Amid Macro Skepticism , Alphabet And Microsoft Shone Through

Apr 25, 2024

Jeremy Parkinson

Finance, No picture

Image Source: Pexels MARKETAmid a challenging backdrop marked by a concerning data mix, including significantly lower-than-anticipated Q1 GDP figures alongside unexpectedly heightened price pressures, the S&P 500 staged a remarkable rebound in after-hours trading. This turnaround was propelled by a swift narrative shift catalyzed by strong earnings performances from Alphabet (GOOGL) and Microsoft (MSFT). The tech […]

Expect Big Negative Revisions To BLS Monthly Jobs In 2023, GDP Too

Apr 25, 2024

Jeremy Parkinson

Finance

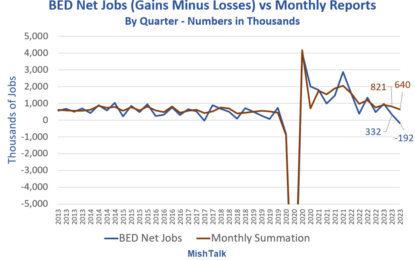

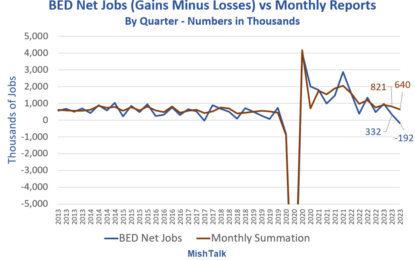

Business Employment Dynamics (BED) data and Monthly Job Data both from the BLS, chart by Mish BED Chart Notes Data is from the BLS Business Employment Dynamics (BED) report and the BLS monthly jobs reports (CES). BED data is less timely but far more accurate than the BLS monthly jobs reports/ For 2023 Q3, the BED reports […]

GOOG/GOOGL: Blowout Quarter, MSFT: Excellent Quarter As Well

Apr 25, 2024

Jeremy Parkinson

Finance

Google (GOOG/GOOGL) just reported a blowout quarter after the market close Thursday. Revenue was +15%, Operating Margin surged to 31.6% from 25.0% a year ago and EPS of $1.89 is up 62% from the year-ago period. These are massive numbers so it’s no surprise the stock is currently +13% in the after-hours to all-time highs. […]

Intelligent Bio Solutions’ Fingerprint Drug Screening Technology Poised For Massive Growth

Apr 25, 2024

Jeremy Parkinson

Finance

TM Editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.Image Source: Pixabay Intelligent Bio Solutions (Nasdaq: INBS) is a medical technology company developing and commercializing innovative, intelligent, rapid, noninvasive testing solutions. They are now catching their stride with commercializing their first razor-razorblade product solution, […]

Bonds, Banks And Builders Make Strange Bed Fellows

Apr 25, 2024

Jeremy Parkinson

Finance, No picture

Image Source: Pexels Over the past few weeks we’ve talked about the upside in shorting bonds – and taken some positions accordingly over in the Live Trading Room.We’ve talked about weakness in homebuilders’ stocks, too, and we’ve also acted on that thesis. There are some interesting developments that suggest we could be in for lower lows […]

Market Talk – Thursday, April 25

Apr 25, 2024

Jeremy Parkinson

Finance

ASIA:The major Asian stock markets had a mixed day today: NIKKEI 225 decreased 831.60 points or -2.16% to 37,628.48 Shanghai increased 8.08 points or 0.27% to 3,052.90 Hang Seng increased 83.27 points or 0.48% to 17,284.54 ASX 200 closed Kospi decreased 47.13 points or -1.76% to 2,628.62 SENSEX increased 486.50 points or 0.66% to 74,339.44 […]

Google Becomes A Dividend Stock After Q1 Earnings

Apr 25, 2024

Jeremy Parkinson

Finance, No picture

Image Source: Unsplash Alphabet Inc (Nasdaq: GOOGL) says it performed better than Street expectations in its first financial quarter. Shares of the tech titan are in the green in after-hours. Google stock rallies on solid ad revenue Investors are rewarding the multinational partially on solid growth in ad revenue. Google generated $61.65 billion in revenue from advertising […]

Cocoa Prices Surge Higher Into Important Resistance

Apr 25, 2024

Jeremy Parkinson

Finance, No picture

Image Source: Unsplash Cocoa futures prices have rallied sharply over the past year.And the rally has really heated up over the past 3 months.Today we look at a “monthly” chart of Cocoa to highlight this rare and sharp rally.As you can see, hot Cocoa has gained 100% quicklyafter breaking out of a 23-year sideways trading pattern.The strong […]

S&P 500, Nasdaq Snap Three-Day Win Streak

Apr 25, 2024

Jeremy Parkinson

Finance

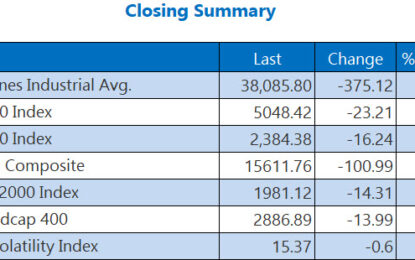

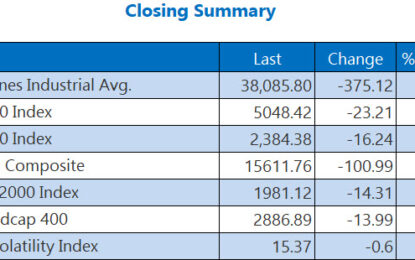

Stocks finished deep in the red today but as a small consolation prize, up off their session lows. The S&P 500 and Nasdaq snapped their three-day win streaks, though the latter was able to bounce off the psychologically significant 5,000 level, while the former was off by more than 200 points in the morning. Fed […]

Microsoft Surges As AI-Growth Drives Across-The-Board Beat

Apr 25, 2024

Jeremy Parkinson

Finance

Image Source: Unsplash Investors can exhale after META’s meltdown as MSFT just reported better-than-expected revenues in Q3 of $61.86 billion (estimate $60.87 billion).All the business segments also beat expectations: Productivity and Business Processes revenue $19.57 billion, estimate $19.54 billion More Personal Computing revenue $15.58 billion, estimate $15.07 billion With the AI-exposed segments strong: Microsoft Cloud revenue $35.1 billion, […]