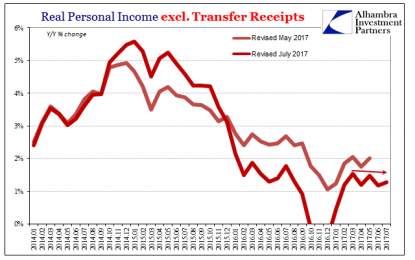

Proving Q2 GDP The Anomaly, Incomes Yet Again Fail To Accelerate

Aug 31, 2017Jeremy Parkinson0

One day after reporting a slightly better number for Q2 GDP, the BEA reports today that there is little reason to suspect it was anything more or lasting. The data for Personal Income and Spending shows that the dominant condition since 2012 remains in effect – “good” quarters, or whatever passes for one these days, […]

Market Valuation Continues To Decline

Aug 31, 2017Jeremy Parkinson0

We now calculate that 52.16% of the stocks to which we can assign a valuation are overvalued and 19.68% of those stocks are overvalued by 20% or more. These numbers have declined fairly significantly below what we saw when we published our last valuation study in June. At that time, we saw an overvaluation figure […]

Pending Home Sales Down Again: NAR Blames “Staggering Lack Of Inventory”

Aug 31, 2017Jeremy Parkinson0

The pending home sales index for July dropped 0.8 percent vs an Econoday expected gain of 0.4%. The National Association of Realtors (NAR) also revised June pending sales from +1.5% to +1.3%. NAR chief economist Lawrence Yun blames a “Staggering” Lack of Inventory. Last month’s resurgence in pending home sales didn’t last long. Sales ended a three-month fad […]

Want To Grow The Economy? Stop Listening To Clueless Economists

Aug 31, 2017Jeremy Parkinson0

The great investor and writer Andy Kessler frequently points out that the failure rate among Silicon Valley start-ups is 90 percent. Every member of the economics profession would be wise to memorize the previous figure and repeat it daily. If so, economists might come closer to understanding why they’re mystified by what they deem slow […]

How To Avoid Getting Stopped Out Of Good Trades By Market Gaps

Aug 31, 2017Jeremy Parkinson0

When the market has a big gap down it’s easy to get scared out of your long trades that have been pulled down by the market. This video gives you a methodical approach to determining when you should sell, and when you should hold on to see if the gap down is a false move. […]

Let’s Talk About Shrinkage (Again)

Aug 31, 2017Jeremy Parkinson0

I’ve got shrinkage on the mind again. Maybe I’ve spent too much time in cold water this summer or maybe it’s just me getting old? I don’t know, but I do know that it’s becoming an increasingly important discussion as the Fed discusses its future policy options. I’ve talked about how the Fed will unwind its […]

Hot Options Alert: Midday – Thursday, August 31

Aug 31, 2017Jeremy Parkinson0

The most active equity options and strikes for midday: WFT, BMY, AAPL, FCX, FB, AAPL, F and KMI.

Iovance Fired Another Shot Across The Bow Of CAR-T

Aug 31, 2017Jeremy Parkinson0

The approval of Novartis’ (NVS) Kymriah is a “major leap forward” for oncology and immunotherapy, but there still remains “significant room for differentiated products,” H.C. Wainwright analyst Joseph Pantginis tells investors in a research note on Iovance Biotherapeutics (IOVA) titled “Pins Set Up: Kite Acquired and Kymriah Approved; TILs Can Knock ‘Em Down; Reiterate Buy.” […]

See No Evil, Speak No Evil

Aug 31, 2017Jeremy Parkinson0

The Jackson Hole speeches of Janet Yellen and Mario Draghi last week were notable for the omission of any comment about the burning issues of the day: …where do the Fed and the ECB respectively think America and the Eurozone are in the central bank induced credit cycle, and therefore, what are the Fed and […]

The Overall Health Of The Gold Market

Aug 31, 2017Jeremy Parkinson0

Ed D’Agostino, COO of the Hard Assets Alliance shares his views on the overall health of the gold market. We look at outside factors that play a roll in the gold market which include central bank policy, overall economic growth, and government actions. He also shares some insights into the demand for the metals from […]