In my recent “bracketology” research, I analyzed over a dozen Net Lease REITs in order to determine the most durable one. In order to determine the most heavy-duty REIT, I provided “wide-moat” ratings for each, based on thirteen key resilience criteria. Although W.P. Carey (NYSE:WPC) was not the winner, the New York-based REIT scored well and deserves an honorable mention.

It’s true that selecting sound securities based on measures of sturdiness is a central part of investing, but selecting sound securities trading at a margin of safety is critical. The basic idea behind value investing is that purchasing a security at materially less than fair value will help improve your odds of making a successful investment. Thus, valuation is an incredibly important aspect of investing – you could argue, the most important.

I must not reveal all of the durability attributes here, since I owe that to my premium subscribers, but I will tell you that W.P. Carey has an arguably strong moat that appears to be getting stronger over time, even during periods of rising interest rates. How strong? That’s the purpose of this article…

Durability Test: Portfolio

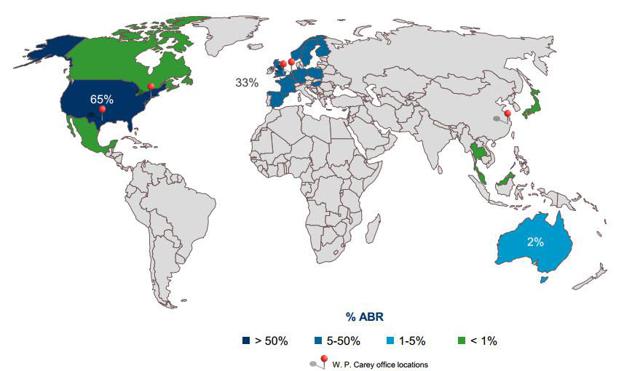

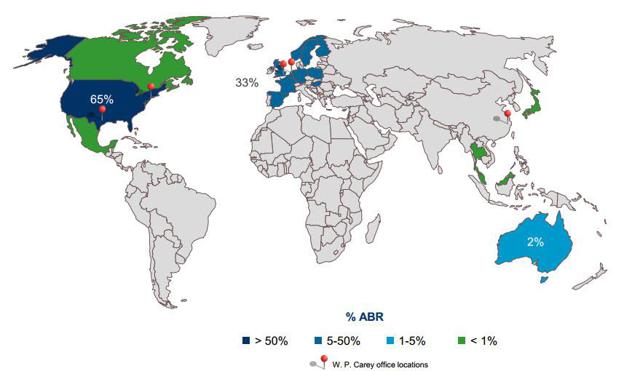

W.P. Carey Inc. is a leading global net lease REIT that provides long-term sale-leaseback and build-to-suit financing solutions for companies worldwide. As of Q2-15, the company had an enterprise value of approximately $10.4 billion. At the end of the second quarter WPC’s owned real estate portfolio consisted primarily of 852 net properties comprising 89.3 million square feet leased to 217 tenants. Around 64% of annualized base rent came from U.S. properties, and about 33% from European properties.

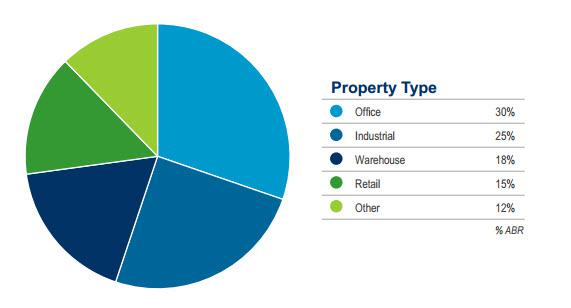

WPC’s diversification allows the company to allocate capital to property types with the best risk-adjusted returns. As you can see below, the mix includes office (30%), industrial (25%), warehouse (18%), retail (15%), and other (12%).

WPC also has a diverse number of tenant categories: