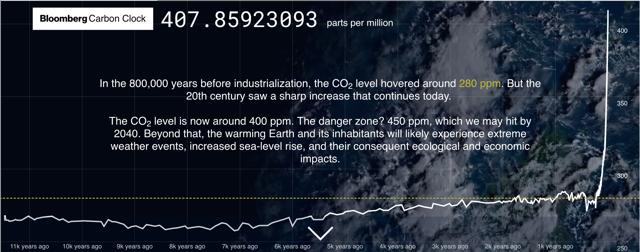

Economic And Other Dangers Of Climate Change: Why We Need To Act Now

Sep 04, 2017Jeremy Parkinson0

Jan Dash PhD is a physicist, an expert at quantitative finance and risk management, and a consultant at Bloomberg LP. In his thought-provoking book, Quantitative Finance and Risk Management, A Physicist’s Approach, he devotes a chapter to climate change and its long-term systemic risk. Jan’s Climate Portal provides background. In this interview with Phil Stock World’s editor Ilene Carrie, Jan discusses climate change and […]

China Slams Trump’s Trade Threat As “Unacceptable”

Sep 04, 2017Jeremy Parkinson0

An angry China slammed President Trump’s threat on Monday to cut off trade with countries that deal with North Korea, as “unacceptable” and “unfair.” As a reminder, following Sunday’s nuclear test by North Korea, Trump threatened to increase economic sanctions and halt trade with any country doing business with North Korea, a threat he has […]

4 Large-Cap Medical Device Stocks To Buy Amid Political Woes

Sep 04, 2017Jeremy Parkinson0

After Trump’s failed efforts to repeal and replace Obamacare, Trump introduced the “skinny” repeal that calls for doing away with parts of Affordable Care Act (ACA) or Obamacare like “individual mandate,” “employer mandate” and “Cadillac taxes”. Last month, the Republicans lost the debate over skinny repeal. The United States witnessed a political dilemma after three […]

Can The US Dollar & Gold Price Advance Together? Sure They Can…

Sep 04, 2017Jeremy Parkinson0

Last week, we noted that the US Dollar Index (DXY) looked likely to have put in a tradable low after the Tuesday ‘spike-and-reverse’ from a zone of major long-term support. By the end of last week this view was further underpinned by continued strength on the heels of the strongest weekly turnabout in the euro in several months (the euro constitutes […]

Risk On Gauge Shifts With Many Markets At Tipping Points

Sep 04, 2017Jeremy Parkinson0

Last week the equity markets had a remarkable reversal of fortune as the SPY and QQQ moved from breaking down under major institutional support levels such as their 50 moving averages, to rebounding to new all-time highs. Additionally, the MarketGauge Risk On / Risk Off gauge changed to green, and several major asset classes ended […]

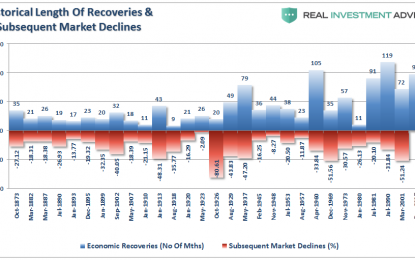

The Rule Of 20 & The Risk To Passive

Sep 04, 2017Jeremy Parkinson0

“The following is an excerpt from this past weekend’s newsletter. I have several follow up articles coming over the next few weeks that will reference Byron Wien’s comments.” The Rule Of 20 Byron Wien recently asked the question of where we are in terms of the economy and the market to a group of high-end investors. To wit: […]

Varoufakis: The Book

Sep 04, 2017Jeremy Parkinson0

Detail of a fresco from the House of the Tragic Poet, Pompeii, 2nd century BC About a month ago, I finished reading former Greek finance minister Yanis Varoufakis’ book “Adults in the Room”, subtitled “My Battle With Europe’s Deep Establishment”, and published by The Bodley Head. I started writing about it right away, but noticed […]

North Korea’s H-Bomb Rattles Monday’s Markets

Sep 04, 2017Jeremy Parkinson0

North Korea’s apparent test of a hydrogen bomb spurred a quick and fairly predictable response by investors, given that the US market was closed for the Labor Day holiday. The funding currencies, like the yen and Swiss franc, were bought back, gold rallied, and equities were sold. While playing up the fact that all options, […]

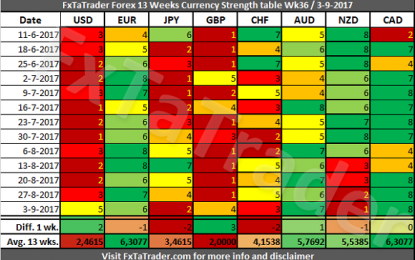

Forex Strength And Comparison Week 36/2017

Sep 04, 2017Jeremy Parkinson0

In the Currency Strength table, the CAD was again the strongest currency while the NZD was the weakest. There were some significant changes last week with the GBP gaining 3 points and the USD 2 points. The JPY and CHF lost 2 points. The other currencies remained around the same level of last week with a maximum change […]

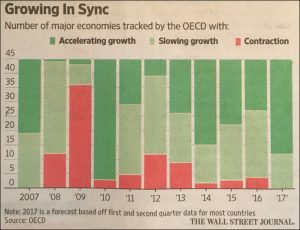

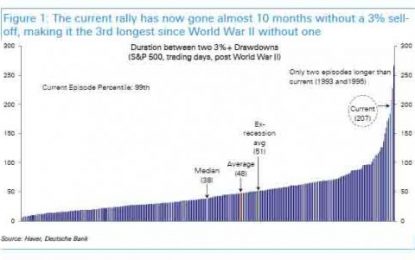

How Stocks Reacted To The Biggest Geopolitical Shocks Since World War II

Sep 04, 2017Jeremy Parkinson0

As Deutsche Bank warns in a note over the weekend, the S&P 500 is “long overdue for a pullback” for one simple reason: the BTFDers (and central banks) have overextended the current rally in the S&P 500 to the point where it is now one for the history books. Traditionally, 3-5% selloffs in the S&P […]