Inside The “Wildest Commodity Trade” Ever… Just Don’t Blink

Aug 25, 2017Jeremy Parkinson0

Besides the hilariously fabricated economic data and the whole central planning bit – both of which are now everywhere these days – the one most notable feature about China’s economy and capital markets are the constantly rolling, bursting and resurrecting asset bubbles: from housing, to stocks, to bonds, to commodities, to cryptocurrencies, to pretty much […]

GBP/JPY: Targeting 38.2% Fibo En-Route To 50% Fibo: Levels & Targets

Aug 25, 2017Jeremy Parkinson0

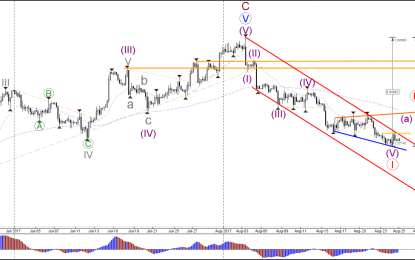

Pound/yen continues producing lots of pips for traders. What’s next for the “dragon”? Here is the technical view from Credit Suisse. Here is their view, courtesy of eFXnews: Credit Suisse FX Technical Strategy Research notes that GBP/JPY’s rejection of its downtrend from December 2016 has seen a sharp fall to complete a small top below […]

GBP/USD Challenges Resistance Of Downtrend Channel After 1.2775 Bounce

Aug 25, 2017Jeremy Parkinson0

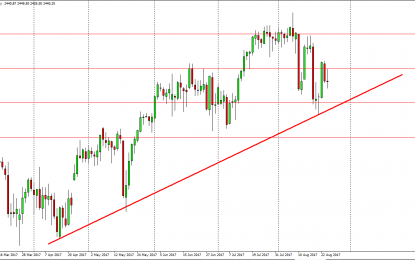

GBP/USD 4 hour The GBP/USD is testing the resistance line of the downtrend channel (red) after indeed bouncing near the round quarter support level of 1.2750. A bullish breakout could start wave A (purple) of a larger wave 2 (red) correction. A bearish break below support (blue) and the 1.2750 support could restart the downtrend […]

What Does A Bond Collapse Mean For The Stock Market?

Aug 25, 2017Jeremy Parkinson0

Hindsight is 20/20 and for years, investors have been following the advice of major names in finance who anticipated market collapse…or rather, were very vocal about it after the fact. While I doubt we are anywhere near a market collapse (at least not one caused by a major event which can happen any time), former […]

S&P 500 And Nasdaq 100 Forecast – Friday, August 25

Aug 25, 2017Jeremy Parkinson0

S&P 500 The S&P 500 went back and forth during the Thursday session, testing the 2450 level, and then pulling back. I think that the neutral candle suggests that we are waiting for words out of Janet Yellen to decide where to go next. After all, Federal Reserve policy will be important involving the dollar […]

Eurozone Flash PMI’s Signal Robust Growth In August

Aug 25, 2017Jeremy Parkinson0

IHS Markit’s flash estimates of the purchase manager index across the manufacturing and the services sector showed that business activity continued to expand in August. The strong numbers came with both Germany and France registering strong output growth during August. Germany’s output showed a faster pace of expansion compared to the month before. Bundesbank’s report […]

Jackson Hole Question: How Fast Will The Fed Unwind Its Balance Sheet?

Aug 25, 2017Jeremy Parkinson0

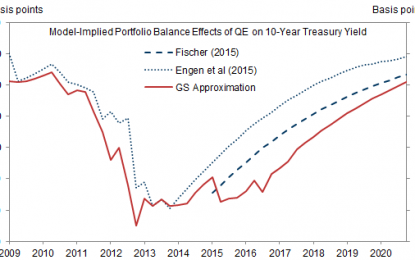

Financial media, Fed watchers, and the punditry pay special attention to the Kansas City’s Fed’s annual conference at Jackson Hole. It is a forum that draws top speakers, innovative ideas, and a sense of the possible policy changes. I expect that a key question will be the reduction of the Fed’s $4.5 trillion balance sheet […]

USDCAD Daily Analysis – Friday, August 25

Aug 25, 2017Jeremy Parkinson0

USDCAD’s short term downtrend from 1.2778 extended to as low as 1.2505. As long as the price is in the falling price channel on the 4-hour chart, the downtrend could be expected to continue and deeper decline to test 1.2413 support is possible. On the upside, a clear break above the top trend line of […]

US Dollar May Rise As Euro Falls On Yellen, Draghi Speeches

Aug 25, 2017Jeremy Parkinson0

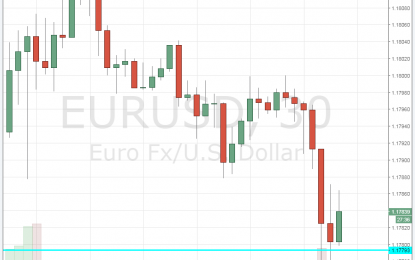

Currency markets put in a muted performance in Asia Pacific trade as investors looked ahead to headlines emerging from the Fed’s annual monetary policy symposium underway in Jackson Hole, Wyoming. Traders are most keen to hear comments from Fed Chair Janet Yellen and ECB President Mario Draghi, both of which may set the stage for major policy changes. […]

German IFO Business Climate Beats With 115.9 – EUR/USD Rises

Aug 25, 2017Jeremy Parkinson0

Business confidence remains elevated in Germany. IFO’s business climate makes a minor slide from 116 to 115.9, better than 115.5 predicted. Business expectations advanced from 107.3 to 107.9, defying projections for a fall. The Current Assessment measure dropped from 125.5 to 124.6. EUR/USD is moving up a few pips, erasing the previous slides. The bigger […]