The New Zealand Dollar is pulled back from fresh four-month highs against the US Dollar last week with price now targeting areas of interest for near-term price support. These are the updated targets and invalidation levels that matter on the NZD/USD charts heading into the close of the month.

NZD/USD DAILY PRICE CHART

Technical Outlook: In my previous NZD/USD Price Outlook we noted that, “Key daily support rests at the 6700/15 zone (tested yesterday) with a breach above 6850 needed to fuel the next leg higher in price.” Kiwi briefly registered a high a 6883 before turning lower last week and while the risk remains for a deeper pullback, we’re looking for support into / ahead of the highlighted trendline confluence just above the 6700-handle. Key resistance stands at the upper parallel / 200-day moving average at ~6874 – a breach / close above is needed to fuel the next leg higher targeting the 50% retracement of the yearly range at 6930.

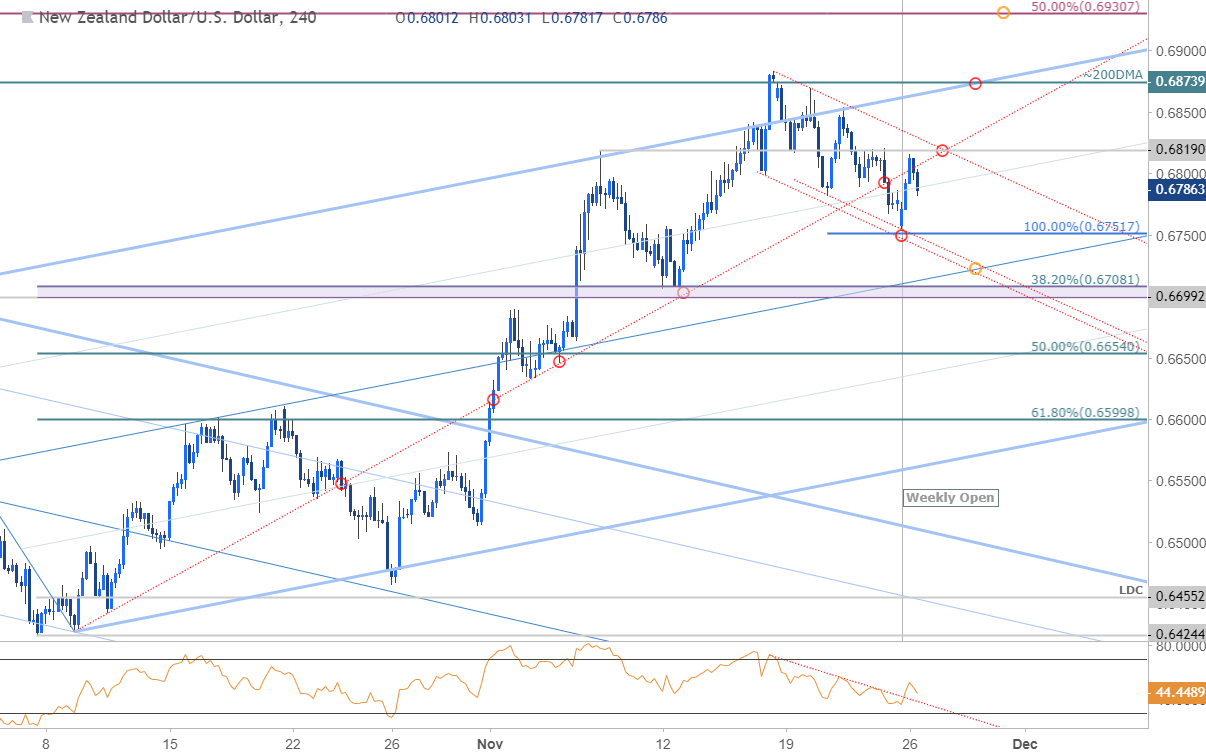

NZD/USD 240MIN PRICE CHART

Notes: A closer look at price action shows Kiwi trading within the confines of a descending channel formation (possible bull flag formation) extending off the highs. Price turned just ahead of the 100% extension at 6752 – so was that it? The jury is still out and while the broader outlook remains tilted to the topside, the threat remains for another test of this level if not deeper into the highlighted slope confluence at ~6725 or the 7700/08 zone – both levels of interest for possible price exhaustion / long-entries IFreached. Initial resistance stands at 6819 with a breach above 6874 needed to mark resumption of the broader uptrend.

Bottom line: Kiwi has pulled back from uptrend resistance and IF this is just a correction, price should establish a low ahead of 6700. From a trading standpoint, looking for a drop towards the median-line OR a breach and retest of channel resistance as support for long-entries. A downside break below the figure would invalidate the reversal play with such a scenario exposing 6654 and the 61.8% retracement at 6600.