E Markets Are Anticipating A Rate Hike

Mar 14, 2017Jeremy Parkinson0

Tomorrow is Fed day. Metals and Miners near-term outlook hinges on their decision. The previous rate hikes supported prices after an initial drop. But, those rate hikes were 12-months apart. Therefore, it is unclear how metals will react this time around. Markets are anticipating a rate. However, what they will be looking for is forward […]

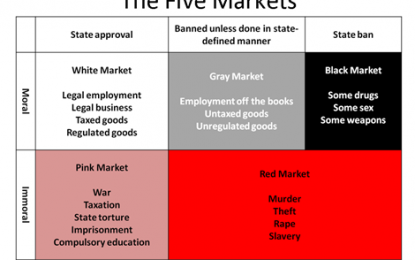

How The Black Market Is Saving Two Countries From Their Governments

Mar 14, 2017Jeremy Parkinson0

Ever since governments began banning and licensing different parts of the economy, the black market has made sure people still have access to the things they need. Unstable governments always turn on their own citizens using price controls, heavy taxes, and even the threat of imprisonment to prop up their failing systems. As conditions inevitably deteriorate, […]

Navios Maritime Partners L.P. Announces $100.0 Million Offering At $2.10 Per Common Unit

Mar 14, 2017Jeremy Parkinson0

MONACO, March 14, 2017 (GLOBE NEWSWIRE) — Navios Maritime Partners L.P. (“Navios Partners”) (NYSE:NMM), an international owner and operator of container and dry bulk vessels, announced today that it has agreed with investors to sell approximately 47.6 million common units for an aggregate of $100.0 million in a registered direct offering at $2.10 per common […]

How Can The Fed Cause The Most Pain?

Mar 14, 2017Jeremy Parkinson0

The indexes ended the day slightly lower as all eyes are on the Fed. The market is pricing in a 93% probability of a 25 basis point increase in short term rates tomorrow. In tonight’s video let’s review what a rate hike could mean to the stock market. Is this another “sell the news” situation? Video Length: […]

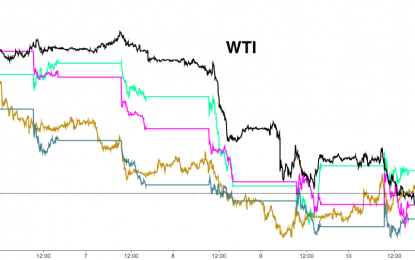

Here’s How To Play An Increasingly Volatile Oil Market

Mar 14, 2017Jeremy Parkinson0

If you needed a reminder that oil prices can be volatile and are hyper-sensitive to every single data point and/or headline that crosses the wires, you got all the proof you needed last week. And then you got some more evidence on Tuesday when, as we wrote earlier, oil whipsawed as API data clashed with Saudi […]

E Alimentation Couche-Tard Reports Earnings

Mar 14, 2017Jeremy Parkinson0

The company reporting today was Alimentation Couche-Tard (ANCUF) which fell short with its Q3 results. It reports in US dollars because of its US operations are key. For some reason trading was suspended in Canada early this morning but resumed at 9:06 am. It reported $287 mn in net earnings, up 4.7% from $274 mn in the prior […]

Keeping It Real: Integrity In Financial Prognostications

Mar 14, 2017Jeremy Parkinson0

This post has to do with something which may seem like an oxymoron: integrity in financial prognostications. What inspired me to address this topic? Oh, that’s easy: As you can see, back on February 22nd, Dennis “Commodity King” Gartman went on CNBC to declare that, at long last, for the first time in about five years, […]

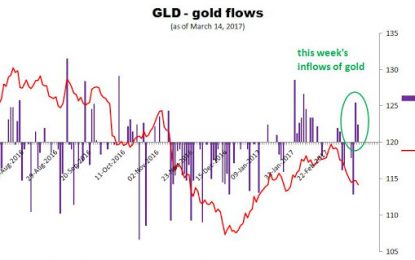

Ahead Of The Fed Meeting

Mar 14, 2017Jeremy Parkinson0

US investors are buying gold bullion once again. Surprisingly, it is happening ahead of tomorrow’s Fed announcement day. Yesterday and today as many as 314.2 thousand ounces of gold were added to GLD vaults: Another gold bullion vehicle, iShares Gold Trust (IAU) added 9.6 thousand ounces of gold. Interestingly, today the share prices of precious metals mining […]

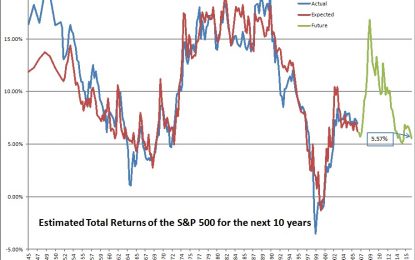

Estimating Future Stock Returns, December 2016 Update

Mar 14, 2017Jeremy Parkinson0

What a difference a quarter makes! As I said one-quarter ago: Are you ready to earn 6%/year until 9/30/2026? The data from the Federal Reserve comes out with some delay. If I had it instantly at the close of the third quarter, I would have said 6.37% — but with the run-up in prices since […]

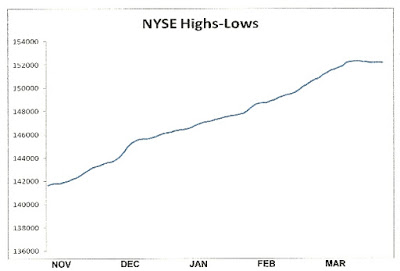

What’s Preventing The Dow From Exploding?

Mar 14, 2017Jeremy Parkinson0

The stock market has once again entered a period of consolidation as investors wait for the results of the most important legislative decision of the year. The fight to repeal and replace Obamacare has taken the spotlight as Congress debates the passage of legislation that would eliminate its most burdensome aspects for businesses and individual […]