The Next Big Crude Oil Move

Oct 10, 2017Jeremy Parkinson0

The weekly continuation chart of WTI Crude Oil displays an 18-month H&S top pattern. This is a chance that the Sep 28 high will represent the high of the right shoulder. If this analysis is correct (always a big IF), the right shoulder appears to be taking the form of a 15-week channel. Note on […]

VanEck Vectors Oil Services ETF Is Up 19% Since August. Did You Buy It?

Oct 10, 2017Jeremy Parkinson0

Back on August 4, I told you that major oil companies were raking in record cash flows. Giants like BP (NYSE: BP) and Royal Dutch Shell (NYSE: RDS-B) made more cash in the first half of 2017 than they did in 2014 when oil was more than $100 per barrel. However, one critical sector didn’t see […]

Tesla Inc. Stock: Bulls And Bears Battle Over EV Infrastructure

Oct 10, 2017Jeremy Parkinson0

Tesla Inc. (TSLA) stock is off and running out of the gate this morning after one perma-bull raised his price target for what he sees as the company’s biggest competitive advantage. He believes that the EV maker’s Supercharger infrastructure and Gigafactory combine to create that advantage: EV infrastructure. Blomst / Pixabay However, another firm also weighed in on […]

Will Dow ETFs Continue To Shine In Q3 Earnings?

Oct 10, 2017Jeremy Parkinson0

While Wall Street is scaling multiple highs on Trump’s pro-growth reforms, the Dow Jones Industrial Average has been an outperformer since election last year. This is because a strong rotation in leadership in the large-cap domestic space has benefited Dow Jones more than its other large-cap counterparts like the S&P 500. Notably, the Dow Jones […]

US Dollar: It Ain’t Over Till It’s Over

Oct 10, 2017Jeremy Parkinson0

“It is in the nature of the human being to seek a justification for his actions.” ― Aleksandar Solzhenitsyn Despite the rising probability, along with increasing sentiment and real positioning, suggesting the US dollar cyclical bull market rally is over (ending with the peak in early January 2017 labeled 5 of III below), the jury […]

Alibaba’s Bigger Than Amazon (Again)

Oct 10, 2017Jeremy Parkinson0

For the first time since June 2015, Alibaba is now bigger (in market cap) than Amazon.com… As Bloomberg notes, after 831 days, Alibaba Group Holding Ltd. has regained the title of the world’s biggest e-commerce company. The Chinese retailer surpassed Amazon.com Inc. Tuesday as the U.S. retail giant’s stock continued to stall after second-quarter earnings missed estimates and the merchant […]

Can We Blame The New Iphone’s Mediocrity On Inflation?

Oct 10, 2017Jeremy Parkinson0

Apple (AAPL) held its 10th anniversary iPhone press event on 9/12. As expected, the tech giant released new iterations of their decade-old smartphone as well as the new iPhone X. Whereas the media has focused on innovation and technology, the event also tells another story: how the company uses the perception of innovation as a strategy […]

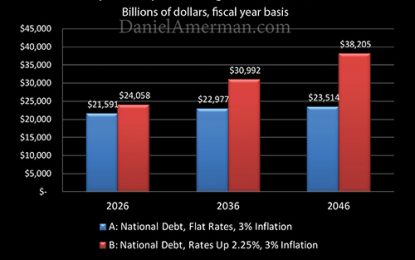

The Profoundly Personal Impact Of The National Debt On Our Retirements

Oct 10, 2017Jeremy Parkinson0

In this analysis we will take a look at something deeply personal – which is how the $20 trillion United States national debt may change the day-to-day quality of life for savers and retirees in the decades ahead. That is likely a somewhat unusual perspective for many savers and investors. On the one hand, we […]

Nigeria’s Economy To Grow By 0.8%

Oct 10, 2017Jeremy Parkinson0

The International Monetary Fund on Tuesday predicted that Nigerian economy will grow at 0.8 percent in 2017 and 1.9 percent in 2018. Nigeria, the largest economy in Africa contracted by 1.6 percent in 2016 due to global oil glut that eroded 70 percent of its foreign revenue. However, the economy emerged from recession in the second quarter […]

The Most Active Equity Options And Strikes For Midday – Tuesday, Oct. 10

Oct 10, 2017Jeremy Parkinson0

The most active equity options and strikes for midday are: INTC, CZR, FCX, BAC, JNJ, AAPL, PFE, NVDA, UAL.