Are U.S. Drillers Actually Making A Comeback?

May 20, 2015

Jeremy Parkinson

Finance

Is U.S. shale about to make a comeback? Oil prices have rebounded strongly since March. The benchmark WTI prices soared by more than 36 percent in two months, and Brent has jumped by more than 25 percent. There is a new found bullishness in the oil markets – net long positions on Brent crude have […]

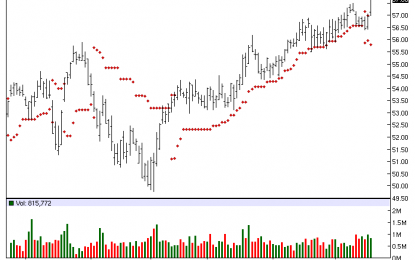

How To Avoid Choppy Stock Market Periods

May 20, 2015

Jeremy Parkinson

Finance

There is a simple answer on How to Avoid Choppy Stock Market Periods..You can’t!!! You have to keep on plugging away in the stock market… However using a combination of moving averages and % moves to the up and down you can stay on the right side of the stock market…

CNBC’s Santelli And Mish Discuss Municipal Bonds; Egan-Jones On Chicago; S&P Blames Moody’s; Message To Bondholders

May 20, 2015

Jeremy Parkinson

Finance

I was back on CNBC with Rick Santelli on Tuesday May 19. The topic once again was municipal bonds with a spotlight on Chicago. Here are a pair of videos. Live Santelli Exchange CNBC’s Rick Santelli discusses Chicago’s credit downgrade and municipal bond crisis, with Mike Shedlock, Sitka Pacific Capital Management. Link if video does […]

Money – A Legal, Not An Economic Thing

May 20, 2015

Jeremy Parkinson

Finance

by Dirk Ehnts, Econoblog101 I have recently read a paper by Christine Desan that is titled Money as a legal institution. The author argues that money is a legal thing, that it is defined by laws and that the law is changed in times of crisis. I very much agree with that. Economists have been so bad […]

Another Record – Financial Review

May 20, 2015

Jeremy Parkinson

Finance

Podcast: Play in new window | Play in new window (Duration: 13:15 — 6.1MB) DOW + 13 = 18,312.39 (record) SPX – 1 = 2127 NAS – 8 = 5070 10 YR YLD + .03 = 2.26% OIL – 2.17 = 57.26 GOLD – 17.80 = 1209.00 SILV – .61 = 17.17 Record high for […]

Greece’s Exit Could Be Even More Serious For The Euro Zone

May 19, 2015

Jeremy Parkinson

Finance

Professor Joseph Stiglitz, economics professor and Nobel Prize Laureate at Columbia University’s Business School, sees a Greek exit from the Euro Zone having a more serious impact on Europe. In this Bloomberg interview, he explains why. (See video below.)

Beijing We Have A Problem: China Suffers Record Capital Outflow In Q1

May 19, 2015

Jeremy Parkinson

Finance

Back on April 18 in “China Sees Largest Capital Outflow In Three Years,” we noted that according to JP Morgan estimates, China saw its fourth consecutive quarter of capital outflows in Q1, bringing the total over the last 12 months to some $300 billion. This is part and parcel of what we have called China’s […]

Trends Driving Recent Gold Rally Firmly Entrenched

May 19, 2015

Jeremy Parkinson

Finance

Gold hit a three-month high on Monday, driven by fears over Greece’s ability to pay debts and soft economic data in the US. The price of gold peaked at $1,232.20 Monday, before sliding a bit on Tuesday. CNBC reports a sharp rise in the euro and indications the European Central Bank may speed its 1 […]

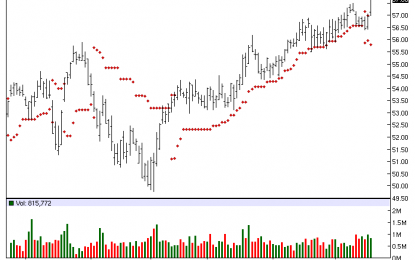

Torchmark – All Time High

May 19, 2015

Jeremy Parkinson

Finance

The Chart of the Day is Torchmark (NYSE:TMK). I found the stock by sorting today’s All Time High list for the stocks with the highest technical buy signals, then used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 2/11 the stock gained 5.63%. Torchmark Corporation is a financial […]