European Ardagh Group Set For A Strong IPO This Wednesday

Mar 15, 2017Jeremy Parkinson0

Ardagh Group (Pending:ARD) expects to raise $300 million in its upcoming IPO ($345 million if the underwriters exercise their option to purchase additional shares). Based in Luxembourg, Ardagh Group is a supplier of rigid packaging solutions, including metal and glass containers for the food and beverage markets. Ardagh Group will offer 16.2 million shares at […]

Quick Guide To T. Rowe Price GNMA Fund (PRGMX)

Mar 15, 2017Jeremy Parkinson0

T. Rowe Price GNMA (PRGMX – Free Report) a Zacks Rank #2 (Buy) invests exclusively in securities that are backed by the full faith and credit of the U.S. government, primarily GNMA mortgage-backed securities, and investments linked to these securities. The T. Rowe Price GNMA fund, managed by T. Rowe Price, carries an expense ratio of 0.59%. Moreover, […]

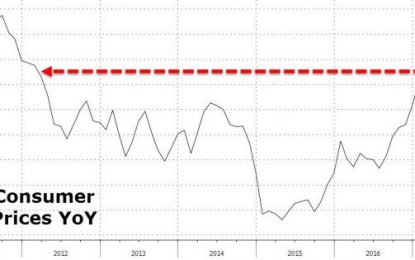

Stagflation Strikes As US Consumer Prices Surge At Fastest Pace In 5 Years

Mar 15, 2017Jeremy Parkinson0

After the hotter-than-expected PPI print, Consumer Prices confirmed that inflation is running hot with the fastest rise since Feb 2012. Notably core CPI (at 2.2%) has been above The Fed’s mandated 2% ‘price stability’ level for 15 months in a row. Of course, one of the big drivers of this price surge is in shelter and […]

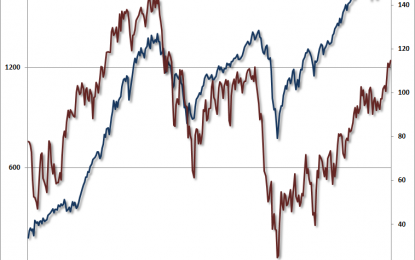

Most Overvalued Stock Market On Record — Worse Than 1929?

Mar 15, 2017Jeremy Parkinson0

The US stock market today has never been more dangerous and overvalued, according to respected Wall Street market analyst John Hussman. Indeed, Hussman goes as far as to say that “this is the most dangerous and overvalued stock market on record — worse than 2007, worse than 2000, even worse than 1929” as reported by Marketwatch. For some […]

The Corporate Bond Market: The Start Of The Matter

Mar 15, 2017Jeremy Parkinson0

Of all virtues to which we must ultimately aspire, forgiveness demands the most of our souls. In our naivety, we may fancy ourselves man or woman enough to absolve those who have wronged us. But far too often, we find our pool of grace has run dry. So deeply burdened are we by our emotions that grace to us […]

US Inflation And Retail Sales Mostly In Line With Expectations – USD Ticks Up

Mar 15, 2017Jeremy Parkinson0

Inflation and retail sales data for February leave the stage open for the Fed. Most data comes out as expected: core CPI is 2.2% y/y as predicted. Retail sales are up 0.1%, core sales are up 0.2% and the retail control group is up 0.1% a small miss. There are upwards revisions to retail sales numbers. […]

E The Trillion Dollar Coin

Mar 15, 2017Jeremy Parkinson0

“Change is good, but dollars are better.” -Unknown Recently I penned an article highlighting the country’s fiscal condition. This year’s Ides of March (15th) acquires special significance with the expiration of the Obama-Boehner debt ceiling deal, the Fed meeting, and an election in the Netherlands. Unless there’s an increase in the debt ceiling, the Treasury will be […]

Supply Slide Drive

Mar 15, 2017Jeremy Parkinson0

Crude oil is back on a supply side drive after the American Petroleum Institute (API) reports an oil supply drop, perhaps signaling that last week’s massive crude oil supply increase was a fluke! This comes after mixed data from OPEC surrounding Saudi Arabian production numbers where the Saudis reported a production increase, perhaps to send […]

RBC Capital Markets Reiterates Outperform Rating On Apple Inc. – Here’s Why

Mar 15, 2017Jeremy Parkinson0

..Analysts at RBC Capital Markets, today reiterated their Outperform rating on Apple Inc. (AAPL) while boosting their price target from $140 to $155. That new target suggests an 11.5% upside to the stock’s Tuesday closing price of $138.99. From StockNews.com In a note to clients, RBC said it has seen increased focus on AAPL’s services […]

Goldman Says “Not In OPEC’s Interest” To Extend Cuts; IEA Thinks Maybe You Need To Be More “Patient”

Mar 15, 2017Jeremy Parkinson0

Yesterday was a fun day for crude. As documented here extensively, oil initially plunged on reports that Riyadh raised output to over 10m b/d in February, reversing 1/3 of the cuts made in January. Oil promptly plunged. Apparently surprised at just how closely the market still listens to the kingdom, Riyadh pulled a “just kidding,” and tried to play the whole […]