Gold prices ended Monday’s session down $1.27 an ounce, pressured by a stronger dollar and keener risk appetite in the world marketplace. Global stock markets were mostly higher yesterday. U.S. stocks started the week on a positive note as all three major indices ended the day in positive territory. U.S. economic data due for release Monday is light and includes the Conference Board’s consumer confidence index.

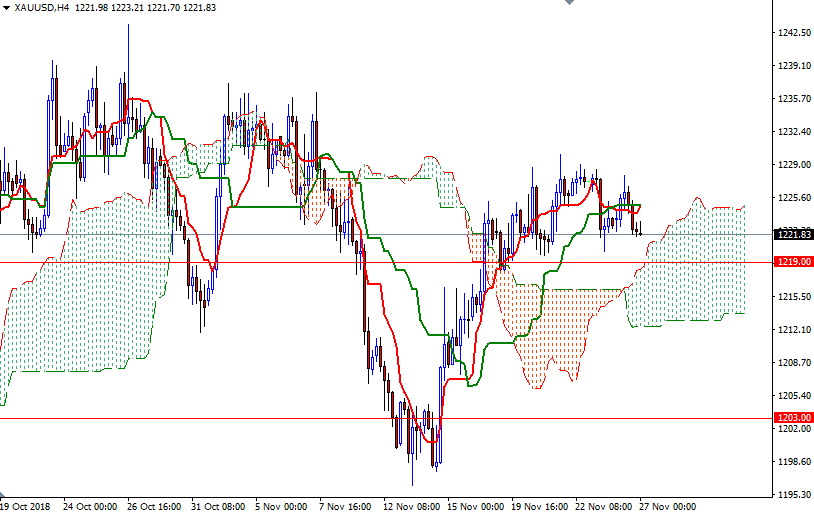

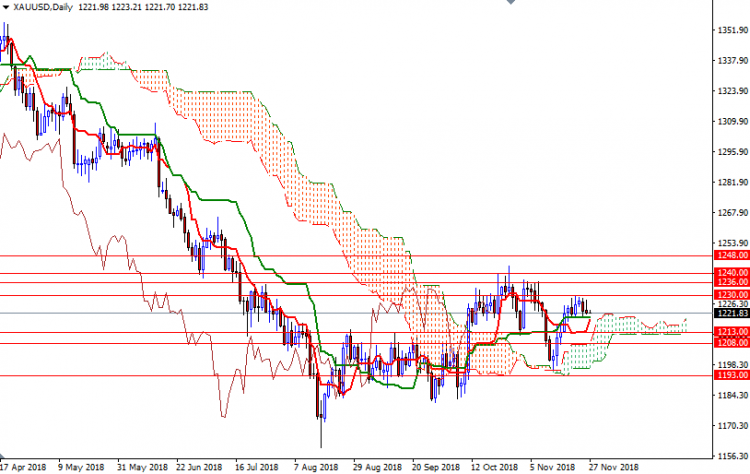

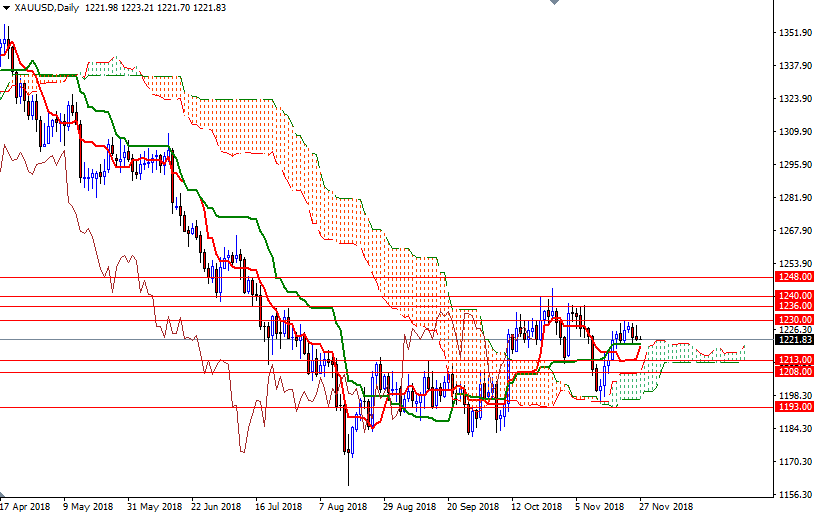

From a chart perspective, the bulls have the near-term technical advantage, with the market trading above the daily and the 4-hourly Ichimoku clouds. However, note that XAU/USD is currently residing below the clouds on the H1 and M30 charts so the bulls have to lift prices above the 1225.30-1224.80 area to march towards 1232/0. If this strategic resistance is successfully broken, look for further upside with 1236 and 1240 as targets.

If the market continues to trade below 1225.30, keep an eye on the 1219.50-1218.70 zone, the confluence of the daily Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line). A break below 1218.70 could see a move to 1216. The bears have to drag prices below 1216 to set sail for 1213. Closing below 1213 would open up the risk of a drop to 1203.