Those Rising German Trade Surpluses

Mar 08, 2017Jeremy Parkinson0

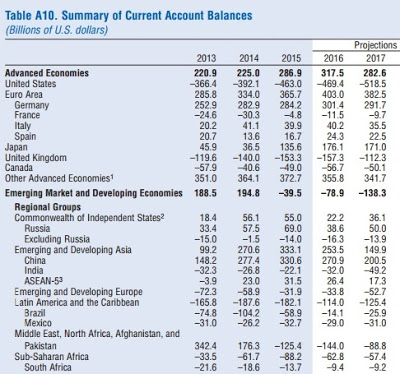

For the world as as a whole, exports need to equal imports. Thus, the large US trade deficits are necessarily offset, out there in the world economy, by equally large trade surpluses in other countries. From a global perspective, these offsetting surpluses are largely in three countries: China, Germany, and Japan. Here’s are some statistics from […]

E Cisco Systems Stock Is A Great Long-Term Investment

Mar 08, 2017Jeremy Parkinson0

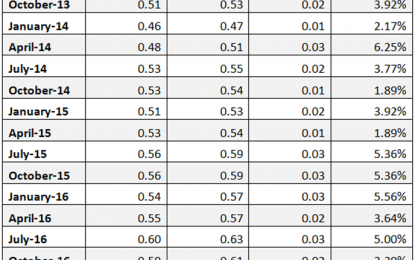

Cisco Systems (CSCO) has done very well in the last few years, and its stock has outperformed the market by a significant margin. In fact, since the beginning of 2014, CSCO’s stock has gained 52.5% while the S&P index has increased only 28.1% in the same period. What’s more, the company has a compelling valuation […]

Is U.S Economic Growth Slowing In Q1?

Mar 08, 2017Jeremy Parkinson0

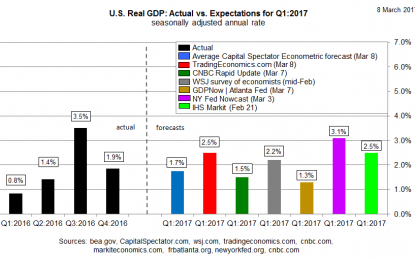

Yes, according to Tuesday’s revised GDP estimates from the Atlanta Fed and CNBC’s Rapid Update survey data. The Capital Spectator’s new economic projection is also anticipating a weaker pace of growth Vs. last year’s fourth quarter. It’s too early to say for sure if the weaker forecasts are accurate (quite a lot of Q1 data […]

China Trade Data “Surprises” Bigly, Shows First Deficit In 3 Years

Mar 08, 2017Jeremy Parkinson0

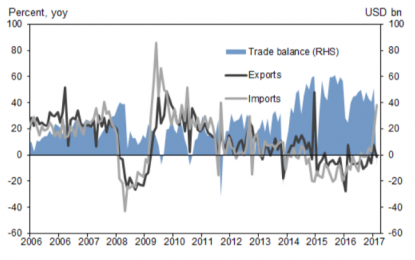

Wednesday begins in China, where we got highly anticipated trade data that probably shouldn’t have been so highly anticipated given that seasonality makes the compare largely meaningless. But you know, whatever. Here’s the breakdown: CHINA FEB. TRADE BALANCE -60.4B YUAN; EST. 172.5B YUAN CHINA FEB. IMPORTS RISE 44.7% Y/Y IN YUAN TERMS; EST. 23.1% CHINA […]

EUR/USD: Awaiting A Renewed Minimum

Mar 08, 2017Jeremy Parkinson0

Previous: Trading on the EUR/USD pair closed down on Tuesday. The single currency depreciated against the dollar on the back of a rise in US 10-year bond yields and a drop in their German equivalent. By the end of the day, US 10-year bond yields had risen by 0.72% to 2.494%. German 10-year bond yields […]

USD/JPY – Can It Hit 115.00?

Mar 08, 2017Jeremy Parkinson0

After weeks of listless trade, USD/JPY is showing some signs of life as it continues to hold on to the 114.00 figure. Although recent trading was decidedly muted the recent price action has all the marks of a dollar breakout. The benchmark 10-year rate inched above the key 2.50% level helping to fuel pro-dollar flows […]

Deutsche Bank: Sell The Bounce?

Mar 08, 2017Jeremy Parkinson0

A textbook bearish formation has been spotted in Deutsche Bank (DB) (traded in Xetra Germany) according to Elliott waves. A 5 wave decline has been seen and together with a price break below my automated indicator, I expect a bounce towards 18.30-18.50€ to go short and use the highs as stop. The minimum expectation […]

Stocks Mixed As Treasuries Suffer Longest Losing Streak Since 2012, Dollar Pops Ahead Of ADP

Mar 08, 2017Jeremy Parkinson0

Asian markets dropped following disappointing China trade and Japan GDP data, while European stocks rebounded for the first time in five sessions led by miners and banks. US futures were little changed as the dollar strenghtened, pressuring oil further below $53; sterling slid for the eighth day out of nine, dropping under 1.215 before the […]

Insuring Your Portfolio With Insurance Stocks

Mar 08, 2017Jeremy Parkinson0

A while back I wrote about investing in the ‘boring’ HVAC industry. Investing in boring industries rarely gives your portfolio a “shot in the arm” in terms of dramatic capital appreciation but what it can do is provide stability and predictability in terms of tempered growth and a potential reliable source of growing dividends for decades […]

Is A Second OPEC Cut On The Cards?

Mar 08, 2017Jeremy Parkinson0

OPEC’s coordinated effort to curtail global supply has so far managed to put a floor under oil prices, which have been sitting modestly above US$50 since the deal was announced at the end of November last year. But resurging U.S. shale has been capping the upside, and Brent has not breached US$58 per barrel. Analysts […]