The stock market is crashing with the S&P 500 index down 3.3% and the Nasdaq down 4% today. Both indices closed at their lows for the day and have continued lower in after-hours, which adds to the bearish view. The Dow had it’s worst day since February 8th and the S&P 500 fell through support at the 100-day moving average to 2,785, which was resistance in June of this year. Prior resistance often turns into support and the RSI is oversold, so we could get a bounce over the next few days.

The next major level of support for the S&P 500 index is the 200-day moving average at 2,765. The 200-day moving average has held on almost every correction in the past 10 years, with the exception of a few instances. Likewise, the RSI has only dipped below 30 during a few instances in the past decade and typically bounced back very quickly. It is currently at 23. Will this time be different?

We have been anticipating a major stock market crash for some time now and have admittedly been early in these calls. But a myriad of factors are weighing heavily on stock this week, increasing the odds that the current correction would be more than a normal pullback.

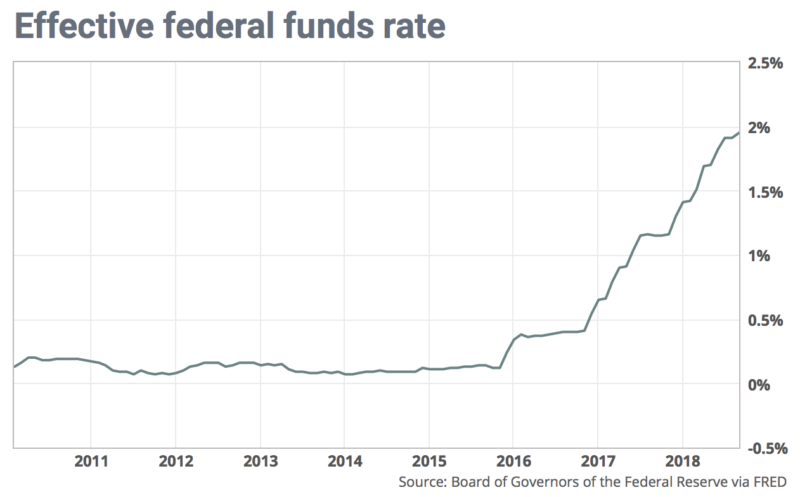

Rising Interest Rates and Quantitative Tightening Contribute to Decline

The Federal Reserve has been raising interest rates and reducing their balance sheet. They are essentially taking away the punch bowl, making it more expensive to borrow money, more expensive to pay off debt and more difficult for business to grow. They have shifted from quantitative easing (QE), which helped pull the economy out of the financial crisis of 2008, to quantitative tightening (QT).

In QE, a central bank buys bonds to drive down longer term rates as well. As it creates money for those purchases, it increases the supply of bank reserves in the financial system, and the hope is that lenders go on to pass that liquidity along as credit to companies and households — spurring growth.

The Fed is now letting up to $50 billion of its bond holdings mature every month without replacing them. That takes money out of the financial system, as the Treasury Department then finds new buyers for its debt. The Fed describes the winding down of its balance sheet as part of a “normalization” of its policy stance, along with rate hikes, given the solid performance of the American economy and rising inflationary pressures. But the risk is that the Fed may overestimate the strength of the economy and normalize faster than the markets can handle. One slight miscalculation can lead to a full blown market crash and major Recession or Depression.