Downstream Concerns Continue To Paint Bearish Picture For Crude Oil

Sep 01, 2017Jeremy Parkinson0

Fundamental Forecast for USOIL: Bearish Talking Points: A week after Harvey’s landfall, assessing damage and demand impact still premature Last major crises in the region (Katrina 2005) was followed by ~18% drop in Oil Per BHI, US Oil Rigs unchanged WoW. Rig count stable at 759 active US oil rigs IGCS showing increase in retail long oil positions, […]

Now Capex?

Sep 01, 2017Jeremy Parkinson0

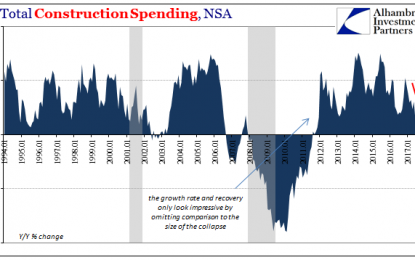

Of all the high frequency data the Personal Savings Rate is probably the least reliable. It is subject to both regular and benchmark revisions that can change the estimates drastically one way or the other. One step up from that statistic is the figures for Construction Spending. The initial monthly estimates don’t survive very long, […]

The Big Four Economic Indicators: August Nonfarm Employment

Sep 01, 2017Jeremy Parkinson0

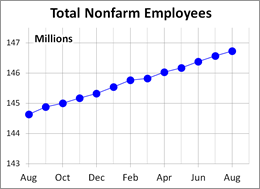

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. This committee statement is about as close as they get to identifying their method. There is, however, a general belief that there are four big indicators that the committee weighs […]

Amazon Has Twice As Many Fulfillment Centers As The Rest Of The Entire US Retail Industry

Sep 01, 2017Jeremy Parkinson0

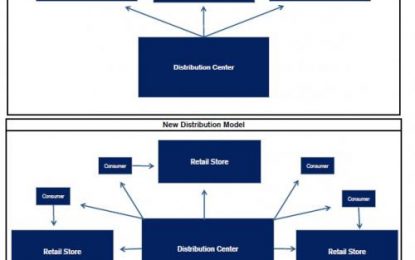

Ask a number of analysts what is the secret to Amazon’s retail (if not overall) success, and 9 out of 10 times the answer will be its meticulous, seamless, and incredibly efficient distribution and logistics system. Or, as Credit Suisse puts it, Amazon (AMZN) has stumbled on (really created) a new distribution model: a “pull” […]

Harvey’s Aftermath: How Might The U.S. Economy Fare?

Sep 01, 2017Jeremy Parkinson0

In today’s edition of Market Week in Review, Consulting Director Sophie Antal Gilbert chatted with Kara Ng, senior quantitative investment strategy analyst, about the anticipated economic impacts to the U.S. from Hurricane Harvey, which caused untold destruction in Texas and Louisiana earlier this week. Economic and financial market implications of Harvey “Our hearts go out […]

Hurricane & Political Surprises As Dow Rises

Sep 01, 2017Jeremy Parkinson0

It was a tumultuous month politically, economically, and meteorologically. The devastating destruction left in the wake of Hurricane Harvey’s 130 mile per hour winds and 50+ inches of rain displaced more than 30,000 people in Texas, destroyed upwards of 40,000 homes, and created estimated damages of $190 billion, making this storm the costliest hurricane in […]

Toward The Housing Bubble, Or Great Depression?

Sep 01, 2017Jeremy Parkinson0

During the middle 2000’s, one more curious economic extreme presented itself in an otherwise ocean of extremes. Though economists were still thinking about the Great “Moderation”, the trend for the Personal Savings Rate was anything but moderate, indicated a distinct lack of modesty on the part of consumers. In early 2006, the Bureau of Economic […]

Despite Pessimism Economy Doing Just Fine

Sep 01, 2017Jeremy Parkinson0

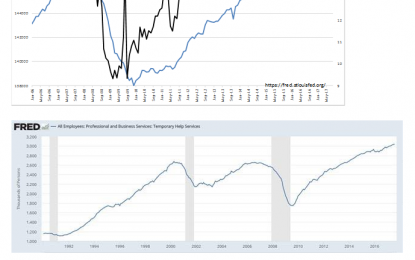

“Davidson” submits: US Household Survey Employment falls a little, but remains on trend from 2009. Light Weight Vehicle Sales lower, some indicating a Harvey impact. Temp Employment and Job Openings, both precursors to higher full-time employment, continue to reach higher levels. Nothing is more telling than Real Personal Disposable Income and Real Retail and Food […]