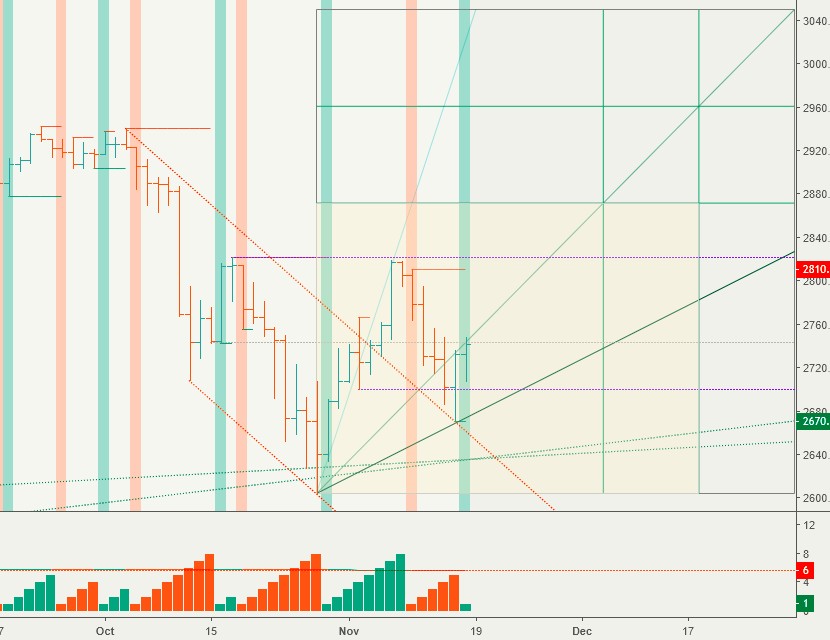

If you followed the year-end chart unfold live, then you have noticed that the futures hit every single technical target with utmost precision. First of all, the lower weekly target acted as support/resistance all week long. Second, the futures crossed but didn’t close below 2700. And third, on Thursday SPX bounced off the point where the 1 x 1 angle and the down-sloping channel crossed:

Last week we also referenced the Buying pressure indicator which had peaked on Nov 7th. This same indicator bottomed on Nov 15th and is turning up again, which favors higher prices this shortened week. Price keeping track with the rising angles will confirm whether the bullish scenario is unfolding or not.

Current signals: Daily Buy, Weekly Buy, Monthly Sell

Weekly Sell pivot at 2700.

The projected trading range for next week for SPX is 2680-2800.

Oil dropped below the lower weekly target on Tuesday, but clawed its way back the rest of the week and touched it again on Friday.

Current signals: Daily Buy, Weekly Sell.

Daily Sell pivot for Monday at 56

The projected trading range for Oil for next week is 54.5 – 59:

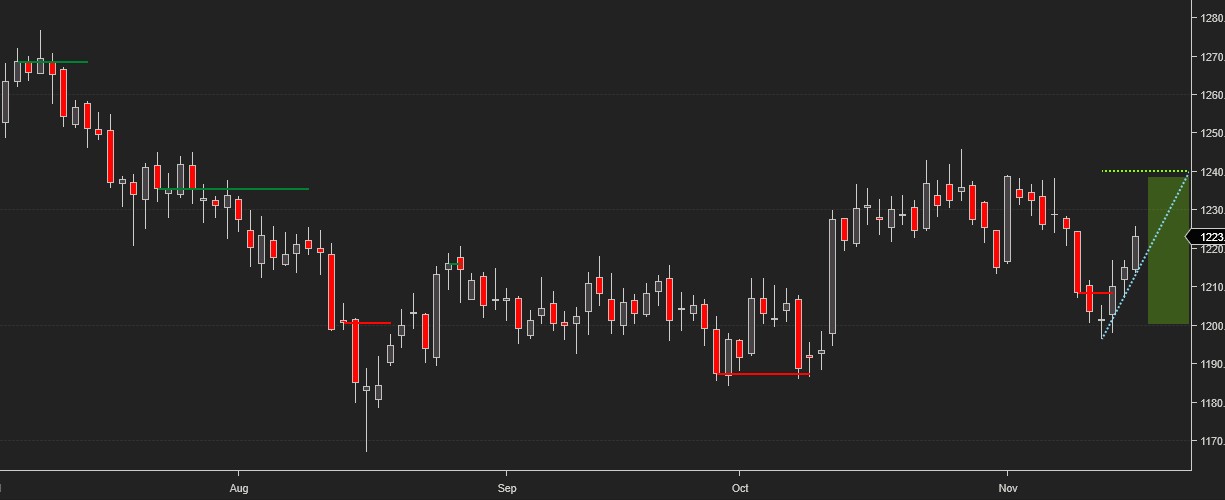

Gold bounced twice off the lower weekly target, rallied, and finished the week in the middle of the projected trading range.

