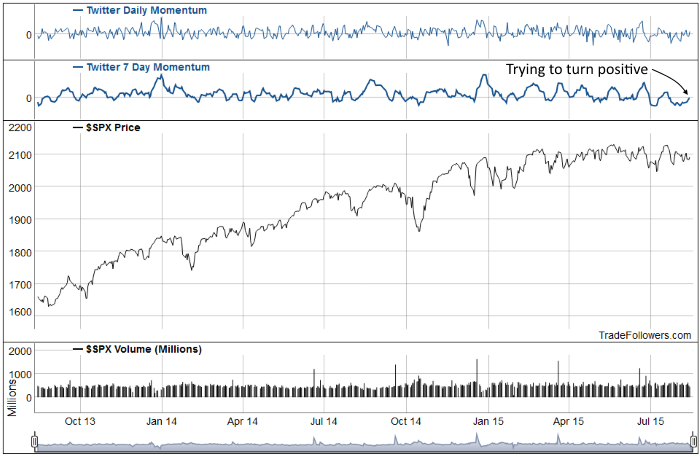

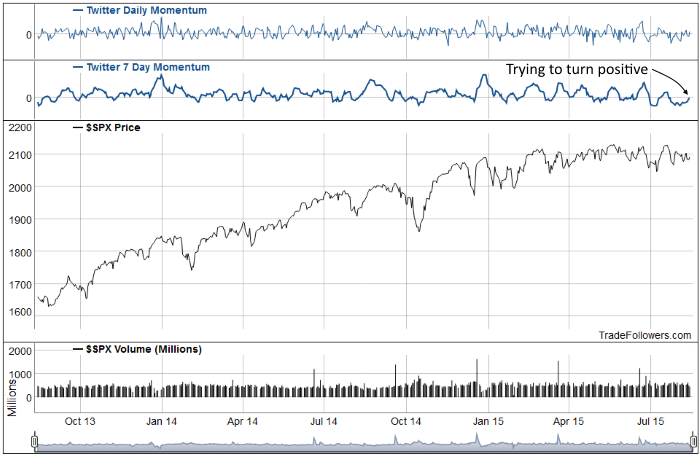

Not a lot has changed from last week’s post on Twitter sentiment for the S&P 500 Index (SPX) Negative sentiment persists, but it’s slowly righting itself. The daily indicator bounced back and forth between mildly positive and mildly negative prints during the week. This caused 7 day momentum to drift slowly higher, but it still hasn’t been able to get above zero. It appears that market participants are waiting for a reason to get bullish.

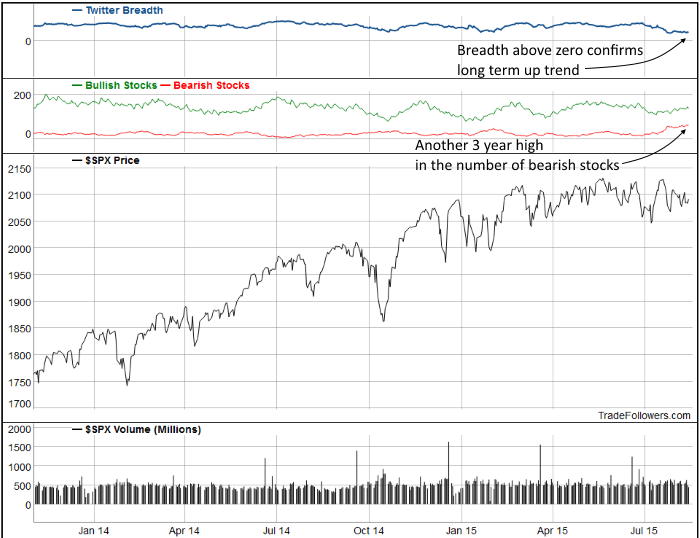

The number of bearish stocks on Twitter rose to another three year high last week, but the number of bullish stocks rose as well. This caused breadth to drift sideways in the high thirties. As long as breadth is above zero the long term trend should be up. You can see the interactive chart of breadth here.

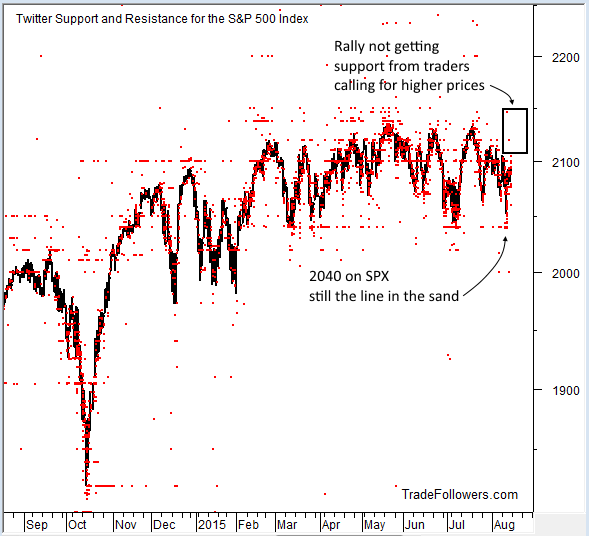

Price targets from traders on Twitter still lack optimism. There were very few higher tweets which indicates a lack of hope. 2040 on SPX is still the must hold level. If it breaks selling will likely accelerate.

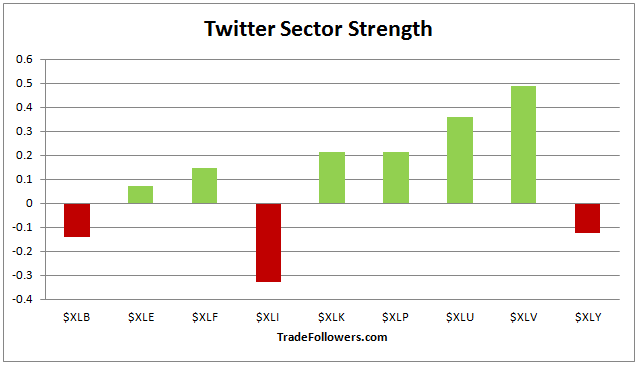

Sector sentiment continues to show caution with the defensive sectors getting the most support from the Twitter stream.

Conclusion

Market participants have moved back to neutral on 7 day momentum, but are reluctant to tweet higher prices. The high number of bearish stocks is stealing hope as individual portfolios suffer. This has resulted in strength from defensive sectors. In short, people are waiting for a reason to get bullish before committing themselves.