Markets Scorecard: Four Months Into The Year, Here’s Where Things Stand

May 04, 2024

Jeremy Parkinson

Finance

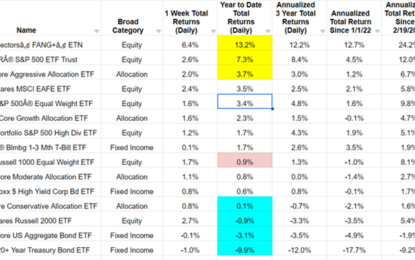

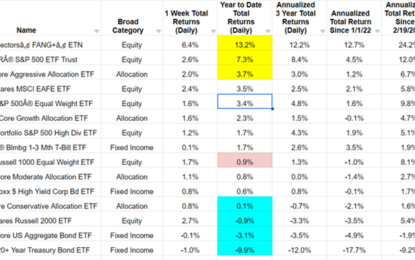

Yellow section: The S&P 500 ETF Trust (SPY) is up more than 7% in four months, and the MicroSectors FANG+ ETN (FNGS) has produced above-average returns, continuing the move that started last Halloween. But markets are getting volatile and earnings season is not over. So, this will likely be a moving target the next few weeks. This is why […]

Are New Highs Coming In The Stock Market?

May 04, 2024

Jeremy Parkinson

Finance, No picture

After dropping 80 points on Tuesday, the S&P 500 rallied to finish green for the week. Have key “end of the pullback” hurdles been cleared or is the door open to additional downside? In this week’s video, we’ll review the latest charts and data to help us answer the question, are new highs coming in the […]

Gold & Silver Correction Continues

May 04, 2024

Jeremy Parkinson

Finance

Image Source: PixabayGold, Silver, and the miners declined this week but all remained above key support levels. Silver retested support at $26.30 and formed a bullish hammer today. Gold & gold stocks could decline more and test their support levels.Video Length: 00:09:30More By This Author:The Most Important Gold Chart In 2024 Debt Monetization & Recession is […]

Jobs: Household Report Is Way Below A Weak Headline Number

May 04, 2024

Jeremy Parkinson

Finance

Image Source: PixabayThe analysis below covers the Employment picture released on the first Friday of every month. While most of the attention goes to the headline number, it can be helpful to look at the details, revisions, and other reports to get a better gauge of what is really going on. Current Trends The BLS reported a gain of […]

How To Make The Most Of Today’s Market – Friday, May 3

May 03, 2024

Jeremy Parkinson

Finance, No picture

Image Source: PexelsStocks have lost ground lately, with the S&P 500 index losing roughly 5% of its value from its recent record peak. Driving this shift in sentiment appears to be a reassessment of Fed policy in the wake of unfavorable inflation readings over the last few months.This year’s monthly inflation readings appear to show that […]

Financial Markets Report For Friday, May 3

May 03, 2024

Jeremy Parkinson

Finance

Image Source: PixabayIn this video, Ira Epstein reviews the activity in the Financial Markets after the day that just ended, Friday, May 3.Video Length: 00:16:54More By This Author:SPDR ETF Report For Thursday, May 2Financial Markets Report For Thursday, May 2Financial Markets Report For Wednesday, May 1

Navigating Market Trends: Elliott Wave Insights For NDX Tech Stocks

May 03, 2024

Jeremy Parkinson

Finance, No picture

Image Source: UnsplashElliott Wave Analysis of NDX Tech Stocks: Nasdaq 100 and SP500 Wave (4) low being in place strengthens day by day and we can continue to build long positions across many markets such as Bitcoin and crypto tokens. Apple’s earnings also injected strength into the tech sector, some of the stocks were quite flat […]

US Dollar Closes A Losing Week Following Soft NFP

May 03, 2024

Jeremy Parkinson

Finance

Image Source: Pixabay US Nonfarm Payrolls report from April underperformed, showing a lower-than-expected increase. The odds of a rate cut in September increased, which seems to be applying pressure on the USD. The US Dollar Index (DXY) is visiting the 105 level with sharp losses at the end of the trading week. This comes after Friday’s report of […]

These 3 Companies Shattered Quarterly Records

May 03, 2024

Jeremy Parkinson

Finance, No picture

Image Source: PexelsEarnings season continues to roll along, with a solid chunk of companies already delivering their quarterly results. The period has remained positive, underpinned by strong results from the technology sector.And interestingly enough, several companies – Apple (AAPL – Free Report), Eaton (ETN – Free Report), and Spotify (SPOT – Free Report) – posted quarterly records, with shares of each seeing […]

Dow Jones Industrial Average Gains 450 Points As Investors Up Rate Cut Bets After Softer NFP

May 03, 2024

Jeremy Parkinson

Finance, No picture

Image Source: Unsplash Dow Jones gains 460-plus points as investors raise bets on rate cuts. US data broadly softer on key labor print. Tech stocks dragging Dow Jones higher. The Dow Jones Industrial Average (DJIA) gained nearly 1.2% on Friday after a broad miss from US Nonfarm Payrolls (NFP) and other key labor data revealed a […]