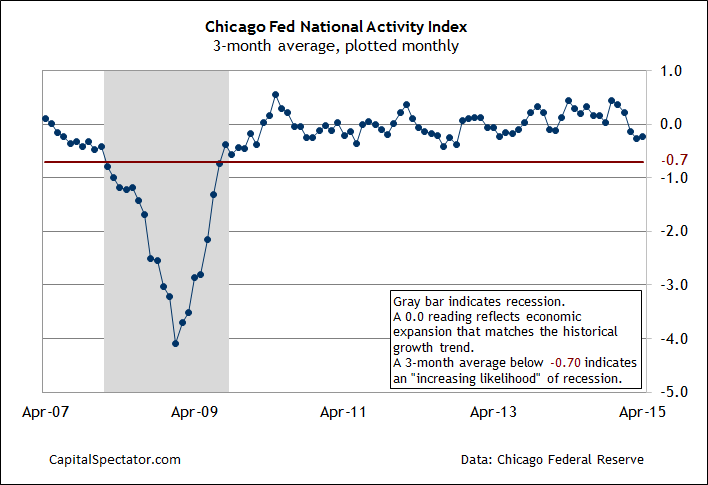

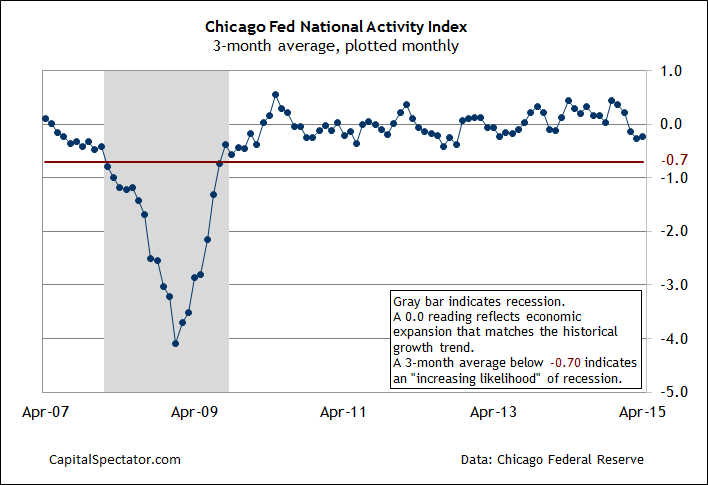

The Chicago Fed National Activity Index’s three-month average (CFNAI-MA3) ticked higher in April, but growth remained below the historical trend for the third month in a row. The latest string of three consecutive negative values represents the longest stretch of below-trend data in nearly two years. Still, CFNAI-MA3 inched up to -0.23 last month and so it remains well above the -0.70 mark that signals the start of new recessions. Nonetheless, growth remains weak by recent standards and so today’s report will continue to stoke debate about the economic outlook.

“Two of the four broad categories of indicators that make up the index increased from March, but only one of the four categories made a positive contribution to the index in April,” the Chicago Fed said in a statement. Nonetheless, the slightly higher reading for CFNAI-MA3 offers another clue for arguing that the US isn’t in recession, at least based on last month’s numbers.

It’s still early for deciding how May’s profile compares, although preliminary clues for this month still point to an ongoing expansion, albeit at a lesser pace vs. the robust gains witnessed in late-2014. Today’s business survey data for the manufacturing sector, for instance, offers a modestly upbeat profile. Markit’s purchasing managers’ index (PMI) dipped to 53.8 for May from 54.1 in the previous month, touching a 16-month low. But that’s still well above the neutral 50.0 mark that separates growth from contraction.

Meanwhile, running today’s revised CFNAI-MA3 data through a probit model continues to show that the probability is low (roughly 9%) that a recession started in April (a view that jibes with yesterday’s update on business cycle risk via The Capital Spectator’s proprietary indexes). The current risk estimate in the chart below is based on a probit regression that analyzes the historical record of NBER’s business cycle dates with CFNAI-MA3.