A sugar high – from debt-fueled tax cuts – is expected to wear off in the near term, contracting economic growth coupled with a deepening trade war, could lead to the next financial crisis.

One looming threat to President Trump’s booming economy besides tariffs, is the consumer, as their revolving credit, i.e., credit card, debt has recently hit all-time highs, during a period of rising interest rates, could create a squeeze, thus reducing their ability to buy things they do not need nor can afford during this upcoming holiday season.

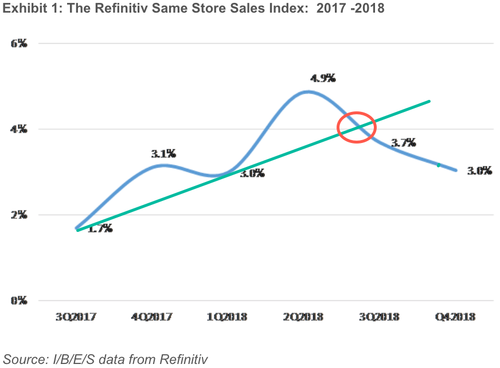

According to a new report from Lipper Alpha Insights, the Refinitiv Same Store Sales Index shows a 3.9% average for the first half of 2018.

However, there is a reason to believe that consumer spending is starting to stall from the previous two quarters (Q3 and Q2) as consumer debt servicing payments increase.

For Q4 2018, the Refinitiv Same-Store Sales Index is expected to print around 3.0%, well below the 4.9% from Q2, a sign that the consumer might have topped out before the holiday rush.

President Trump’s deepening trade war with China has been a significant concern for retailers, and are increasingly being mentioned on earnings calls. Retailers started reporting Q3 2018 earnings last month, and more than 25 of them have warned about tariffs.

Refinitiv shows that retailers are much more bearish this year compared to last year for Q4, as some have mentioned consumer weakness and trade wars could produce a weak holiday season.

To date, there are nine negative retail EPS preannouncements and only one positive.

Exhibit 1: The Refinitiv Same Store Sales Index: 2017 -2018

Exhibit 2: The Refinitiv Same Store Sales Sector Indices:2016 -2018

And earlier today, core retail sales rose only 0.3% MoM (below expectations).

Everything looked great in the report except furniture and home furnishings -0.3%, and food service and retail places -0.2%.