International Economic Week In Review: The Slowdown Gains Traction

Nov 15, 2015

Jeremy Parkinson

Finance

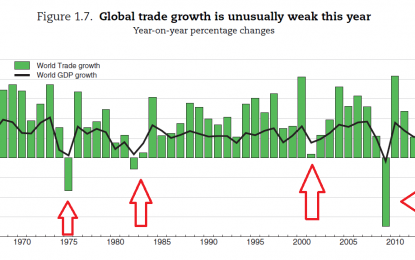

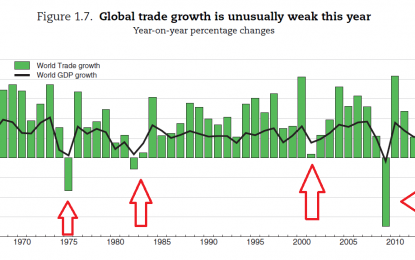

The OECD is the latest organization to issue a report with downward global growth projections: Global growth has eased to around 3% this year, well below its long-run average. This largely reflects further weakness in EMEs. Deep recessions have emerged in Brazil and Russia, whilst the ongoing slowdown in China and the associated weakness of commodity prices […]

5 Undervalued Companies For Value Investors With A High Beta – November 2015

Nov 15, 2015

Jeremy Parkinson

Finance

There are a number of great companies in the market today. By using the ModernGraham Valuation Model, I’ve selected the five undervalued companies for value investors reviewed by ModernGraham with the highest beta. A company’s beta indicates the correlation at which its price moves in relation to the market. A beta greater than 1 indicates a […]

EURUSD: Above 1.0673 Zone Leaves Threats To The Upside

Nov 15, 2015

Jeremy Parkinson

Finance

EURUSD: With EUR struggling to close marginally higher the past week, risk of a recovery higher is not over yet. This development leaves the 1.0673 zone providing support and leaving threats to the upside. Support comes in at the 1.0700 level but if violated, expect more weakness to occur with eyes on the 1.0673/50 levels. […]

Economic Events Of The Coming Week – 11/15/2015

Nov 15, 2015

Jeremy Parkinson

Finance

Monday: Preliminary data on Japan’s GDP will be released for the third quarter. October’s final estimate for consumer prices in the Eurozone will also see light. ECB President Draghi will speak in Madrid. Tuesday: Consumer, as well as Producer Price Indices will see light in the U.K., where core inflation is still holding strong at 1%. In […]

Weekly Economic & Political Timeline – 11/15/2015

Nov 15, 2015

Jeremy Parkinson

Finance

This week should be more newsworthy than last week, with key Central Bank events due concerning the USD, the JPY and the AUD. The most important element will be the FOMC Meeting Minutes release on Wednesday as the market will probably see these comments written after the key economic data release from the day before […]

Eight Things On My Mind At The Start Of The New Week

Nov 15, 2015

Jeremy Parkinson

Finance

1. Nous Sommes Paris: The attack in Paris is tragic and reprehensible. Our thoughts and prayers are with the victims and the people in France. There are several political and economic consequences, aside from the tighter security and elevated alertness. The attack overshadowed other issues at the G20 meeting. On one hand facing terror, investors often […]

The Forensic Accounting ETF: Where The Bodies Are Buried

Nov 15, 2015

Jeremy Parkinson

Finance

Photo credit: Tony Hoffarth Forensic accountant John Del Vecchio likes to joke that he knows “where the bodies are buried” in the financial statements. In his line of work, you have to. John is a professional short seller and the author of What’s Behind the Numbers, an excellent primer on short selling I reviewed two years ago. […]

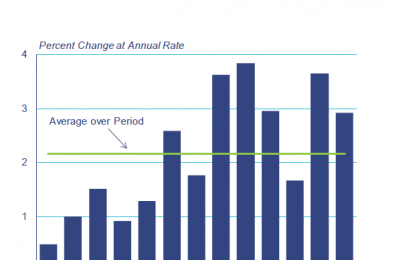

U.S. Equity And Economic Review: It’s A Revenue Recession

Nov 15, 2015

Jeremy Parkinson

Finance

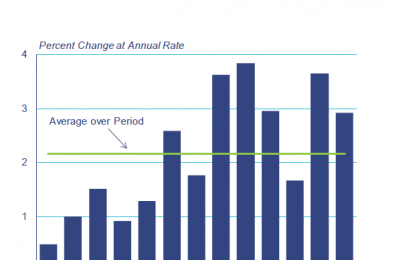

Last week, Fed President Rosengren offered his analysis of the US economy: Many headlines have focused on real GDP growing at only 1.5 percent in the third quarter. However, I would like to share with you a measure that focuses on domestic demand – real final sales to domestic purchasers, which is shown in Figure 1. This […]

Market In-review: Stocks Heavy As Oil Slips

Nov 15, 2015

Jeremy Parkinson

Finance

■ Oil prices lowest since August on OPEC commentary ■ Global equities trade heavily on oil and other commodities’ decreases ■ U.S. stock indices decline after six consecutive weekly gain streak ■ Draghi says more Q.E. possible in Dec ■ USD weakens vs. major currencies in spite of expected Dec Fed liftoff Oil prices […]

U.S. Employment Numbers Too Strong For A Fed Hike

Nov 15, 2015

Jeremy Parkinson

Finance

The question of whether the Fed will raise interest rates by the end of the year is still very much in doubt. But inflation numbers to be reported on Tuesday could provide the final clues as to whether the Fed’s first rate increase in nearly a decade will actually take place. The release of U.S. […]