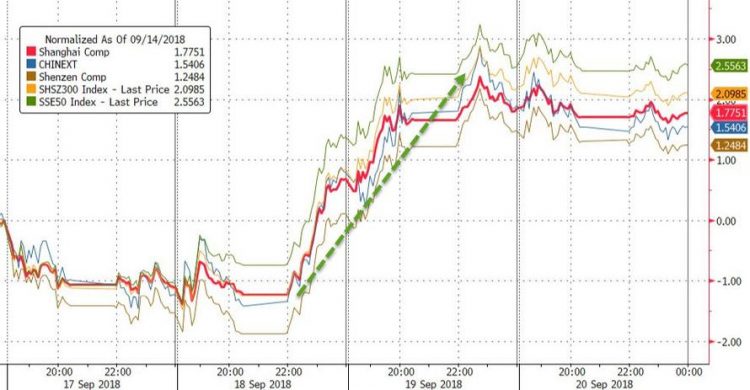

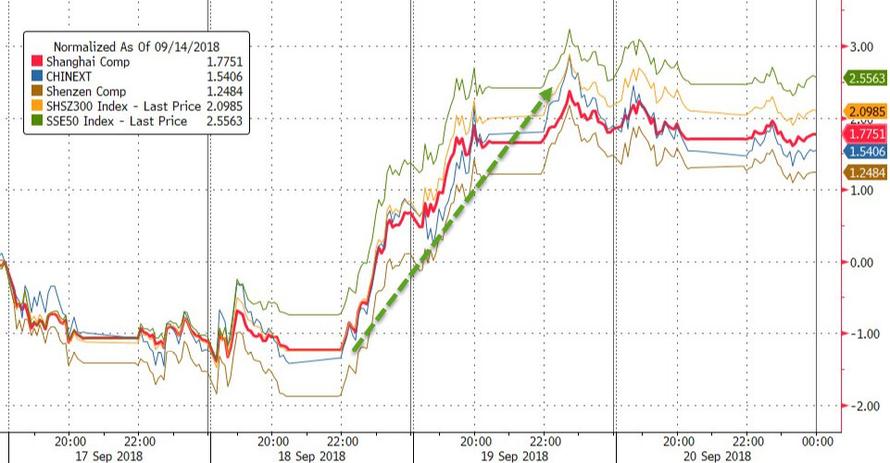

China stocks went nowhere overnight… seems like the panic buyers from Tuesday have left (cough National Team cough)

The Dow finally broke above its January record highs and there were record highs all around for stocks as trade wars are now a buying opportunity (so the narrative goes – if stocks drop, then Trump will pull out of trade war, so buy stocks, durr!!)

US Equity markets gapped up at the cash open and never looked back, but Trannies underperformed…

Futures show the week’s incessant bid at the cash opens…

The rise in yields prompted renewed buying in financials…though we note the decoupling today…

Regional Banking Index broke back above all its key DMAs…

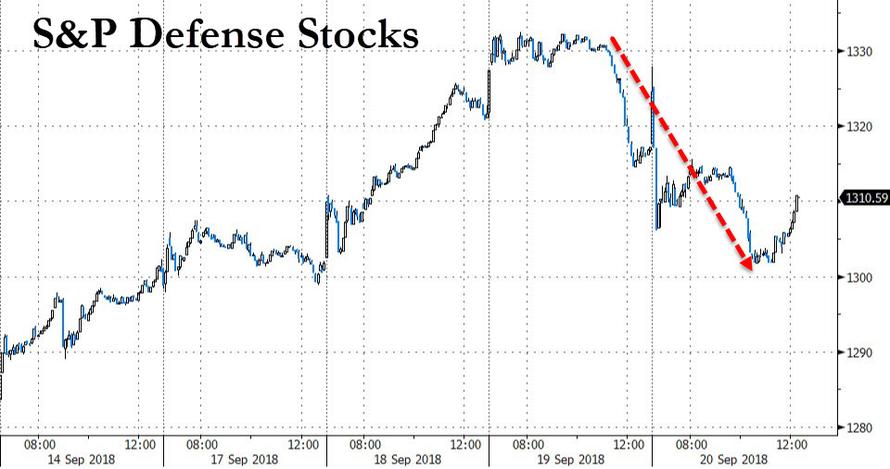

Defense stocks sank as North Korea denuclearization headlines hit and Russia didn’t bomb Israel…

FAANG stocks are notably decoupled this week ahead of tomorrow’s index reclassification…

