“Technically Speaking” is a regular Tuesday commentary updating current market trends and highlighting shorter-term investment strategies, risks, and potential opportunities. Please send any comments or questions directly to me viaEmail, Facebook or Twitter.

As I noted last week, the “Ides Of March” is upon us and there is a LOT of stuff going on that could send ripples through the market. Here is a brief listing of the key events to watch out for:

The most important, if mostly priced in, event is this FOMC announcement on Wednesday where Traders view a quarter-point Fed hike this week as a virtual certainty and will be watching the central bank’s policy decision for signals on what will come next.

The Dutch general election whose results should be known on Thursday morning. Focus will be on the performance of the anti-EU, anti-immigration party PVV, and party leader Geert Wilders’ pledge to hold a referendum on EU membership.

On Wednesday the US debt ceiling limit expires and is due to be reinstated on Thursday absent some last minute breakdown in communication.

UK Prime Minister May is expected to invoke Article 50 of the Treaty of Lisbon as soon as Tuesday. This begins the long goodbye from the EU.

President Trump may also reveal his first budget outline for fiscal year 2018 on Thursday.

The G-20 Meeting will convene in Baden-Baden on March 17-18th. This is the first meeting since Donald Trump’s U.S. election victory in November where his protectionist stance on international trade is likely to be a key issue.

The BoJ is expected to maintain the status quo for monetary policy, leaving its long rate and short rate targets unchanged at 0.0% and -0.1%, respectively. Watch for a potential reduction to QE programs.

The BOE is expected to keep rates on hold.

And there is a bunch of economic data out this week with a focus on inflation and sentiment data.

