Redacted Version Of The March 2016 FOMC Statement

Mar 16, 2016

Jeremy Parkinson

Finance

January 2016 March 2016 Comments Information received since the Federal Open Market Committee met in December suggests that labor market conditions improved further even as economic growth slowed late last year. Information received since the Federal Open Market Committee met in January suggests that economic activity has been expanding at a moderate pace despite the global economic and financial developments of […]

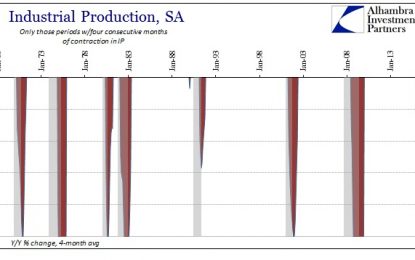

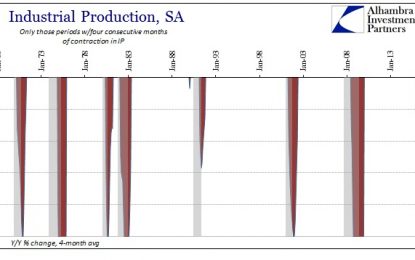

Industrial Production Drops For A Fourth Straight Month

Mar 16, 2016

Jeremy Parkinson

Finance

US Industrial Production contracted for the fourth consecutive month in February, falling 1.03% year-over-year. It was the third drop of more than 1% in those four months, leaving the 6-month average now at -0.57%. A single month of -1% is usually associated with recession, let alone three of the past four and a negative six-month […]

LinkedIn Corp Stock Falls After Downgrade From Morgan Stanley

Mar 16, 2016

Jeremy Parkinson

Finance

LinkedIn (LNKD) stock received a downgrade from analysts at Morgan Stanley as a result of decelerating growth in enterprise and Talent Solutions and rising investments in all four of the social network’s businesses. They also warned investors that the company’s platform probably won’t be as big as they thought it would be previously. Their price […]

Market Talk – March 16, 2016

Mar 16, 2016

Jeremy Parkinson

Finance

With both Asia and European markets were in pretty much a waiting station ahead of the FED, so it is probably worth us heading straight to where the action started! Even the events of the UK Budget were almost removed with talks of, “It could all change come June 23rd anyway” so why get too hot under […]

S&P 500 Snapshot: The Fed Tempest In A Teapot… A Modest Gain On Low Volume

Mar 16, 2016

Jeremy Parkinson

Finance

The pre-FOMC trade this week has been, in our characterization, in the doldrums, as illustrated by the fractional losses on Monday and Tuesday and the two narrowest intraday trading ranges of 2016. Today’s market action saw a typical 2 PM mini-drama with the release of the statement followed by Janet Yellen’s press conference. It was […]

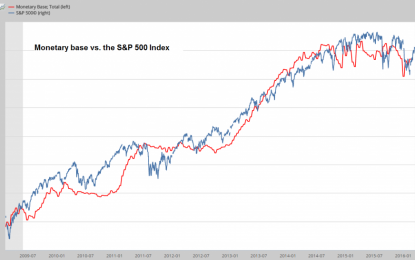

The Monetary Base, Buybacks And The Stock Market

Mar 16, 2016

Jeremy Parkinson

Finance

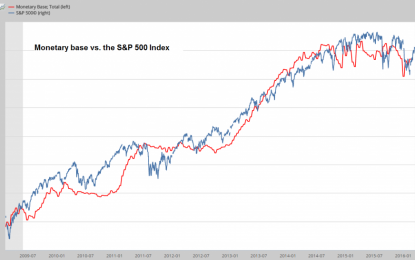

A Useful Leading Indicator? We often see charts comparing the S&P 500 to the growth in the Federal Reserve’s balance sheet, or more specifically, to assets held by the Fed. There is undeniably a close correlation between the two, but it has struck us as not very useful as a “timing device”, or an early […]

Gold, Stocks, & Bonds Soar As “Cowardly Lyin'” Fed Batters Banks & Greenback

Mar 16, 2016

Jeremy Parkinson

Finance

Watching the markets’ reaction and listening to Yellen’s incomprehensible drivel brought to mind two Gladiator clips… Pre-Fed… and Post-Fed… So let’s survey the ‘damage’… Rate hike odds plunged… And the market turmoiled all over the place… But Gold was the post-Fed winner… Trannies were best on the day… (not the pump and dump between statement […]

