Top 5 Charts Of The Week – Wednesday, August 15

Aug 15, 2018

Jeremy Parkinson

Finance, No picture

This week: Global equities – death cross breadth and what it’s telling us about emerging markets US cyclicals vs defensives and the S&P500 outlook (a bearish or bullish rotation?) A surge in US credit growth on the cards based on Fed loan officer survey Spike in policy uncertainty in China – why it makes sense […]

3 USAA Mutual Funds For Spectacular Gains

Aug 15, 2018

Jeremy Parkinson

Finance, No picture

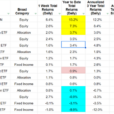

USAA Investment Management Company allocates its assets across a wide range of mutual fund categories, including both equity and fixed-income funds. The company seeks to follow military values — Service, Loyalty, Honesty, and Integrity — to offer financial services such as brokerage services and discretionary asset management. Founded 40 years ago, the company currently has […]

Two Largest QQQ Components Compromised?

Aug 15, 2018

Jeremy Parkinson

Finance, No picture

Last week, I opined a technical piece entitled, ” Momentum Divergences Flashing Warnings Signs for QQQ & FAANG Stocks”, which highlighted the near- and intermediate-term divergences that were and still are developing in the big-cap technology sector. Today I follow up with a look under the hood and the technical setups in Apple (AAPL) and […]

The CBO On Trade Policy Uncertainty

Aug 15, 2018

Jeremy Parkinson

Finance, No picture

The CBO’s Budget and Economic Outlook is a must read. In addition to the widening budget deficit (no supply-side miracle here), and the downward revision in projected 2018 growth, there is this commentary in the section blandly titled “Some Uncertainties in the Economic Outlook” (page 14 onward): A sizable uncertainty in the U.S. trade and inflation forecast stems […]

GBP/USD Eyes June 2017-Low As U.K. CPI Fails To Impress

Aug 15, 2018

Jeremy Parkinson

Finance, No picture

BRITISH POUND TALKING POINTS GBP/USD trades to fresh 2018 lows as fresh data prints coming out of the U.K. do little to sway the monetary policy outlook, and recent price action warns of a further decline in the exchange rate as the Relative Strength Index (RSI) pushes deeper into oversold territory. GBP/USD EYES JUNE 2017-LOW AS […]

Why One Bank Thinks The Fed Has No Choice But To Launch QE4 Next Year

Aug 15, 2018

Jeremy Parkinson

Finance, No picture

With the current Emerging Market rout growing stronger by the day as the dollar surges, crushing carry trades left and right and sending EM currencies plunging, in the process validating the June warning from RBI governor Urjit Patel who warned the Fed that continued liquidity extraction in the form of balance sheet shrinkage will only make contagion […]

Productivity Up 2.9% – Real Hourly Earnings Down: Thank You Fed!

Aug 15, 2018

Jeremy Parkinson

Finance, No picture

Productivity for the second quarter rose 2.9%. Year-over-year inflation-adjusted hourly earnings are down. The BLS report on Productivity and Costs for the Second Quarter 2018 shows that despite productivity increase, real wages are declining. Nonfarm business sector labor productivity increased 2.9 percent during the second quarter of 2018, the U.S. Bureau of Labor Statistics reported today, as […]

EUR/USD Price Analysis: Euro Testing 1.13 – Is Relief In Sight?

Aug 15, 2018

Jeremy Parkinson

Finance, No picture

Euro testing near-term structural support- a threat for recovery while above 1.1275 Euro is trading into fresh yearly lows today with price now testing key near-term support objectives. Here are the updated targets and invalidation levels that matter on the EUR/USD charts. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more. EUR/USD DAILY PRICE CHART […]

AUD/USD: Bearish Trend Still Dominates Ahead Of AU Jobs

Aug 15, 2018

Jeremy Parkinson

Finance, No picture

The price action so far today is emblematic of a textbook “risk off” day: stocks are falling across the globe, oil is trading off by nearly 3%, bond yields are generally retreating, and the yen is the strongest performing major currency (though we would note that gold bugs still can’t seem to catch a break!). One […]