Most Asian stock markets rose on Monday, with Europe set to follow, as

fears eased that Washington would draft a harsh bill for regulating the

banking sector and after an unremarkable conclusion to a Group of 20

leaders’ summit.

G20 leaders meeting in Toronto agreed to take

their own paths to ensuring economic growth and left room to move at

their own pace, trying to balance contrasting priorities by pledging to

halve budget deficits by 2013 without stunting growth.

The

heads of the G20 rich and developing nations also promised to clamp down

on risky behaviour by banks without restricting lending, and agreed to

give banks more time to adopt tougher rules.

That followed an

historic overhaul of financial regulations by U.S. lawmakers on Friday,

with banks forced to spin off swap trading operations. Banks will be

able to keep most of their books but will be barred from commodity,

equity and some credit default swaps.

“I don’t see much

substance from G20,” said Lin Yuhui, deputy general manager of Jinhui

Futures.

“Basically it’s saying everyone is back to minding

their own business, just like before the crisis,” Lin said.

The

MSCI index of Asia Pacific shares outside Japan rose 0.6 percent, with

financial shares outperforming. Hong Kong stocks led the way, rising 0.4

percent.

Financial bookmakers said Europe’s main benchmark

indexes would likely head in the same direction, with spreadbetters

expecting Britain’s FTSE 100, Germany’s DAX and France’s CAC- 40 to open

as much as 0.9 percent higher.

U.S. stock futures were

slightly weaker, however.

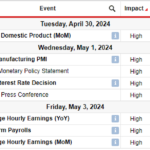

Investors will have to weather a

welter of U.S. data this week, including June jobs numbers on Friday,

consumer confidence, pending home sales and some early earnings reports.

U.S. economic data has been mixed in recent weeks, raising

doubts about the strength of its recovery.

In Tokyo, the Nikkei

share average fell 0.5 percent, extending falls after closing last week

below a key support level and booking its biggest weekly loss in a

month with an indecisive outcome likely in an upper house poll next

month.

A muted reaction to the G20 meeting didn’t help, with

the Japanese market slipping across the board.

Wall Street had

finished almost unchanged on Friday, although financial stocks had

gained on relief the U.S. financial regulation bill would not inhibit

Wall Street profits as much as had been feared.

Underlining the

less-than-decisive conclusion to the G20 summit, Angel Gurria, head of

the Organisation for Economic Co-operation and Development, said the

“incipient recovery” offered policy choices but also made it harder to

find common ground.

“When the house was on fire, we all knew

what to do: get a hose,” Gurria told G20 leaders.

Asian debt

spreads narrowed after widening in the previous four sessions, with

investors encouraged to buy riskier assets after the G20 leaders

committed to cutting budget deficits.

The Asia ex-Japan iTraxx

investment-grade index narrowed 7 basis points (bps) from Friday to

132/134, a Singapore-based trader said. CHINA MUTES YUAN TALK

Signalling

the difficulties groups such as the G20 have in addressing matters

crucial to global economic imbalances, China succeeded in having a line

praising its decision to move towards a more flexible exchange rate

removed from the G20 communique.

Beijing maintains debate about

the yuan has no place in international forums, and did not want even a

positive reference to the currency to set a potential precedent for

singling its currency out.

The People’s Bank of China set the

yuan’s daily mid-point at 6.7890 against the dollar on Monday, a new

post-2005 revaluation high.

The yuan has risen about 0.5

percent in the past week since the PBOC said on June 19 that it was

unshackling the currency from its two-year-old peg to the dollar, but

gains have been kept in check by big state-owned banks and any further

appreciation is expected to be glacial.

Japan’s retail sales in

May rose 2.8 percent from a year ago, their slowest annual pace since

January, in a sign consumption driven by government stimulus spending

may be slowing. Retail sales had been surging since the start of the

year, helped by government subsidies for durable goods.

Investors

seeking to cut long positions in favour of the greenback had the dollar

on the defensive on Monday. The euro held gains as the focus shifted to

the sustainability of a U.S. recovery from euro zone debt worries.

The

dollar index edged up 0.1 percent to 85.43, holding above last week’s

low of 85.09. The dollar hovered near a five-week trough against the yen

after data released on Friday showed U.S. gross domestic product in the

first quarter grew more slowly than expected.

“I have a

feeling in my bones that perhaps Friday was the start of the market

questioning the viability of the U.S. as the safe haven,” said Tim

Lovell, an economist at ICAP in Sydney. Higher commodities and the

subdued U.S. dollar helped the Australian and New dollars. The

Australian dollar held firm at around $0.8750. U.S. crude oil futures

briefly rose to their highest in nearly eight weeks at $79 a barrel as

tropical storm Alex forced Mexico to reduce oil exports and some U.S.

producers to evacuate platforms and curb output.