Weekly Market Outlook – March 21, 2016

We just completed the fifth straight bullish week for the market. The S&P 500 (SPX) (SPY) advanced 1.35% last week, clearing a couple of key resistance lines in the process. Yet, other resistance lines have yet to be hurdled, and could end up being problems that work against stocks now that the S&P 500 is up 12% from the February 11th low…enough to give all those would-be profit-takers something to think about.

We’ll weigh the good and bad below, right after taking a closer look at this week’s and last week’s economic news.

Economic Data

Last week was a busy one in terms of economic news. And, the bulk of it was disappointing. Retail sales dwindled, inflation is tepid (although that worked out in our favor, letting the Fed back off on its rate hike plans), and industrial activity tiptoed a tad lower. Although it wasn’t enough to derail the rally this time around, there are a few red flags worth exploring.

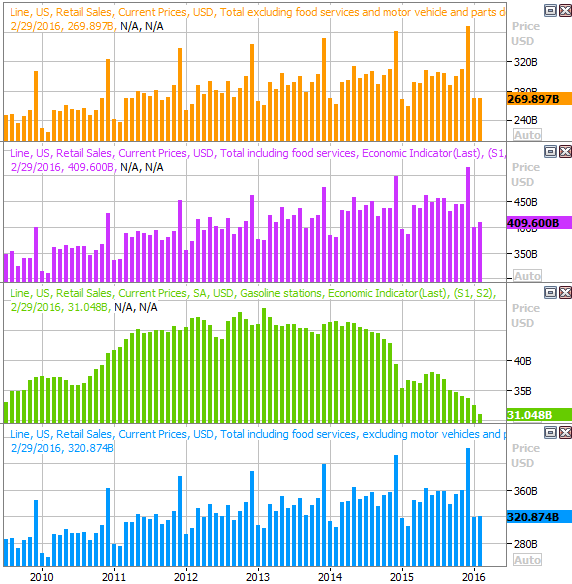

One of those red flags is the slight decline in February’s Retail spending. With or without automobiles, consumers tightened their purse strings to the tune of -0.1%. It’s the first time in a long time we’ve seen such a stagnation, so we don’t want to read too much into it just yet. It’s also worth noting — and this is evident on our chart below — the only weak, non-growth link is from gasoline stations, and that may have been the result of a huge plunge on gasoline prices last month.

Retail Sales Chart

Source: Thomson Reuters

Whatever the case, we need a good showing on this front in March, even if only for psychological reasons.

Housing starts and building permits were also off a little, though more troubling was the fact that they came in below expectations at a point in time in the year when construction activity should be perking up… at least a bit.Nevertheless, the bigger trend here remains a positive one.

Housing Starts and Building Permits Chart