Deutsche Bank: “Path Of Least Resistance” Is For Everything To Rally

Jun 03, 2017Jeremy Parkinson0

You’d be forgiven for throwing in the towel on trying to understand exactly how to reconcile the inexorable rise in equities, the resilience of EM, and the weak dollar with what’s supposed to be a Fed tightening cycle. Yes, Trump and some members of his inner circle have tried to jawbone the dollar lower at various […]

This Bull Market Plays By Different Rules, But It Will End As They Usually Do

Jun 03, 2017Jeremy Parkinson0

Friday’s jobs numbers were perfect for this bull market, but not because of the media’s focus on the new highs in QQQ, SPY and DIA. Consider the advice and quote of legendary investor John Templeton, “Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria.” As I look at the […]

Margins Might Not Expand In The Next Few Quarters

Jun 03, 2017Jeremy Parkinson0

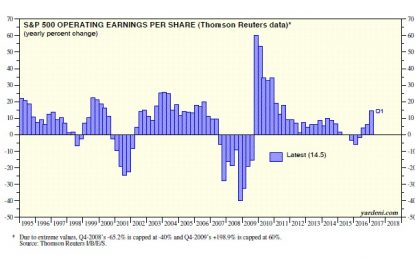

The stock market closed at a new record high on Thursday. The main reason for this rally is seen in the chart below. It shows year over year quarterly operating earnings growth since 1995. The mini-decline in earnings growth in 2015 and 2016 is like the one in 1998. Earnings growth had been sinking prior to […]

Market Confirms Breakout

Jun 03, 2017Jeremy Parkinson0

Market Confirms Breaks Out Market & Sector Analysis 401k Plan Manager Review & Update In last week’s missive, I discussed the breakout of the market. “The breakout does keep our allocation model nearly fully allocated. We are holding onto a little larger than normal cash pile just to hedge some volatility risk during the summer months.Also, stops have now […]

US Dollar At Risk As Political Jitters Rattle Financial Markets

Jun 03, 2017Jeremy Parkinson0

Fundamental Forecast for the US Dollar: Neutral UK election may drive risk aversion, hurt Fed rate hike bets Comey testimony may stoke uncertainty fears, sour sentiment Efforts to loosen US financial rules may be overshadowed Retail traders expect the US Dollar to rise. Find out here what that hints about the price trend! The US Dollar succumbed to […]

Speculators Make Small Adjustments, But Like That Peso

Jun 03, 2017Jeremy Parkinson0

Speculators in the future market made mostly minor adjustments in the gross positioning in the currencies. Ten of the 16 gross positions we track were adjusted by less than 3k contracts. There was only one above 7k. The bulls added 13.9k contracts, which lifted the gross long position to 112.5k contracts. It is the most in […]

Trade Deficit In Pictures: China, Mexico, Canada, Germany, Japan, EU

Jun 03, 2017Jeremy Parkinson0

Trump’s howling about the US trade deficit with Mexico, Canada, Germany, the EU, etc, has me thinking about how to portray the result in pictures. Data is from the latest Census Department report on International Trade. Click on image for enhanced view. Trade Deficit Exports Imports Percent of Total Total 243,905 498,608 742,513 100 Eurozone […]

Economic Data And Forecasts For The Weeks Of June 5 And June 12

Jun 03, 2017Jeremy Parkinson0

Here are my forecasts for upcoming economic data. ` Forecast Prior Observation Consensus Week of June 5 June 5 Productivity – Q1 (r) -0.1% -0.6 -0.2 Unit Labor Costs 2.5 3.0 2.6 Factory Orders – April […]

Gold Miners In 2017 Whipsaw

Jun 03, 2017Jeremy Parkinson0

Ever since 2012’s failure of the ‘QE 3 rally’ in the precious metals it has not been fruitful to micro manage the gold sector, because that failure jump started a savage bear market that would need time to work out the excesses both in the sector’s investor base and in its mining businesses, which had […]

E SPX Fast Approaching Final Phase Of Rally

Jun 03, 2017Jeremy Parkinson0

VIX declined to challenge the May 9 low, but did not exceed it. Today’s low qualifies as a retracement low and potentially opens the door for new highs. A rally above mid-Cycle resistance at 15.22 implies that VIX may challenge its Ending Diagonal at 17.50 in the next move. (Investopedia) The CBOE Volatility Index (VIX) is […]