Managing The Chaos – Investing Vs. Gambling

Apr 23, 2017Jeremy Parkinson0

How does one invest amid the slew of palm sweating, teeth grinding headlines of Syria, North Korea, Brexit, expanding populism, Trumpcare, French candidate Marine Le Pen and a potential government shutdown? Facing a persistent mountain of worries can seem daunting to many. With so many seemingly uncontrollable factors impacting short-term interest rates, foreign exchange rates, […]

US Dollar Bracing For French Election, Trump Tax Plan, GDP Data

Apr 23, 2017Jeremy Parkinson0

Fundamental Forecast for the US Dollar: Neutral US Dollar focused on 1Q GDP data amid slowdown fears Risk-positive French election outcome to boost greenback Tax reform bill to put “Trump trade” back in the spotlight The US Dollar fell for a second consecutive week as the Fed rate hike outlook continued to deteriorate. Geopolitical jitters are almost certainly […]

Wall Street And Bear Scat

Apr 23, 2017Jeremy Parkinson0

As seen in the Bear’s Eye View (BEV) chart below, the last all-time high for the Dow Jones happened on March 1. Since then however, it’s been slowly deflating. The post-election run up in the Dow Jones (enclosed in the Red Circle) was an excellent advance; one of the best in the post March 2009 […]

Target2 And Secret Bailouts: Will Germany Be Forced Into A Fiscal Union With Rest Of Eurozone?

Apr 23, 2017Jeremy Parkinson0

Project Syndicate writer, Hans-Werner Sinn, explains why the ECB’s asset purchases and Target2 imbalances constitute “Europe’s Secret Bailout”. Under the ECB’s QE program, which started in March 2015, eurozone members’ central banks buy private market securities for €1.74 trillion ($1.84 trillion), with more than €1.4 trillion to be used to purchase their own countries’ government […]

GBP/USD Forecast April 24-28

Apr 23, 2017Jeremy Parkinson0

GBP/USD enjoyed its strongest weekly gain in 2017, gaining 270 points. The pair closed the week at the 1.28 level. This week’s key event is Preliminary GDP. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD. The pound jumped sharply as Prime Minister May shocked the markets by calling a […]

Liquidity Supernova And The Big Ugly Flaw

Apr 23, 2017Jeremy Parkinson0

April 21 – Reuters (Vikram Subhedar): “The $1 trillion of financial assets that central banks in Europe and Japan have bought so far this year is the best explanation for the gains seen in global stocks and bonds despite lingering political risks, Bank of America Merrill Lynch said on Friday. If the current pace of […]

Trump’s Steel Import Probe: U.S. Steel Over Reliance?

Apr 23, 2017Jeremy Parkinson0

Domestic steel maker United States Steel and its foreign rival Reliance Steel are scheduled to report first-quarter earnings next week. Both companies are expected to come up with stellar performances. Which of these will come out ahead? Such a comparison comes into sharp focus considering Trump’s latest policy imperative: steel imports. Trump Probe Bolster Steel […]

Bonds: This Just In…

Apr 23, 2017Jeremy Parkinson0

Note: We highlighted the contrary bullish bond play right here at TalkMarkets back on December 6. Now it appears it won’t be long before it goes the other way, as the media have begun to talk bullish. Wash, rinse, repeat… This is actually a tag-along to the regular ‘Bonds’ segment in this week’s NFTRH 444. […]

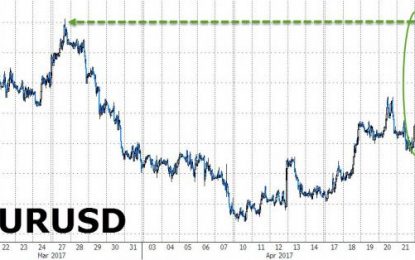

EUR/USD Spikes To 5-Month Highs After Early French Results

Apr 23, 2017Jeremy Parkinson0

With projections all confirming Le Pen and Macron into the second round (though varying notably on who is leading), the markets appear comforted by Macron’s position as EURUSD has spike almost 100 pips breaking above 1.09 to 5-month highs… EUR/USD above 1.09… To its highest since Nov 11th… Breaking above the 200-day moving average…

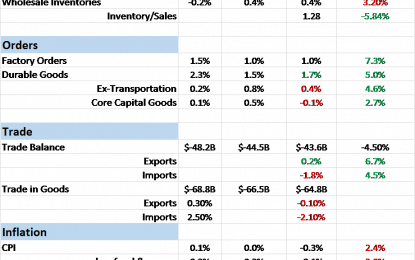

Bi-Weekly Economic Review – Sunday, April 23

Apr 23, 2017Jeremy Parkinson0

It wasn’t a very good two weeks for economic data with the majority of reports disappointing. Most notable I think is that the so called “soft data” is starting to reflect reality rather than some fantasy land where President Trump enacts his entire agenda in the first 100 days of being in office. Politics is […]