Polish Central Bank Buys Gold According To Secret EU Plan

Dec 06, 2023Jeremy Parkinson0

The Polish central bank has bought roughly 300 tonnes of gold in recent years to bring its gold to GDP ratio in line with the average in the eurozone. For medium and large economies in the eurozone, to which Poland might be included in the future, an equal monetary gold to GDP ratio is a […]

Ducks Are Lining Up For FOMC Restraint And Continued Market

Dec 06, 2023Jeremy Parkinson0

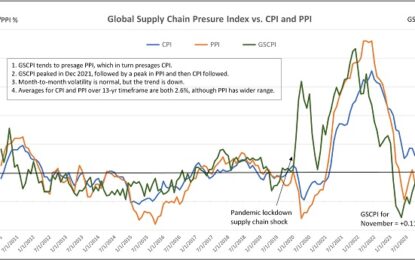

The New York Fed’s Global Supply Chain Pressure Index (GSCPI) for November was released today, and although it rose more than expected (likely due to disruptions from heightened global hostilities), it still suggests inflation will continue its gradual retreat, with a reading near the long-run average. But let me start by talking about October’s inflation indicators. Last […]

Using Fed Projections To Infer The Term Premium?

Dec 06, 2023Jeremy Parkinson0

Image Source: Pixabay I was passed along the article “Views from the Floor — Tighter and Tighter” by the Man Institute published last month. It discusses using the FOMC long-term projections to infer the term premium in the 10-year Treasury yield.The methodology is straightforward (I have a busy week, so I have not gathered the data to replicate […]

Happy Days For How Long?

Dec 06, 2023Jeremy Parkinson0

With less than a month left to go to close out the year, it’s a good time to reflect on the highs and lows that market participants have experienced. While the year began with a rocky start due to the Silicon Valley Bank collapse, the market continued to power forward, stumbling in Q3 as 10-year […]

FT-IGM (Booth School) U.S. Macroeconomists Survey On The Outlook

Dec 06, 2023Jeremy Parkinson0

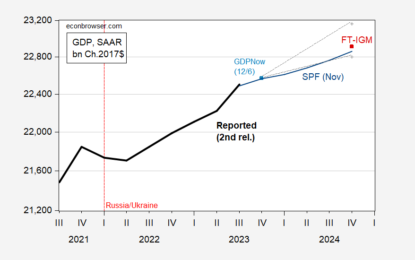

Survey results are out, for responses as of 12/4. FT article here.Survey median GDP matches the SPF November outlook pretty well, taking today’s GDPNow nowcast for Q4:Figure 1: GDP (bold black), GDPNow estimate as of 12/6 (light blue square), FT-IGM 2024Q4 GDP (red square), 90%ile band (gray +), and November 2023 Survey of Professional Forecasters median (blue line). […]

Stocks And Precious Metals Charts – Pushing And Shoving

Dec 06, 2023Jeremy Parkinson0

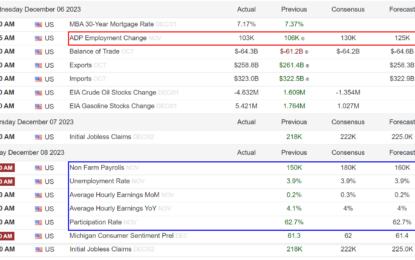

The markets are pretty much running in place ahead of the Non-Farm Payrolls report on Friday.Unless there is some exogenous event, all we might see until then is high frequency pushing and shoving.Have a pleasant evening. More By This Author:Stocks And Precious Metals Charts – Longing For Virtue In The Darkness Stocks And Precious Metals […]

Market Talk – Wednesday, Dec. 6

Dec 06, 2023Jeremy Parkinson0

ASIA:November, core inflation in Tokyo, Japan’s capital, slowed down, aligning with the central bank’s expectation that cost-push pressures in the country will gradually ease. Service prices, a focus for the central bank in assessing wage-driven inflation, experienced their fastest increase since 1994, primarily attributed to a spike in hotel fees due to increased tourism. The […]

Santa Claus Rally Cancelled?

Dec 06, 2023Jeremy Parkinson0

Image Source: Pexels Market Volatility and Santa Claus Rally: There’s emerging volatility in the stock market, raising questions about whether the typical Santa Claus rally will happen. The S&P 500 and Nasdaq are experiencing fluctuations, but these are within the expected daily move, suggesting the markets haven’t reached an extreme volatility state.Analysis of Tech Stocks and Nasdaq: […]

Stocks Drop On December 6 As Growth Concerns Surface

Dec 06, 2023Jeremy Parkinson0

OilStocks finished lower as risk-off seemed to be a theme today, with oil prices slumping below $70. Oil has been a harbinger of all things these days, and the best thing that can happen with oil, at least over the next 6 to 12 months, is to do nothing. Rising oil could stoke more inflation […]

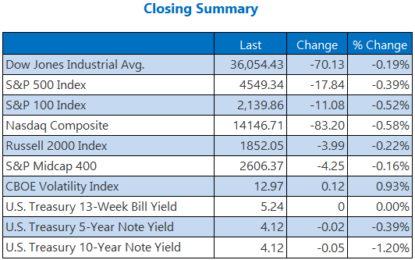

Dow, S&P 500 Suffer 3rd-Straight Loss

Dec 06, 2023Jeremy Parkinson0

All three major indexes settled with losses today, brushing off modest midday gains and this morning’s upbeat ADP private payrolls data. Despite a softening labor market — a good sign for the Federal Reserve’s interest rate policy — the Dow and S&P 500 are now mired in a three-day losing streak. Despite the skid, Wall Street’s […]