Should you buy a company after it has cut its dividend? That’s the question Morgan Stanley’s analysts have tried to answer in a European Equity Strategy research note sent to clients today and a reviewed by ValueWalk.

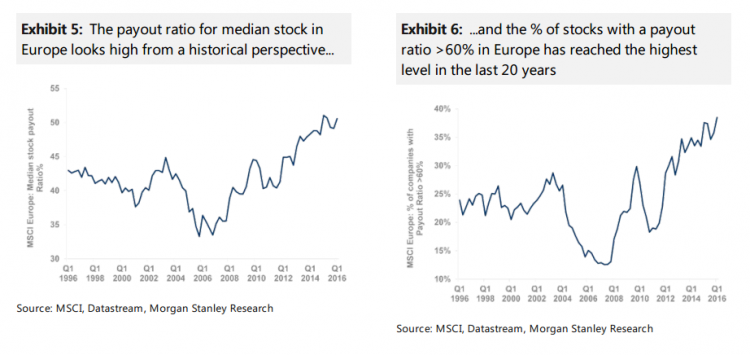

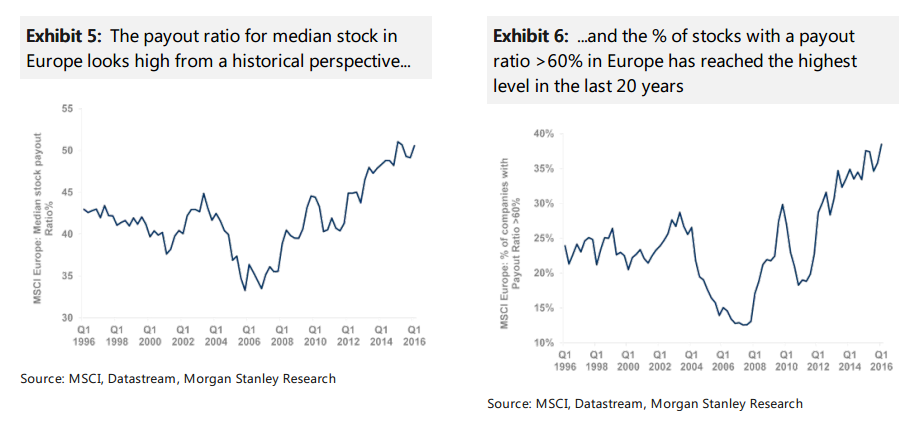

Morgan’s research has been prompted by renewed investor interest in dividend cuts. Against a depressed earnings base, the market’s dividend payout level looks high in a historical context and the median stock’s payout ratio is close to a 20-year high. On a pan-European level, the payout ratio has exceeded 2009 levels. It’s also important to note that this is not an anomaly that is limited to a few key sectors, the percentage of stocks with a payout ratio in excess of 60% of earnings per share has reached the highest level in 20 years.

As European investors have seen over the past few months, even those companies that were considered dividend aristocrats aren’t in any way immune from payout cuts with companies like Rolls-Royce, BHP, EDF, RWE and Repsol all cutting their dividends during the past six months.

An updated study

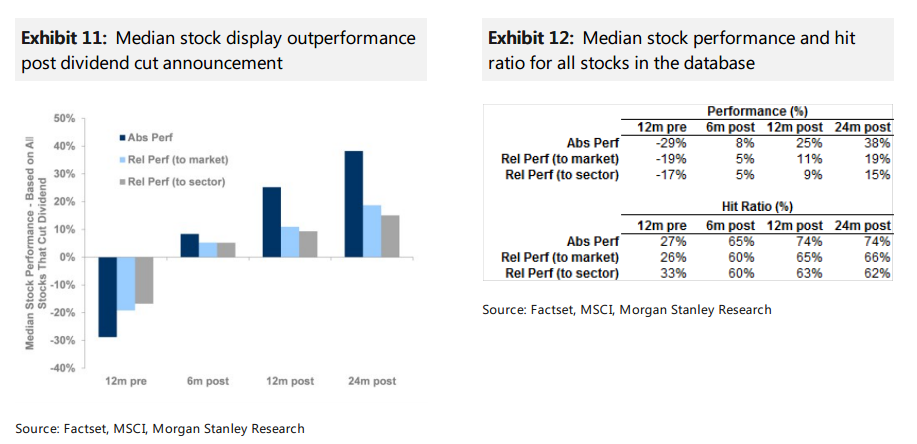

This isn’t the first time Morgan’s investigated this question. Back in 2008, the bank conducted a similar research exercise and found that dividend cuts can indicate powerful inflection points in share prices. At the time, the research showed that investors could do well by buying stocks on dividend reductions, particularly those that are stressed.

A Crisis In Ponzi-Land (Cut The Dividends Already!!!)

In the 2008 version, Morgan’s research showed that UK companies that cut their dividend tended to outperform thereafter, especially if the shares had previously been poor performers, the payout cut was large or the starting yield was high.

In this updated version, Morgan examines 372 instances of dividend cuts in Europe over the last ten years. The stocks are based on the current constituents of MSCI Europe IMI, with a current market cap bigger than $2 billion. To qualify as a dividend cut, the company’s dividend payout has to be reduced by 5% or more.