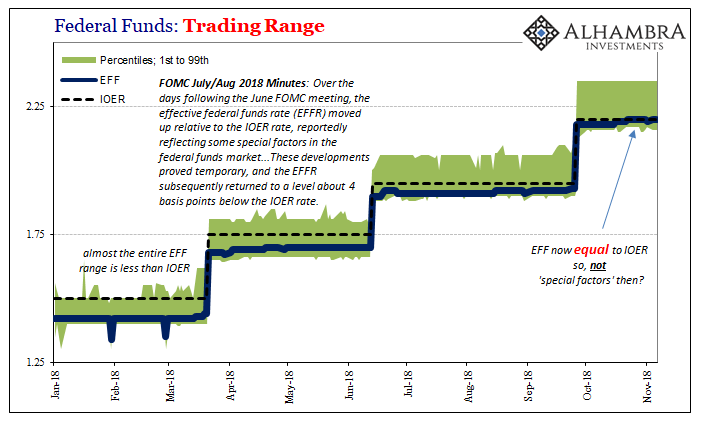

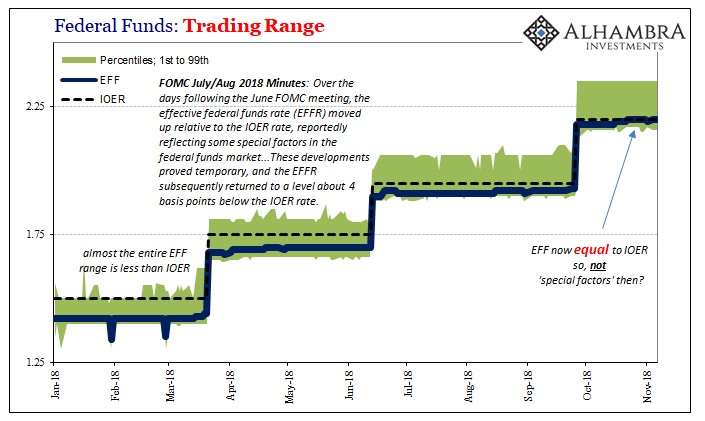

The effective federal funds (EFF) rate actually dipped 1 bp last Friday. Having spent the prior eight trading days equal to IOER at 2.20%, it might’ve been heartening for US central bankers under siege. After all, they adjusted that particular policy tool back in June and then in July said this whole EFF thing was due to “special factors” that had long since dissipated. People were starting to question whether they know what they are doing.

But EFF didn’t embark on a downward trajectory this week. Rather, starting Monday it was right back at 2.20%. A one-day, small reprieve was all. This stubbornness and the ineffectiveness of IOER is being noticed. From Bloomberg:

“The Fed is in denial,” said Priya Misra, the head of global interest-rate strategy at TD Securities. “If the Fed continues to let its balance-sheet runoff continue, then reserves will begin to become scarce.”

This is one of the most frustrating aspects of all this. Even when the mainstream sees what’s wrong, they can’t ever really figure out why. Who cares if “reserves will become scarce”, that’s not what is plaguing the global system. The Fed is actually to blame for everyone blaming the Fed, feeding, as it has, this idea that it is central to the monetary system.

It’s not.

To put it simply, if the US economy was actually booming, then why would scarce reserves matter? They hadn’t for decades before 2008 (and let’s not kid ourselves here, they haven’t mattered one bit after). The Fed’s balance sheet was minimal and yet there hadn’t been any kind of monetary irregularities until August 9, 2007.

In other words, the system creates its own reserves and if the economy was as good as advertised it would be doing that right now. The pullback of the Fed’s balance sheet, this so-called quantitative tightening, wouldn’t matter because the private money system would’ve stepped in with its own forms. You know, what actually happened before.