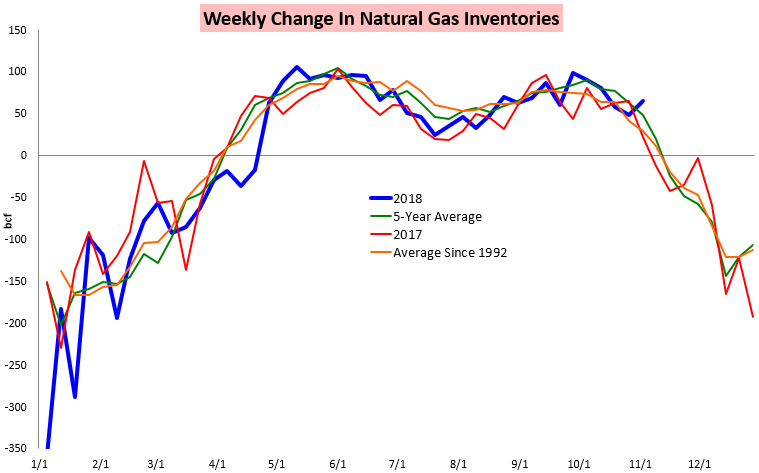

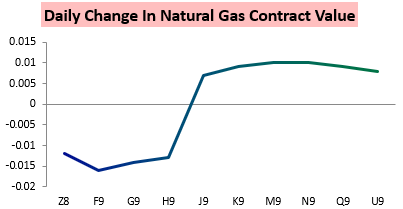

The December natural gas contract settled a few tenths of a percent lower on the day following an announcement from the EIA that slightly more gas was injected into storage than expected last week and colder medium-range weather forecast trends.

The EIA announced that 65 bcf of natural gas was injected into storage last week, which was significantly above most market estimates clustered from 55-60 bcf. Our clients were prepared, however, as we were one of the few far higher estimates at 63 bcf.

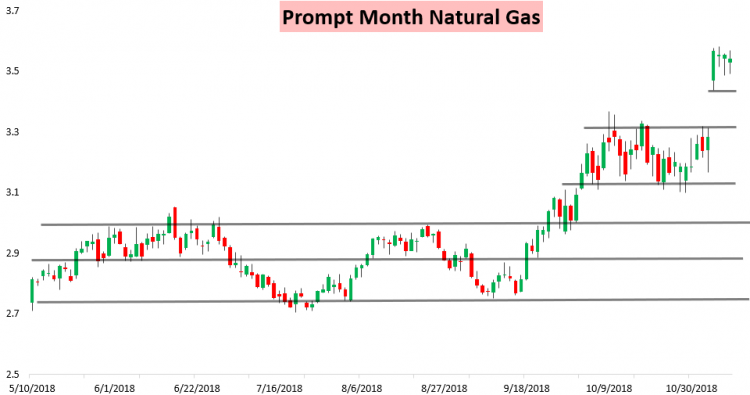

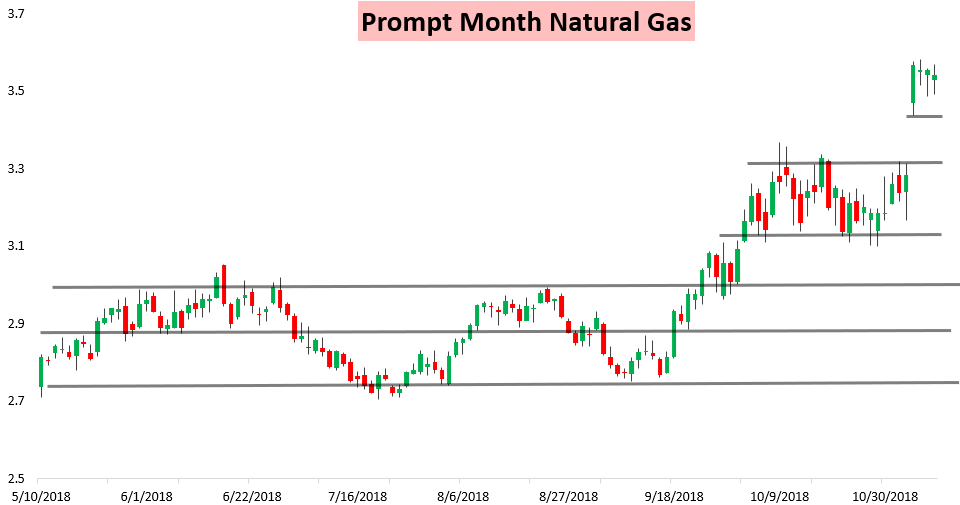

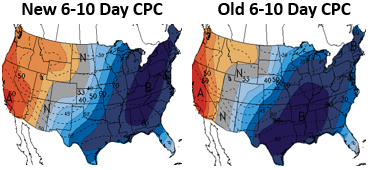

Prices initially dipped down near $3.5 but were able to find support on some colder medium-range weather model trends, which helped the strip limit losses. Most 2019 contracts actually ended in the green on the day.

Prices then continued higher after the settle as the 6-10 Day forecast continued to trend colder.

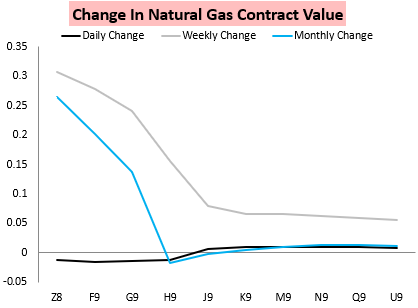

The impact of this cold can clearly be seen in the weekly and monthly change at the front of the natural gas strip, with prices up very significantly over the past 5 trading days.

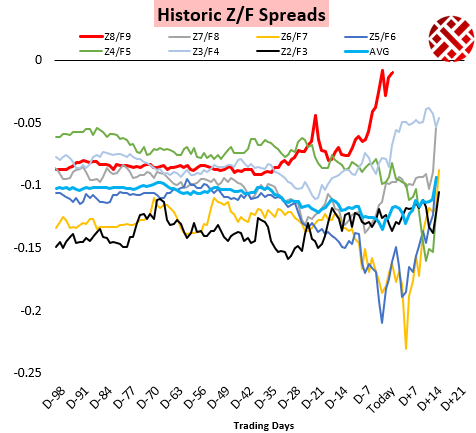

Now, traders are looking both towards next week’s EIA print to see if it again may miss to the high side and to significant cold next week that could blow out physical prices across the country. Henry Hub cash prices continue to trade solidly above prompt, which can be seen in how the Z/F spread has narrowed so much.

Following a massive gap last weekend, traders will certainly be on edge tomorrow as they prepare for another round of weekend weather changes. We will be covering weekend weather risk in all our reports tomorrow, outlining how weather should impact natural gas prices and updating our EIA forecasts for the next few weekly prints after our highly accurate print today.