Sector ETFs To Benefit From Global Negative Interest Rates

Mar 11, 2016

Jeremy Parkinson

Finance

The world is heading toward negative interest rates policies (NIRP) to stimulate sagging growth and prevent deflationary pressure. Most central banks, including the ones in Japan, Sweden, Switzerland, Denmark and Europe have adopted this policy. The central bank of Denmark was the first and foremost to set a negative tone for rates in mid 2012. […]

Mario Draghi Got Lost In A Rabbit Hole

Mar 11, 2016

Jeremy Parkinson

Finance

I’ll try and keep this gracefully short: Mario Draghi ‘unleashed’ a bazooka full of desperate tools on the financial markets yesterday and they blew up in his face faster than you could say blowback or backdraft (and that’s just the start of the alphabet). This must and will mean that Draghi’s stint as ECB head […]

Biotech Investing Guide: 3 Stocks To Buy And 3 To Avoid

Mar 11, 2016

Jeremy Parkinson

Finance

The biotech sector, which has outperformed over the last few years, has not exactly had a great start this year — the Nasdaq Biotechnology Index is down 22.2% year-to-date. Compare this to 11.9% growth during the same period last year and one wonders whether the dream run for the sector is over. The sector has […]

The Best Dividend ETF: Data-Driven Answers

Mar 11, 2016

Jeremy Parkinson

Finance

Charlie Munger has a fitting analogy for investing markets; racetrack betting. “The model I like to sort of simplify the notion of what goes on in a market for common stocks is the pari-mutuel system at the racetrack. If you stop to think about it, a pari-mutuel system is a market. Everybody goes there and […]

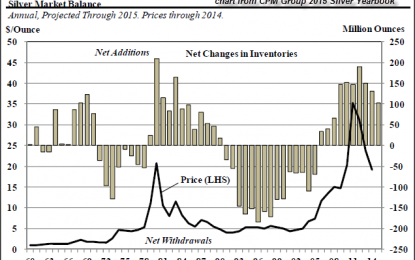

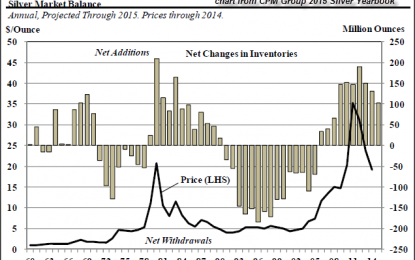

Silver Outbreak: Investment Demand Will Totally Overwhelm The Market

Mar 11, 2016

Jeremy Parkinson

Finance

It’s no secret to the precious metal community that silver is one of the most undervalued assets in the market, however 99% of Mainstream investors are still in the dark. This was done on purpose to keep the majority of individuals invested in Wall Street’s Greatest Financial Ponzi Scheme in history. You see, this is […]

EC

When Bond Kings Short Emerging Market Equities

Mar 11, 2016

Jeremy Parkinson

Finance

“If you’re going to do something in emerging market equities, my recommendation is to short them. They may fall a further 40%.” – JJ Jeff Gundlach hates Emerging Markets. So does almost every other pundit on financial TV. So do the rating agencies. Can you blame them? Over the past five years (through February), while […]

‘Bounce Longs’ Updated

Mar 11, 2016

Jeremy Parkinson

Finance

I thought the pattern was sneaky bullish and that is why I held BSX as I sold the others last week. Today it boinks the 50 day moving averages. As noted earlier in the week, MSCC was bought back at support after being sold just below target. So far, so good although also uninspiring as yet. […]

QE Honesty

Mar 11, 2016

Jeremy Parkinson

Finance

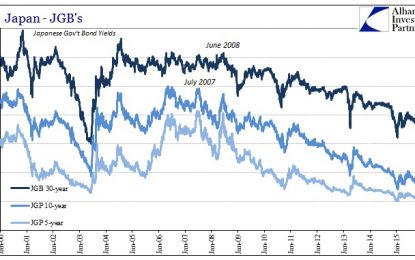

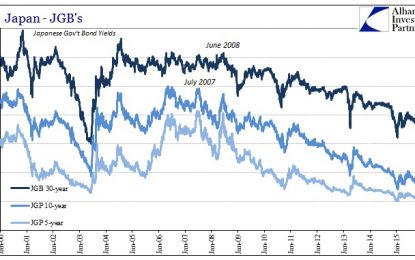

The Bank of Japan had previously “disappointed” last December when it failed to announced more “stimulus.” Setting aside who might actually have been frustrated by the lack of renewed distortions, the Japanese central bank did make some minor alterations to its QQE regime at that time. They expanded the list of eligible collateral and extended […]

Great Graphic: Canadian Dollar Trendline Approached

Mar 11, 2016

Jeremy Parkinson

Finance

The Canadian dollar’s advance continues. Neither the widening of interest rate differentials in the US favor nor a poor employment report has managed to buckle the Loonie. Oil and the general risk-on mood trump the other concerns. In addition, investors are concluding that fiscal stimulus will reduce the possibility of additional monetary stimulus. The implied […]

Confessions Of A Trading Guru

Mar 11, 2016

Jeremy Parkinson

Finance

When you hear the word “trading.” perhaps you think of it as an acquired skill whereby savvy victors consistently outwit the minions of others whose knowledge and abilities are insufficient in today’s complex global markets. Look up the word “guru” and you find it refers to someone who’s an expert, a specialist, a leader or […]