pack when Q3 GDP saw a small recovery but when the mood within […]

Finally Passing Gas: 10 Winners And Losers Of The Panama Canal Expansion

Dec 08, 2015

Jeremy Parkinson

Finance

When the Panama Canal expansion is finally finished next year, the canal will have two new features: the ability to serve ships that can carry up to three times as many containers as it can currently handle, and the ability to serve liquified natural gas carriers, which it currently cannot handle at all. It is […]

How Much Longer Will Rising US Dollar Crush Commodities And Mining Equities?

Dec 08, 2015

Jeremy Parkinson

Finance

In May of 2011 I sent out this chart and published an article entitled, “The Euro-Dollar Dance Doesn’t Fool Gold And Silver Bulls”. I predicted that the Euro (NYSEARCA:FXE) made a bearish technical reversal, while the US dollar (NYSEARCA:UUP) was oversold and could bounce higher to resistance. The chart clearly shows the historical inverse relationship […]