ECB Increases QE And Cuts Rates

Mar 10, 2016

Jeremy Parkinson

Finance

Today’s Economic events Japan PPI y/y -3.40% vs. -3.40% Australia MI inflation expectations 3.40% vs. 3.60% previously China CPI y/y 2.30% vs. 1.80%; PPI y/y -4.90% vs. -4.90% Germany trade balance 18.9bn vs. 19.2bn Italy quarterly unemployment rate 11.50% vs. 11.50% ECB cuts refi rates to 0% from 0.05% ECB cuts deposit rate to -0.40% […]

E

Nine Reasons Why Volatility Is So High

Mar 10, 2016

Jeremy Parkinson

Finance

After years of steadily upward grinding markets, we have suddenly seen three stock market shakeouts of more than 10% over the past six months. The Volatility Index (VIX) has spiked over $50 once and $30 on three separate occasions during the same time period. What gives? Is the bull market over? Is it time to […]

3 Things: Fed Problem, Oil – Ain’t 2009, NFIB Un-Optimism

Mar 10, 2016

Jeremy Parkinson

Finance

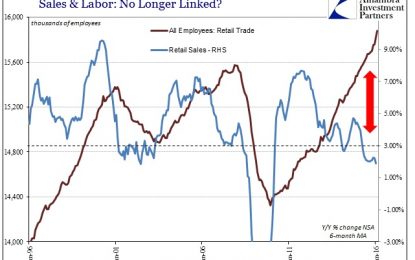

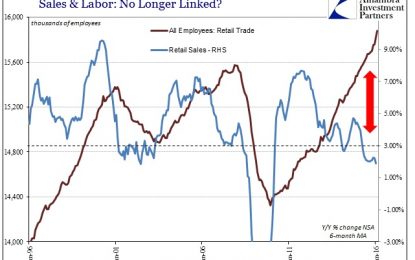

The Fed’s Got A Problem The most recent employment report sent the financial market pundits abuzz claiming that the economy was on solid footing with no recession in sight. The problem, for anyone willing to actually look at the data, was the underlying data was mostly disappointing. While the BLS trumpeted 242,000 new jobs in February, wages […]

ETFs To Watch As Mortgage REIT Q4 Earnings Boost Optimism

Mar 10, 2016

Jeremy Parkinson

Finance

This year has been marked with ups and downs for mortgage REITs that provide real estate financing through the purchase of mortgages and mortgage-backed securities (MBS). Volatile markets triggered by global growth worries and a stronger dollar weighed on these REITs. Meanwhile, these companies are buying back shares and diversifying their businesses to beat market […]

EC

Secular Trends In Employment: Goods Producing Versus Services Providing

Mar 10, 2016

Jeremy Parkinson

Finance

The Department of Labor’s Bureau of Labor Statistics has monthly data on employment by industry categories reaching back to 1939. At the highest level, all jobs are divided into two categories: Service-Providing Industries and Goods Producing Industries. The adjacent chart illustrates the ratio of the two categories since 1939. In 1939 service providing industries employed […]

Could Chinese Weakness Finally Be Priced In?

Mar 10, 2016

Jeremy Parkinson

Finance

The start of the year has been dominated by fears that China’s economy is slowing, which is bizarre because anybody who keeps an eye on economic news knows it has been the case for a couple of years now, and this is behind the softening of commodity prices and shares in mining concerns. The twin […]

How Will Chip Card Technology Impact VeriFone’s Earnings?

Mar 10, 2016

Jeremy Parkinson

Finance

Photo Credit: Mike Mozart VeriFone Systems, Inc. (PAY) Information Technology – IT Services| Reports March 10, After Market Closes Key Takeaways The Estimize community is calling for EPS of $0.47 and revenue expectations of $502.82, 1 cent higher than Wall Street’s earnings estimate and $2.5 million greater on the top line VeriFone is the current leader in […]

Silver Stalling?

Mar 10, 2016

Jeremy Parkinson

Finance

Silver prices are more or less flat since yesterday and our technical outlook therefore remains the same. The short-term trend is bullish above the February 29 low of $14.60 and this suggests that prices may head higher over the coming days. Silver may trade as high as it did last week, recording a peak of $15.83 and […]

ECB: Emptying Mario’s Cart – CIBC

Mar 10, 2016

Jeremy Parkinson

Finance

Fresh off the wild EUR/USD moves on the big ECB decision, here is the view from CIBC: Here is their view, courtesy of eFXnews: Having failed to live up to expectations late last year, the ECB today stepped up with stimulus that actually went beyond what was anticipated. The cut in the deposit rate further into negative […]

Silver Price Forecast: Silver Peak Likely Only After Dow Crash & Major Bottom

Mar 10, 2016

Jeremy Parkinson

Finance

Last year, I produced the following chart and commentary (italics) to show how the Dow could crash like it did in 1929: Above, is a fractal comparison between the current period (1998 to 2015) and the 1920/30s, for the Dow (charts fromtradingview.com). Follow the two patterns marked 1 to 5. I have also indicated where […]