The market is definitely torn about whether last week the Federal Reserve signaled a pause in their rate-tightening campaign. You know where I stand (they did), so there is little to be gained by my shouting into the wind trying to convince anyone.

Yet one of my more astute readers sent a note to be careful what I wish for. Now, he knows we are a long way from the Fed actually cutting rates. In fact, I suspect we both think the Federal Reserve will raise rates this December. But let’s imagine that I am correct and the next meeting brings about a one-and-done rate rise. What if the Fed’s next move after December is a rate cut? I know that seems preposterous right now, yet there are many signs the American economy is slowing faster than the Federal Reserve forecasts.

Regardless of where one stands in regards to future monetary policy, it’s instructive to examine the stock market’s performance around Fed rate cuts. Whether the next cut is one quarter away, one year, or even one decade (for those hard money advocates who believe we need to really normalize rates…), at some point, the Federal Reserve will once again lower rates. Understanding how the stock market has reacted to this development in the past is a good arrow to have in your quiver.

So here’s the deal. The answer is… it’s complicated.

The past two Federal Reserve rate cut cycles have indeed seen the stock market fall extensively during the Fed’s easing of monetary policy.

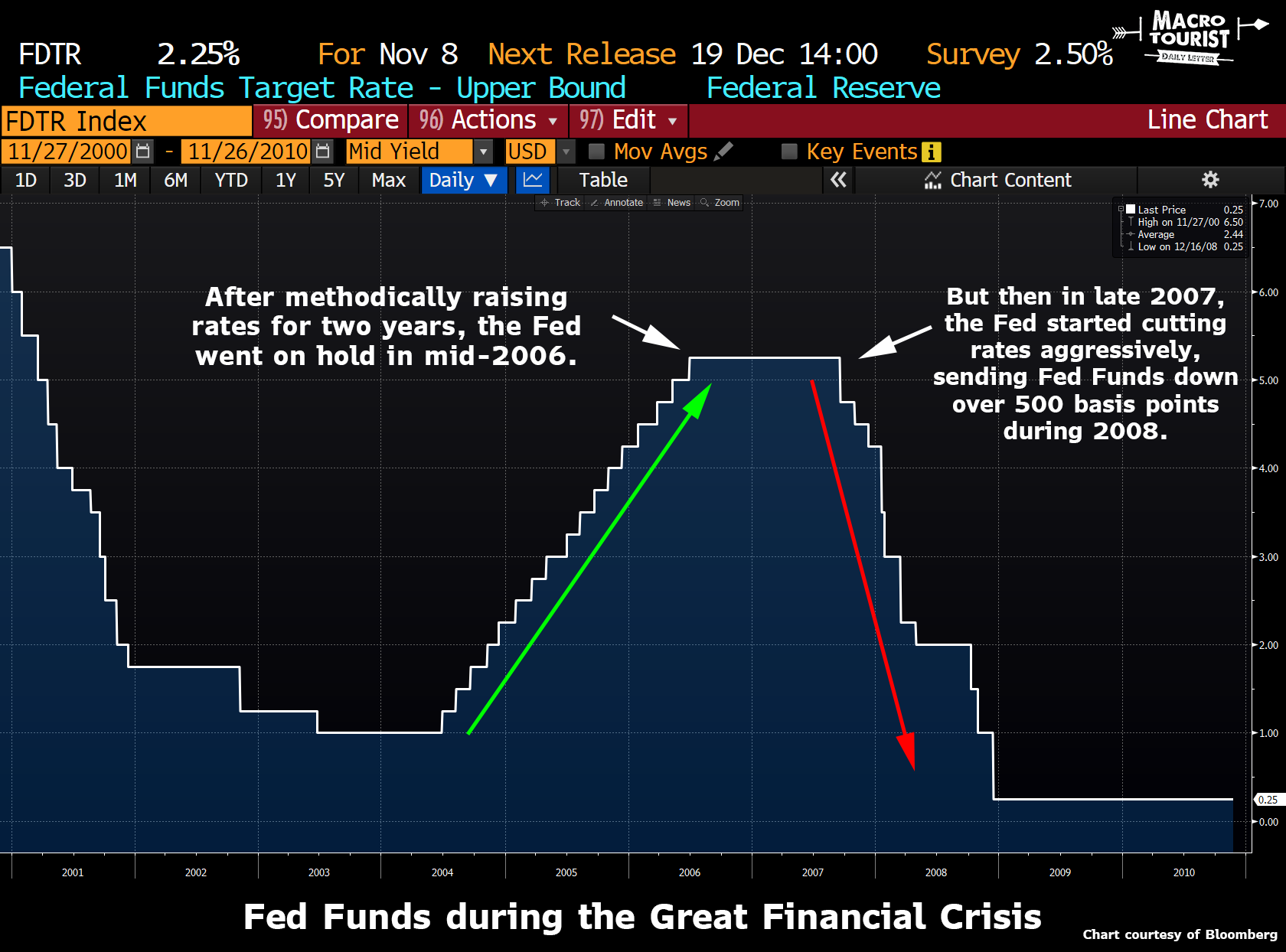

Let’s go through them one by one to get a feel of what they looked like, starting with the most recent Fed cutting cycle:

Did the Fed’s easing come charging to the rescue and save stocks?

Unfortunately not.

The stock market was about to pick its head up off the mat during the first month after the cut, but then it melted for the next year – irrespective of how aggressively the Federal Reserve cut rates.

Well, that’s pretty depressing. But that was the Great Financial Crisis. It was a unique period. What about the previous Fed rate cutting period? How did the Fed handle the bursting of the DotCom bubble?