What To Do At Market Highs

Mar 13, 2017Jeremy Parkinson0

With U.S. markets up over 300% since the March 2009 lows and continuing to set new all-time highs, where are investors to look for future returns?1 Although U.S. valuations are stretched compared to developed international (specifically Japan) and emerging markets, we think the pro-growth policies and potential tax cuts put forward by the new administration can help drive […]

Global Stocks Rise, S&P Futs Flat As Dollar Rebounds Ahead Of Critical Week For Markets

Mar 13, 2017Jeremy Parkinson0

European bourses advance and Asian share rose led by a surge in Hong Kong stocks which rose the most in three months as Japan hit 15 month highs. U.S. futures are little changed along while the dollar rebounded from session lows after Friday’s selloff. Crude oil has continued its retreat, down 0.2% and sliding for […]

Most Markets Fell Last Week, Led By A Slide In US REITs

Mar 13, 2017Jeremy Parkinson0

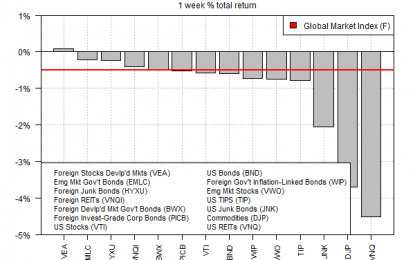

Red ink spilled across nearly every corner of the global markets last week, based on a set of exchange-traded products representing the major asset classes. The lone exception: foreign stocks in developed markets in US dollar terms. Otherwise, losses took a toll far and wide. Vanguard FTSE Developed Markets (VEA) bucked the trend, posting a slight gain […]

Bonds And Equities Rally, Dollar Heavy

Mar 13, 2017Jeremy Parkinson0

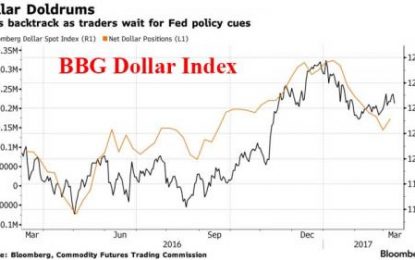

Hit by profit-taking ahead of the weekend, despite US jobs data that remove the last hurdle to another Fed hike this week, the greenback remains on the defensive. It has softened against all the major currencies and many of the emerging market currencies.The chief exception is those in eastern and central Europe. Turkey and Dutch tensions rose […]

Top 4 Assets To Watch This Week – Monday, March 13

Mar 13, 2017Jeremy Parkinson0

Yellen is Likely to Raise Interest Rates on Wednesday This Week.. Two important benchmarks are now within reach – the inflation target of 2%, and maximum employment. For the Federal Reserve Bank, these joint targets act as the barometer of the health of the US economy. Currently, the US unemployment rate for February 2017 is […]

Stock Symbols On Watch For A Breakout

Mar 13, 2017Jeremy Parkinson0

After the big surge higher that we had just two Wednesdays ago, the stock market really hasn’t gone anywhere, in fact, the tendency has been to sell any and all rallies that come our way. That may persist into the week ahead. Stocks symbols and their respective charts are decaying underneath the surface but indices […]

Oil Prices Sink To Three-Month Lows

Mar 13, 2017Jeremy Parkinson0

Oil prices hit their lowest in three months during Monday’s Asian session despite OPECs’s commitment to cut production. The price drop resulted predominantly from the continued addition of U.S. oil rigs for the eighth consecutive week. U.S. crude inventories rose last week by 8.2 million barrels, reported the Energy Information Association. Brent crude fell 35 […]

FX Week Ahead: Fed Rate Hikes, Dutch Elections, BoE And BoJ

Mar 13, 2017Jeremy Parkinson0

The markets are heading into a crucial week which promises a mix of politics and monetary policies. This week will be marked by central bank meetings from the U.S. Federal Reserve, the Swiss National Bank, the BoJ and Bank of England. From these meetings, the FOMC is widely expected to hike interest rates by 25 […]

GBP: BoE On Hold This Week; Scope For Further EUR/GBP Gains – Danske

Mar 13, 2017Jeremy Parkinson0

The pound got a beating on Brexit worries and the implications of a weak pound on consumption. Will the BOE respond? What does it mean for EUR/GBP? Here is their view, courtesy of eFXnews: Danske Bank does not expect Bank of England (BoE) to make any policy changes at its March meeting this week. “We expect BoE […]

Macro Mondays: Bond Duration

Mar 13, 2017Jeremy Parkinson0

Bonds are (unfortunately) one of the least interesting investment categories, mostly because the just don’t warrant any sort of “sexy” risk like equities. However, duration is one of those terms that anyone holding a bond should understand. It isn’t necessarily a measurement of time, but rather a sensitivity measurement to economic changes (as time would naturally do). […]