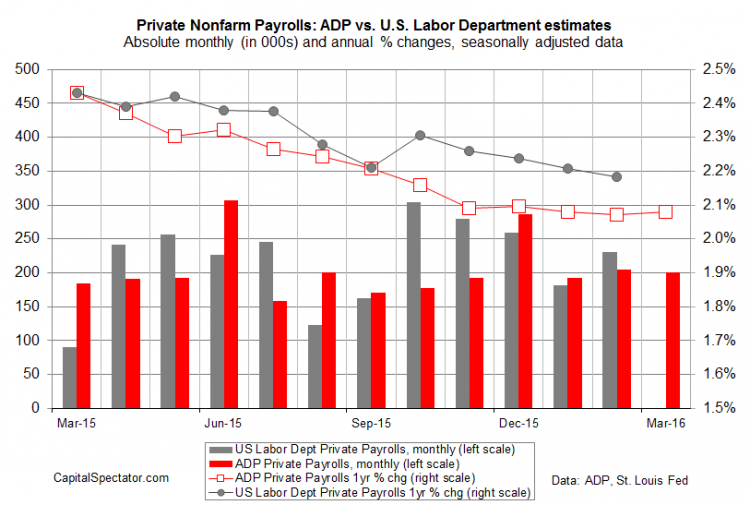

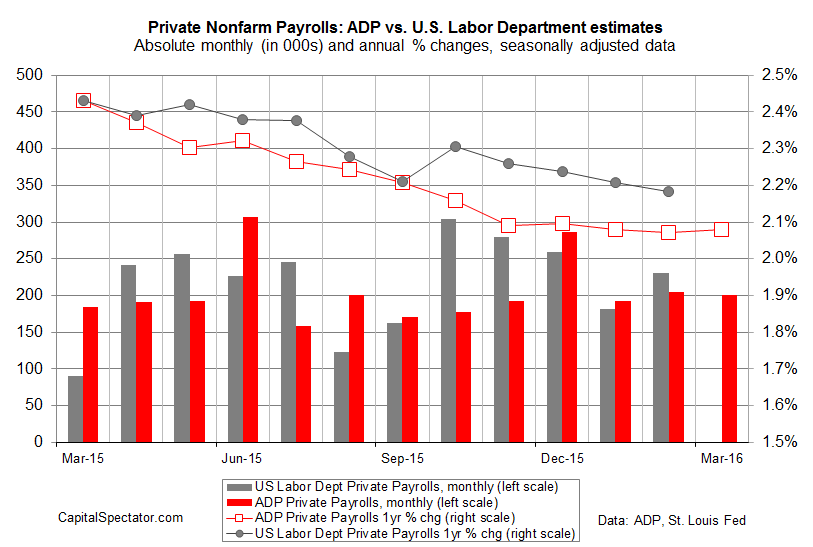

U.S. companies added 200,000 jobs last month (seasonally adjusted), according to this morning’s update of the ADP Employment Report. Although March’s gain was slightly below the previous month’s increase, today’s release suggests that the year-over-year trend for private-sector job creation is settling in to a low-2% trend–a pace that’s strong enough, if sustained, to keep the US recovery on track.

“The job market continues on its amazing streak,” says Mark Zandi, chief economist of Moody’s Analytics, the firm that co-produces the data with ADP. “The March job gain of 200,000 is consistent with average monthly job growth of the past more than four years. The only industry reducing payrolls is energy as has been the case for over a year. All indications are that the job machine will remain in high gear.”

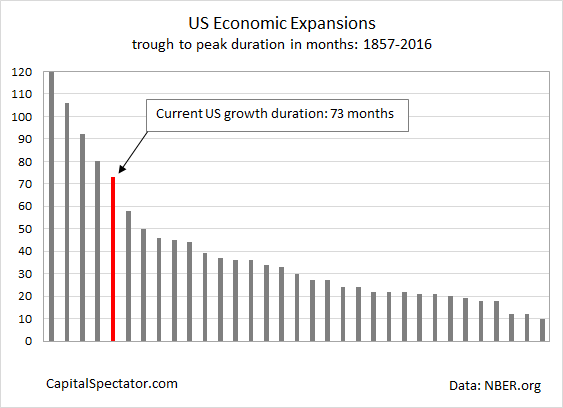

Today’s update will revive the discussion about the sustainability of job growth–and economic growth overall. One school of thought posits that the upside to a relatively modest recovery since the Great Recession is the potential for growth to persist for longer than usual, relative to the historical record. The current expansion (measured from the end of the last recession in June 2009) is 73 months—the fifth-longest duration on record, based on NBER’s data that stretches back to the mid-19th century.

If the recovery can survive for another eight months, the current growth phase will move up to the fourth-longest on record. Today’s ADP data provides fresh data for thinking that reaching that milestone is a reasonable forecast. Supporting evidence can be found in broader measures of US economic activity, including this month’s update of the macro profile, which tells us that recession risk remained low through February. As always, the standard caveat applies–the future’s uncertain. But based on numbers published to date across a spectrum of indicators, the US recovery is set to roll on for the near-term horizon.