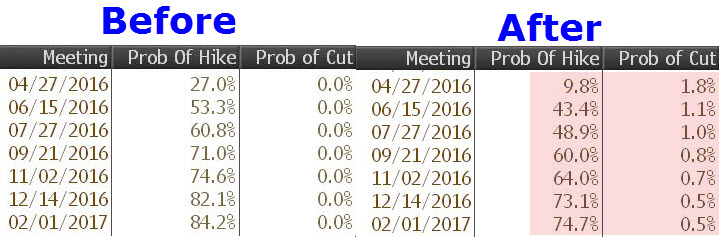

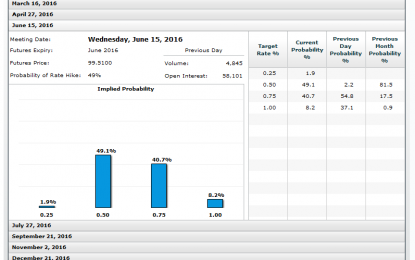

Fed Says Two Hikes, Down From Four; Market Says One

Mar 16, 2016

Jeremy Parkinson

Finance

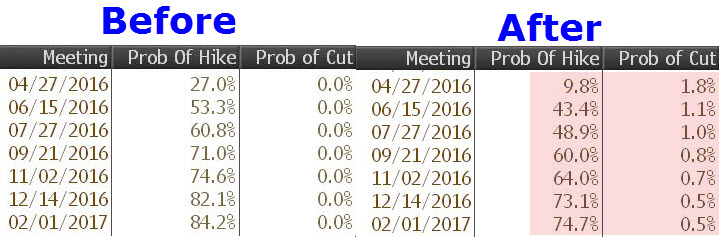

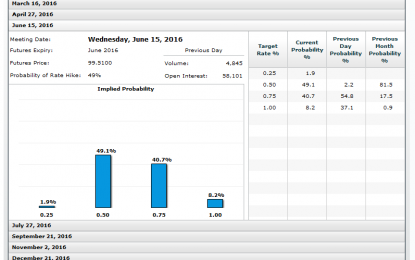

Following today’s FOMC announcement in which the Fed scaled back its rate hike projections from four to two, the market scaled back its assessments even more according to CME Fedwatch analysis of Fed Fund Futures. Let’s compare rate hike odds on March 14 to today to see how the odds shifted. June 15 Meeting Odds on March […]

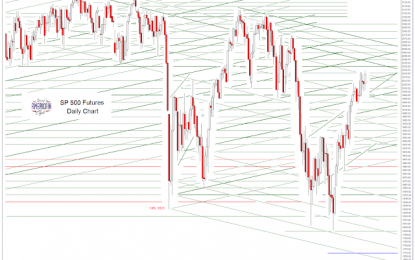

SP 500 And NDX Futures Daily Charts – There Goes The Recovery™ Again, Receding Into The Future

Mar 16, 2016

Jeremy Parkinson

Finance

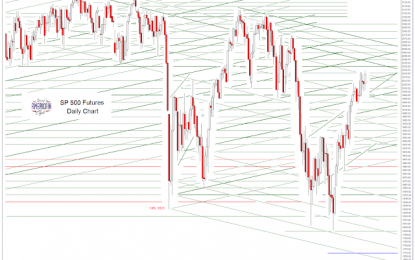

“Victorians, Victorians, who never learned to weep. Who sowed the bitter harvest that your children go to reap.” F. Scott Fitzgerald, This Side of Paradise Ah, the vagaries of empire, and the New American Century. O brave new world, that has such wieners in it. The Fed had to ask for ‘a mulligan’ on its forecasts […]

‘Inflation Trade’ Watch

Mar 16, 2016

Jeremy Parkinson

Finance

So FOMC rolls over on Uncle Buck, secure in the knowledge that it is playing with the house’s money for now. USD could drop a long way before anyone would get overly concerned about it. So in standing down, they have managed to play their own game of global Whack-a-Mole with the currency while continuing […]