![Earnings Kicking In]()

Earnings Kicking In

Jul 18, 2017

Jeremy Parkinson

Finance

“We may encounter many defeats but we must not be defeated.” – Maya Angelou And just like the Nasdaq closed at new highs on the back of NFLX earnings. We’ve got more heavy hitters on deck so we should see more strength over the next few weeks if all continues as it has. Buying dips […]

Where Did The Bears Go

Jul 18, 2017

Jeremy Parkinson

Finance

Bears, man! WHERE DID YOU GO!? Actually had the S&P 500 down about about 8-9 points lower at one point today, but that ended with a sharp buying spree that took price back up to just below breakeven. There’s no one out there to really push stocks substantially higher, but count on the bulls to rally […]

International Business Machines Corp. 2Q 2017 Earnings: Sales Miss Est.

Jul 18, 2017

Jeremy Parkinson

Finance

The IBM 2Q 2017 earnings report was released after closing bell tonight, and the company posted non-GAAP earnings of $2.97 per share on $19.3 billion in sales, compared to the consensus estimates of $2.75 per share in earnings on $19.45 billion in revenue. In the second quarter of last year, International Business Machines reported earnings of $2.95 […]

Ecolab: A High Quality Dividend Aristocrat Held By Bill Gates

Jul 18, 2017

Jeremy Parkinson

Finance

Ecolab (ECL) is arguably one of the most reliable businesses that money can buy, which is perhaps why the company is a large holding in Bill Gates’ dividend portfolio here. Although Ecolab’s dividend yield is low (1.1%), the company’s long-term growth outlook is excellent and supported by its impressive moat (90% recurring revenue in the form […]

When You Stop Reading After The Second Sentence

Jul 18, 2017

Jeremy Parkinson

Finance

On June 27, ECB President Mario Draghi opened that central bank’s international conference in Sintra, Portugal. Most media never made it past the first two sentences of his prepared remarks. For them, the verdict was already delivered in those few lines. They declared that Draghi declared monetary policy was working and the world was on its way […]

Six Flags Drops As CEO ‘Retires’ After Under Two Years In Role

Jul 18, 2017

Jeremy Parkinson

Finance

Shares of Six Flags Entertainment (SIX) dropped in afternoon trading after the company announced the retirement of its chief executive officer after just 17 months in the role. Following the news, an analyst said the news that the company’s current chairman and former CEO is returning to the CEO role is “a positive.” CEO DEPARTURE: […]

It’s Complicated

Jul 18, 2017

Jeremy Parkinson

Finance

Things changed a lot in the past two weeks. The US Fed’s promises to keep tightening financial conditions look a lot shakier than they did at the start of the month, thanks to a series of weak economic readings in the US. I still think we need to be wary of central bankers but with […]

June 2017 Import Sea Containers Suggest Improving Economy

Jul 18, 2017

Jeremy Parkinson

Finance

The June month-over-month import and export container counts are suggesting a growing USA economy, but a slowing global economy – and a worsening trade balance. Analyst Opinion of Container Movements January was great. February was bad. March was good. April is ok. May and June were a mixed bag. Simply looking at this month versus […]

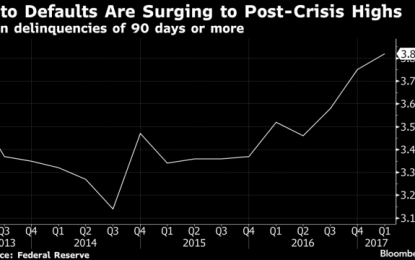

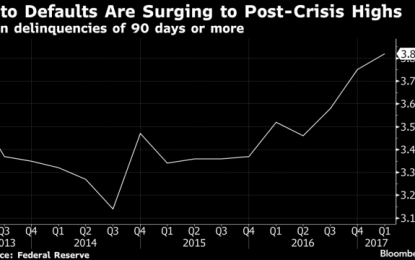

Subprime Redux: Problems Brewing In Auto Loans

Jul 18, 2017

Jeremy Parkinson

Finance

It’s classic subprime: hasty loans, rapid defaults, and, at times, outright fraud. Only this isn’t the U.S. housing market circa 2007. It’s the U.S. auto industry circa 2017. A decade after the mortgage debacle, the financial industry has embraced another type of subprime debt: auto loans. And, like last time, the risks are spreading as […]

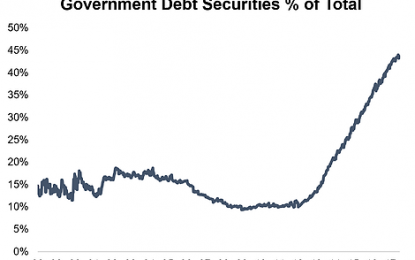

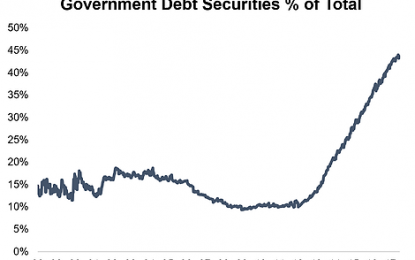

The BOJ Bond Buying Binge

Jul 18, 2017

Jeremy Parkinson

Finance

As the Bank of Japan is set to meet this week to review monetary policy settings it’s worth checking in on a couple of particularly relevant charts. The first one shows the Bank of Japan has now accumulated an impressive 45% of all outstanding Japanese government debt. Strictly speaking this is not debt monetization but it’s not […]