Current signals: Daily Buy, Weekly Buy

Daily Sell pivot for Monday at 1197.

The projected trading range for Gold for next week is unchanged at 1200 – 1240:

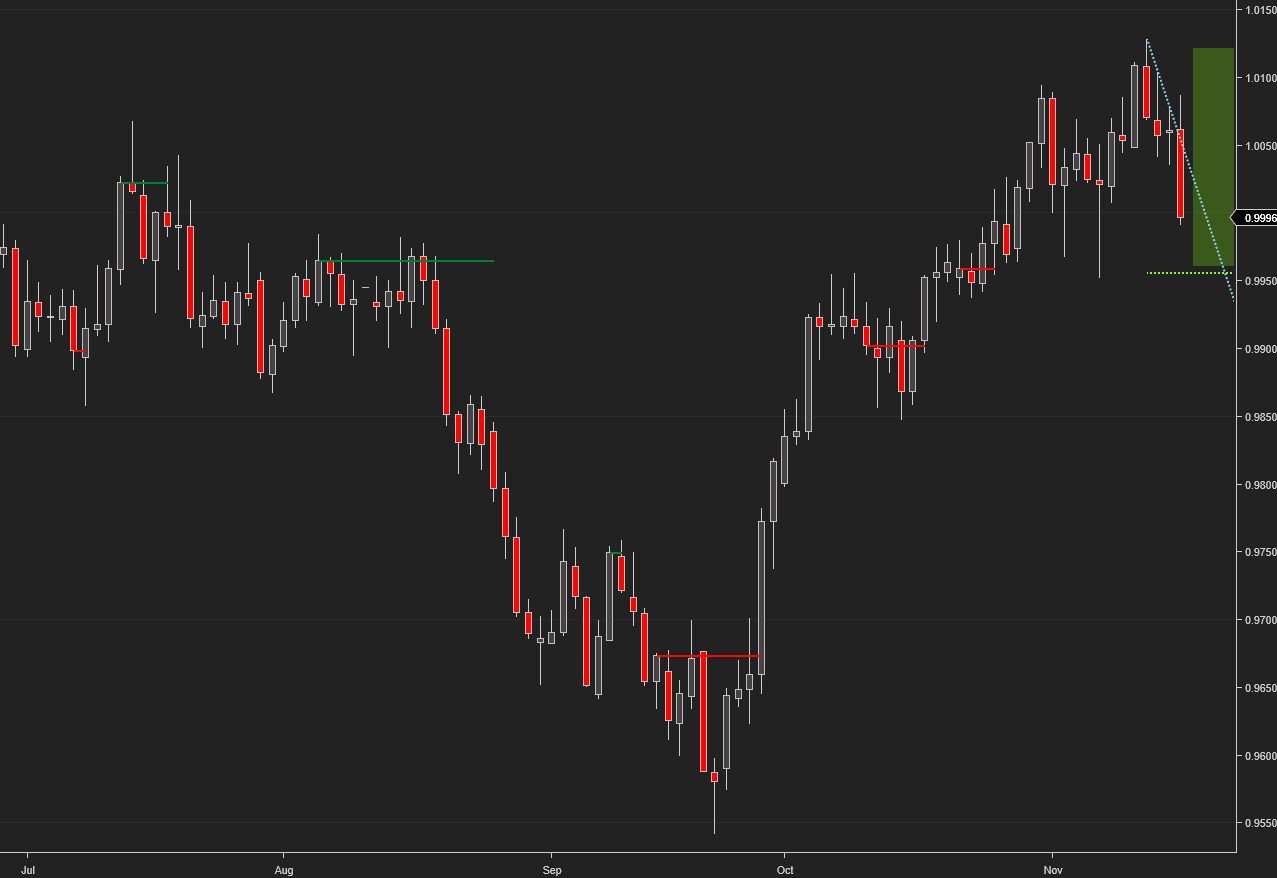

All G6 targets were reached, and the target hit rate this year remains above 85%.

USDCHF reached our upside target and reversed sharply.

Current signals: Daily Sell, Weekly Buy/Hold

Daily Buy pivot at 1.00

The projected trading range for USDCHF for next week is 0.995 – 1.0123:

USDJPY reversed course again and finished the week on the low target.

Current signals: Daily Sell, Weekly Buy/Hold

Daily Buy pivot for Monday at 113.33

The projected trading range for USDJPY for next week is 112 – 114.5: