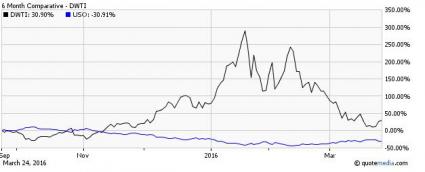

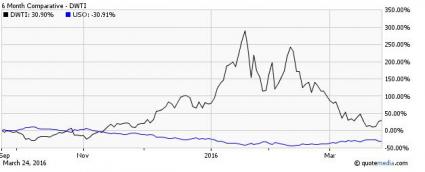

Crude oil has had a wild ride this year. It seemed every day in January oil was making new lows before it bottomed in early February at $26.05.The last five weeks have been the opposite, with almost every day a green day for the black gold.

Crude oil futures looked to have finally topped out at $42.49 earlier this week, before pulling back under $40.00 yesterday.Now it looks like shorts sellers of crude and oil related companies have a solid entry where they can start short positions. Both the commodity and oil stocks look to trend lower into earnings season and risk can be realized with stops at the highs of the year.

Oil is due for a sell off and it wouldn’t be a big surprise if we saw a pullback to the $34-35 area sometime soon. While the pullback starts to form, investors can profit from a fall in oil by buying the ETFs below.

ETF/ETNs to short Crude oil

VelocityShares 3x Inverse Crude Oil ETN (DWTI – ETF report)- This ETN is an investment that seeks to replicate, net of expenses, three times the opposite (inverse) of the S&P GSCI Crude Oil Index ER. The index comprises futures contracts on a single commodity and is calculated according to the methodology of the S&P GSCI Index.

DWTI is a very volatile product that allows bearish oil investors to maximize their gain. If oil falls 5% in a day this ETN will rise 15%, maximizing the bearish bet that is made. DWTI will pull back fast when oil heads higher, so I only encourage short term trading with this instrument.

ProShares UltraShort Bloomberg Crude Oil (SCO – ETF report) – This investment seeks to provide daily trading results that correspond to twice (200%) the inverse of the daily performance of the Bloomberg WTI Crude Oil SubindexSM. The “UltraShort” Funds seek daily results that match (before fees and expenses) two times the inverse (-2x) of the daily performance of a benchmark.

Very much like DWTI, this will move higher as crude oil moves lower. If oil is at $40 a barrel and falls to $39, we would see a 5% move higher in SCO reflecting the 2.5% move in crude lower. The main difference between SCO and DWTI is what magnitude, higher or lower, a trader is looking for.