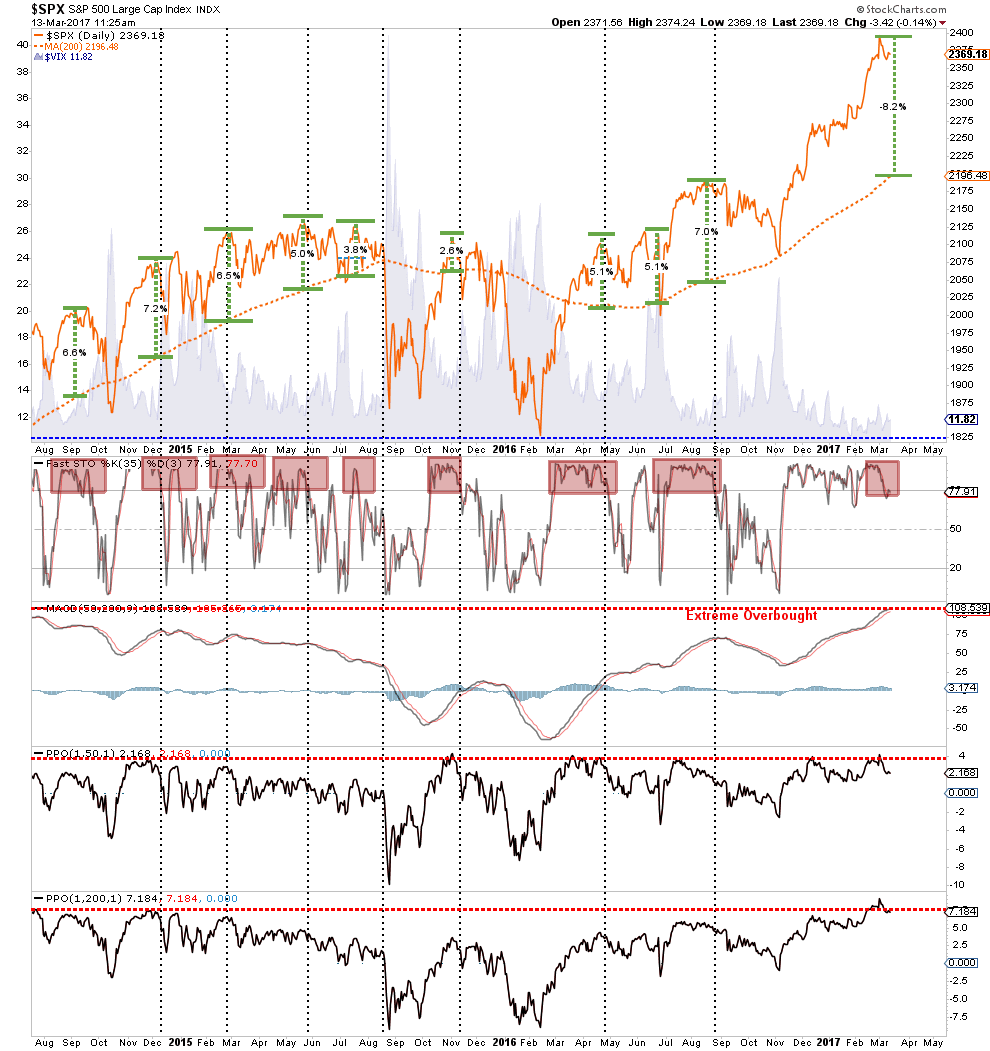

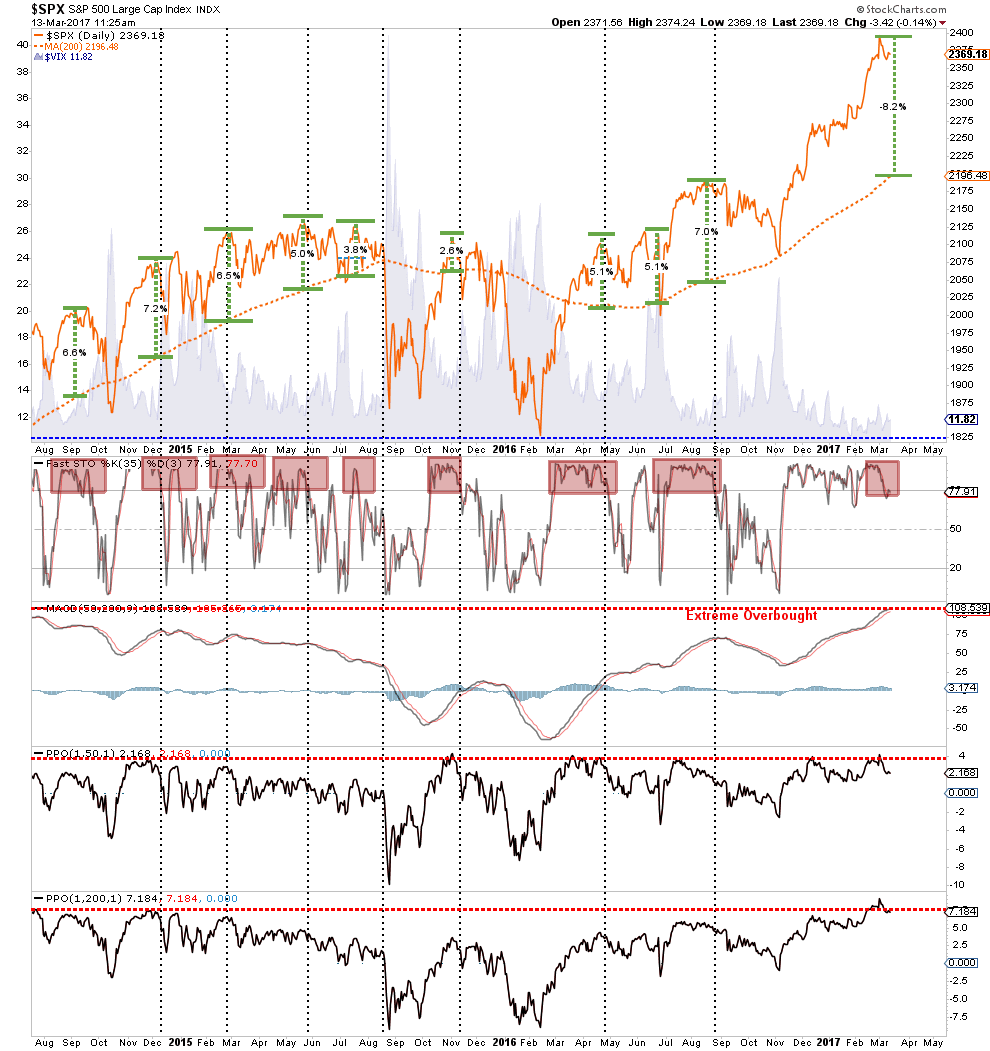

Since the November election of Donald Trump, the investing landscape has gone through a dramatic change of expectations with respect to economic growth, market valuations and particularly inflation. As I discussed previously, there is currently “extreme positioning” in many areas which have historically suggested unhappy endings in the markets. To wit:

“As we saw just prior to the beginning of the previous two recessions, such a bump is not uncommon as the impact of rising inflation and interest rates trip of the economy. Given the extreme speculative positioning in oil longs, short bonds, and short VIX, as discussed yesterday, it won’t take much to send market participants scrambling for the exits.

Buy The Dip? Probably

Will any correction in the days/weeks ahead be a “buyable correction?”

My best guess is probably for the following reasons:

The bullish trend remains intact. (Currently at 2350 short-term, 2250 intermediate-term.)

We remain within the seasonally strong period of the year currently.

Investor optimism remains unabashedly bullish.

There is little fear of a correction in the markets.