Sonos was hammered back below its IPO price (47 days after going public) after AMZN announced enhanced features for its Alexa products…

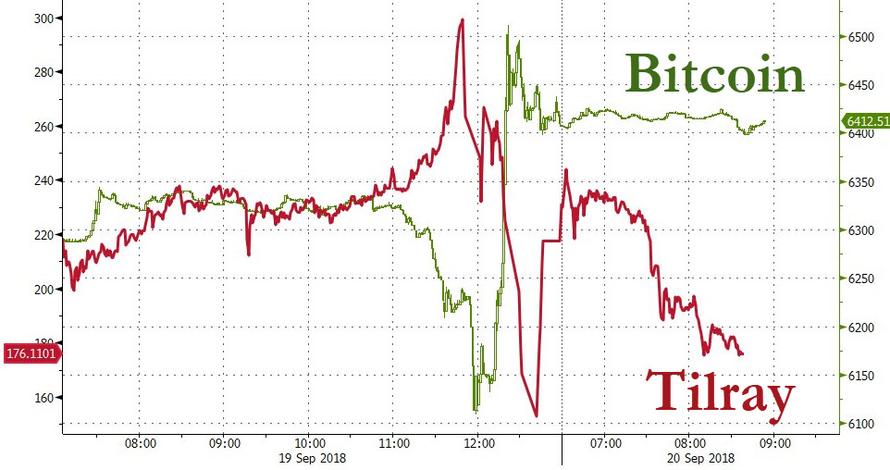

Tilray tumbled – almost erasing its gains from yesterday…

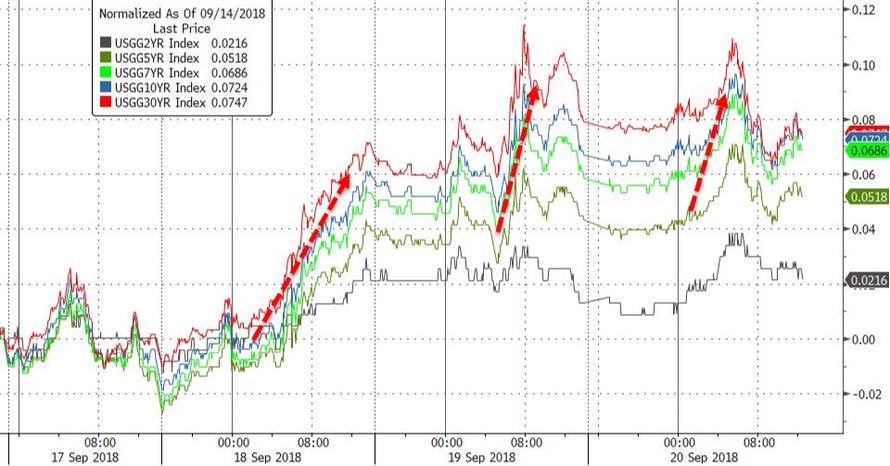

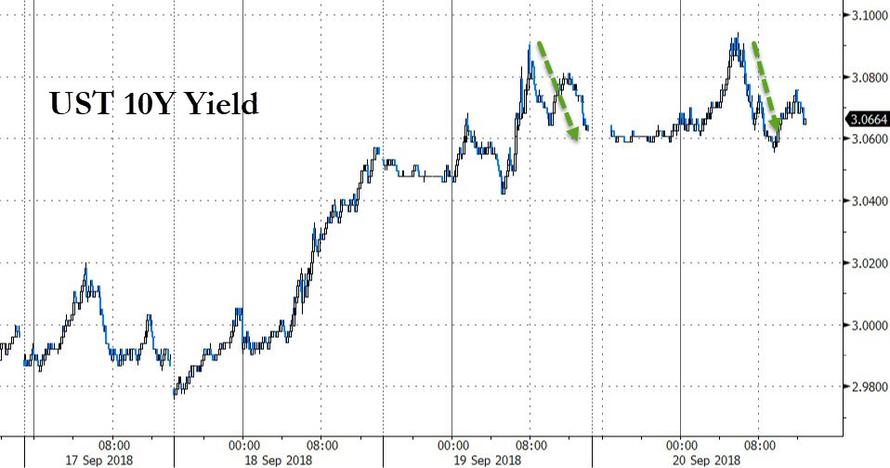

Treasury yields saw modest rises today…

But the bond rout is well off the day’s high yields…

And the dramatic steepening of the yield curve this week has ended…

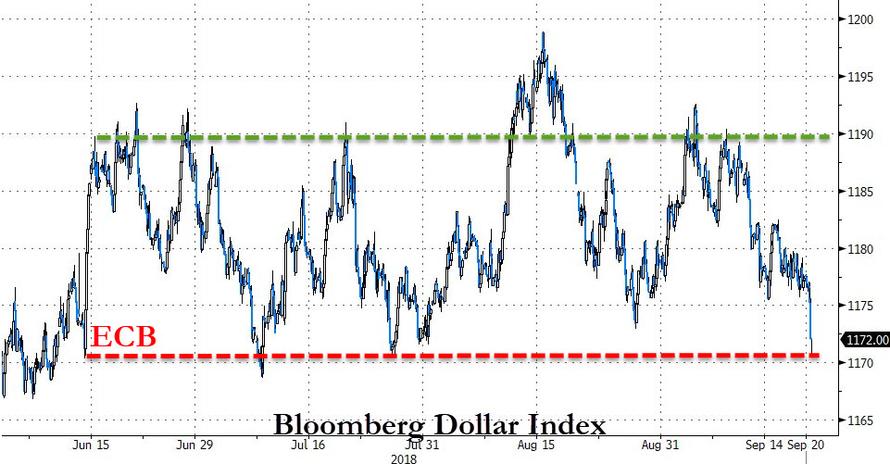

