EUR/USD: Asymmetric Risk But Short Preferable Into French Elections

Mar 15, 2017Jeremy Parkinson0

The euro has many forces moving it. The big political risk is the French Presidential Election. What can we expect for EUR/USD? Here is their view, courtesy of eFXnews: EUR/USD downside risks remains ahead of the French Elections, says Bank of America Merrill Lynch FX Strategy. In that regard, BofAML’s baseline does not include a Le Pen […]

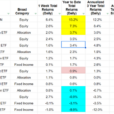

With Rising Rates Ahead, Stick With High Quality Dividend Growers

Mar 15, 2017Jeremy Parkinson0

Rising interest rates are supposed to draw investors away from equities and into the bond market but so far that hasn’t really happened. Despite the interest rate on the 10 year Treasury note increasing from 1.9% to 2.6% since the election, the S&P 500 has still managed to post an 11% gain during that time. […]

The Substantial Opportunity Cost Of Retained Earnings For Investors

Mar 15, 2017Jeremy Parkinson0

When a company creates profits, it has a decision to make. It’s all between how much of the earnings they should pay back to shareholders as a dividend, and how much they should reinvest in the business. Keeping the earnings is known as retained earnings. Many investors can be led astray by the deceitfulness of […]

Is Recent Stock Market Rally Real Or A Blow-Off Top?

Mar 15, 2017Jeremy Parkinson0

The U.S. stock market remains in a full-blown bull market with President Trump re-energizing the base.The U.S. stock market has temporarily become overbought and is likely due for a pause before the next new impulse wave up resumes. My research indicates… This Bull Market is not over. After this, it will move much higher! Courtesy […]

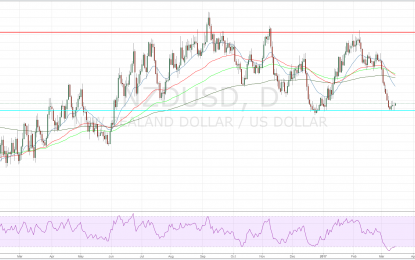

NZDUSD: How Will The Pair React To The FOMC Event?

Mar 15, 2017Jeremy Parkinson0

Key Points: Markets strongly pricing in the risk of a rate hike from the Fed. Dollar bulls may be disappointed as Fed likely to be cautious on forward guidance. Watch for sharp volatility during the FOMC risk event. The New Zealand Dollar is bracing itself ahead of the U.S. Fed’s FOMC decision but the pair […]

Stock Accumulations To Review

Mar 15, 2017Jeremy Parkinson0

Finding stocks which have patterns of interest, is a sequence of filtering by math and eyeball chart scanning. We start with a large sample and end up with a small sample to act upon. Video Length: 00:12:41 NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a […]

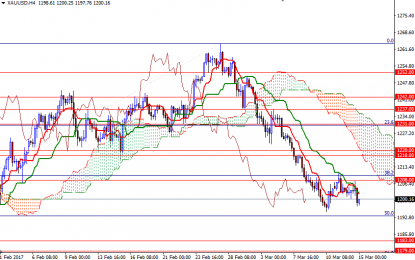

Gold Trades In Narrow Range Ahead Of Fed Meeting

Mar 15, 2017Jeremy Parkinson0

Gold prices ended Tuesday’s session down $5.01 but remained within the trading range of the past four days as the majority of market participants opted to remain on the sidelines ahead of the Federal Reserve’s policy meeting, where the central bank is expected to hike interest rates. Gold prices are trading slightly higher during the […]

Gold Prices May Rise As Fed Clings To Status Quo After Rate Hike

Mar 15, 2017Jeremy Parkinson0

Gold prices edged lower as the US Dollar recovered from post-NFP losses but remained well within their near-term range. Traders were probably reluctant to commit to significant trend progression ahead of the upcoming FOMC policy announcement. The priced-in probability of a rate hike implied in Fed funds futures stands at 100 percent. This means the increase itself may have […]

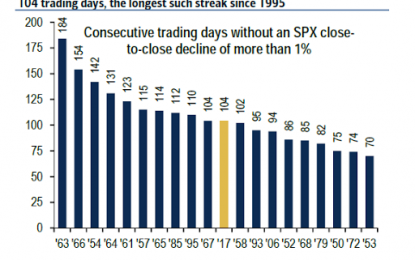

It’s Never Been Cheaper To Hedge Highly Speculative Tech Companies

Mar 15, 2017Jeremy Parkinson0

While many have noticed the demise of volatility in the US equity markets – 104 days without a 1% drop, plunge in VIX, record low monthly ranges – it is the most highly speculative and most over-valued companies that appear to be the biggest beneficiaries of peak animal spirits. It has never been cheaper to hedge […]

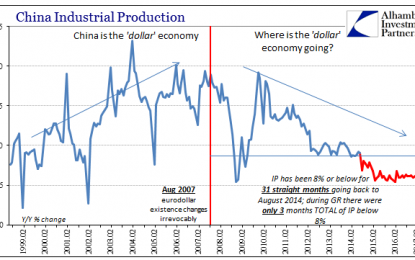

China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

Mar 15, 2017Jeremy Parkinson0

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%. For retail sales, the primary avenue for […]