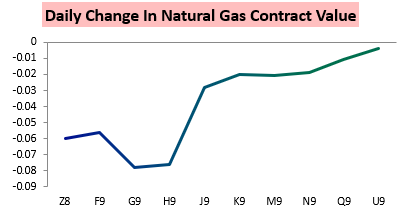

It was another volatile day for the December natural gas contract, as it gapped down significantly last evening and recovered through much of today’s trading session but still settled down almost a percent and a half below Friday’s settle.

The February and March contracts were hit the hardest.

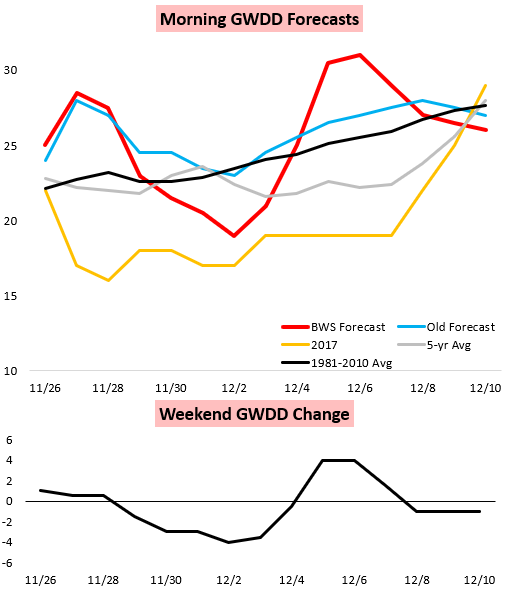

This came following significant weekend GWDD losses.

Such weekend trends were not particularly surprising, as we had been tracking warm risks last week as well. Last Monday we highlighted that we were seeing weather model trends that may allow prices to set a top; they spiked on Wednesday off a bullish EIA print but that turned out to be the top (after initially seeming to set a top Monday).

Then on Friday we warned that risk was skewed lower in prices despite low confidence in this high volatility environment, and that long-range warm risks should arrive on models by today.

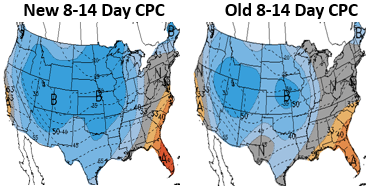

Those medium-range cold risks did intensify as expected, and current Week 2 forecasts have quite a few cold risks per the Climate Prediction Center.

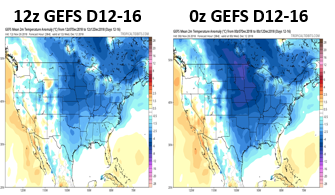

Models then show some easing cold risks late Week 2 into Week 3, as seen by less intense cold on the 12z GEFS this afternoon (model images courtesy of Tropical Tidbits).

Prices did recover from their early morning lows today, thanks in part to lingering Week 2 cold risks and firm cash prices that we noticed in the morning, which is why we said “…we would first look for bounces to $4.1 or even $4.25…” when prices were trading around $4.05. Yet into the settle the December and January contract both logged similar losses (though after hours the January contract has been hit a bit harder).

Natural gas volatility is certainly expected to continue.