The Dollar Index was dumped early, bounced, then dumped again (intraday, the dollar hit its lowest since July 9th)…

We note that the dollar found support at the lower-end of the ECB range…

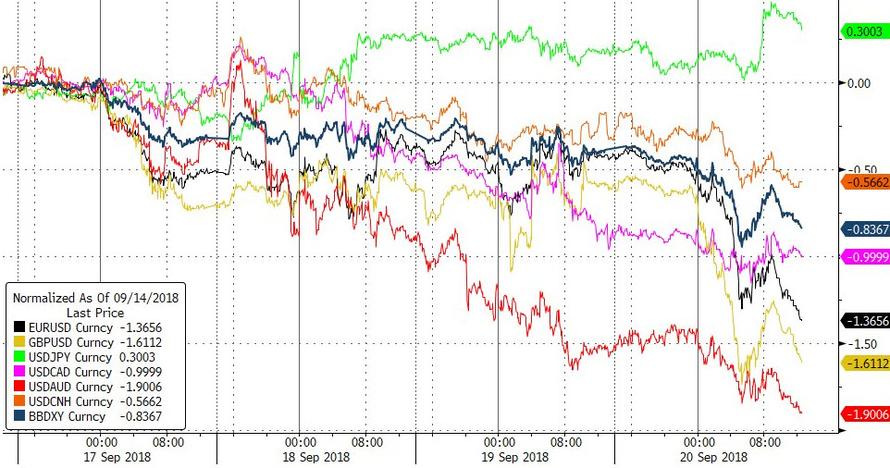

The Loonie was the best performer along with Cable as JPY bucked the trend…

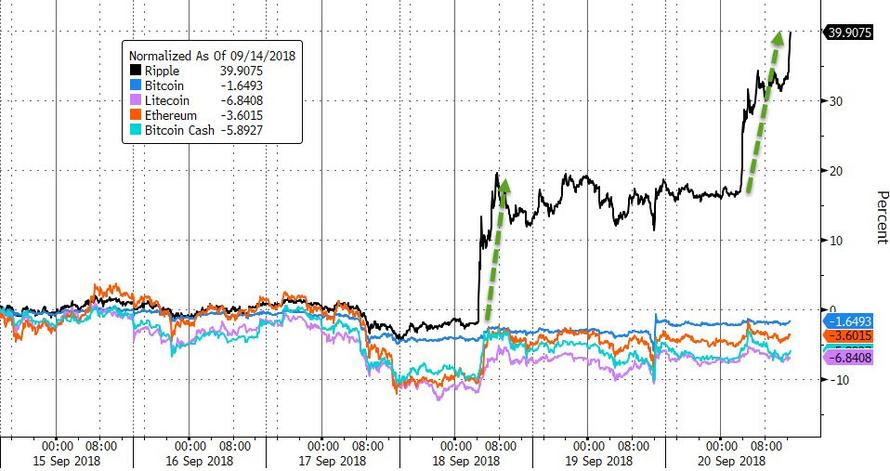

Most cryptos were relatively calm today (ignoring the chaos in TLRY today) but Ripple continued to explode…

Despite USD weakness commodities went nowhere (with WTI lower)…