While Netflix is the undisputed king of online streaming right now that might be about to change. These three stocks are fighting to steal customers and market share from Netflix and could end up with a large slice of the $60 billion video on demand pie.

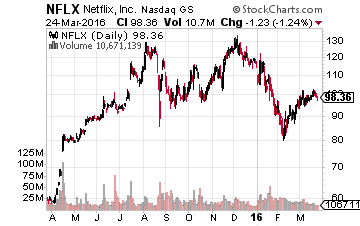

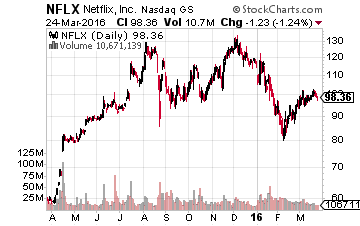

Netflix (NASDAQ: NFLX) has become known as the king of online streaming, blazing a trail to 75 million subscribers and boosting its stock price by nearly 2,300% in the last 10 years.

This comes as Netflix pivoted away from DVDs by mail to the online streaming business — a move that has been more than fortuitous. However, as any booming market goes, it attracts competition, which is bad news for a company that barely makes a profit.

For now, Amazon.com (NASDAQ: AMZN) Prime has yet to become the Netflix killer that everyone had hoped for. This comes as it has over 50 million Prime members, and as a result, streaming video subscribers.

So, a lot of people are flocking to the streaming industry, and there are more and more companies looking to capitalize. And, while Netflix is still the leader based on subscribers, its only managing to generate $120 million in income. This puts Netflix trading at over 350 times earnings.

Combined, Netflix and Amazon are two formidable foes in the online streaming business. Yet, neither are generating a lot of money; Amazon also trades at an outsized valuation of over 470 times earnings.

There have to be better bets on the online streaming industry out there. With that, we’re looking for companies that can eat into Netflix’s market share and profit from the streaming boom. Here are the top three Netflix killers:

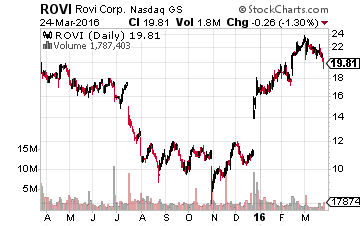

No. 1 Netflix Killer: Rovi (NASDAQ: ROVI)

This is one of the most underrated plays, as it generates most of its revenues from patents. However, it’s making a big bet on becoming a patent powerhouse with its planned purchase of TiVo (NASDAQ: TIVO).

TiVo is the digital recorder business that pioneered DVR. TiVo has patents for things such as fast forwarding through TV while Rovi owns patents for digital entertainment devices. Rovi makes money from licensing deals with the likes to Time Warner Cable (NYSE: TWC) and Comcast (NASDAQ: CMCSA) paying Rovi to use patented TV guide systems.